Feb-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

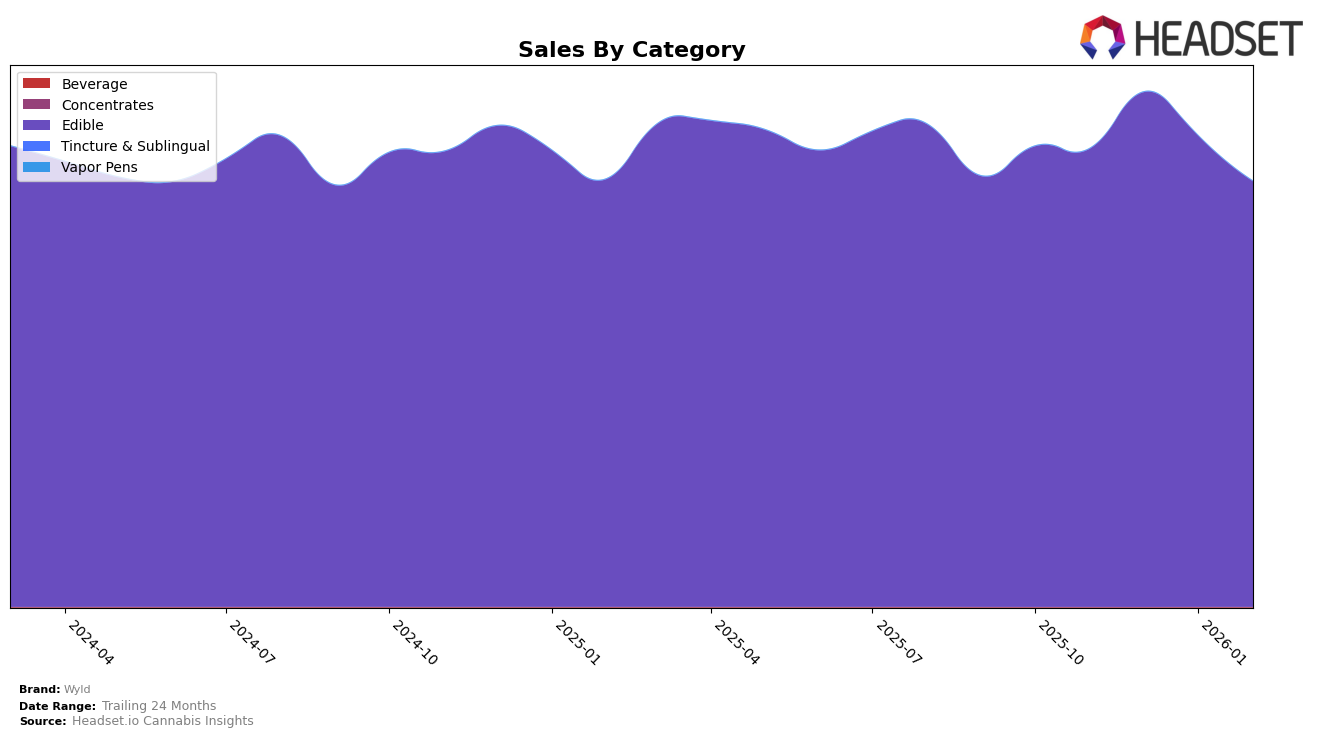

Wyld has shown a strong and consistent performance across various states and provinces in the Edible category. In Arizona, California, Colorado, Michigan, Nevada, Oregon, and Washington, Wyld has consistently held the top rank from November 2025 through February 2026. This dominance in multiple key markets underscores their strong brand presence and consumer preference. Notably, in Alberta, Wyld climbed to the number one spot by February 2026 after maintaining a second-place position for several months, highlighting their upward trajectory in this region.

However, Wyld's performance in certain states and provinces indicates areas where growth potential remains. For instance, in Maryland and Ontario, Wyld was not ranked in the top 30 in November 2025, which suggests an opportunity for further market penetration and brand development. By December 2025, Wyld entered the rankings in both regions, achieving third place in Maryland and fourth in Ontario by January 2026. This suggests a positive trend, as the brand is gaining traction in these markets. Additionally, in Massachusetts, Wyld improved its ranking from third to second place by February 2026, demonstrating its potential for continued growth and increased market share.

Competitive Landscape

In the competitive landscape of the California edible cannabis market, Wyld has consistently maintained its position as the top-ranked brand from November 2025 through February 2026. This unwavering leadership is particularly notable given the presence of strong competitors such as Camino and Kanha / Sunderstorm, which have held steady at the second and third ranks, respectively, during the same period. Despite fluctuations in sales figures, Wyld's ability to sustain its number one rank suggests a robust brand loyalty and market penetration. While Camino and Kanha / Sunderstorm continue to trail behind, the gap in sales highlights Wyld's dominant position, underscoring its strategic advantage in product offerings and customer engagement within the California edibles category.

Notable Products

In February 2026, Wyld's top-performing product was the CBD/CBN/THC 1:1:1 Indica Boysenberry Gummies 10-Pack, maintaining its number one rank for four consecutive months with sales of $287,172. The CBN/THC 2:1 Indica Elderberry Gummies 10-Pack held steady at the second position, continuing its consistent ranking from previous months. Sativa Raspberry Gummies 10-Pack remained the third best-seller, showing a slight decline in sales but not affecting its rank. Indica Marionberry Gummies 10-Pack also retained its fourth place, while Sativa Sour Apple Gummies 10-Pack re-entered the rankings at the fifth spot after missing data in December and January. Overall, the rankings for Wyld's products remained stable, with each product maintaining its position from the previous months despite fluctuations in sales figures.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.