Feb-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

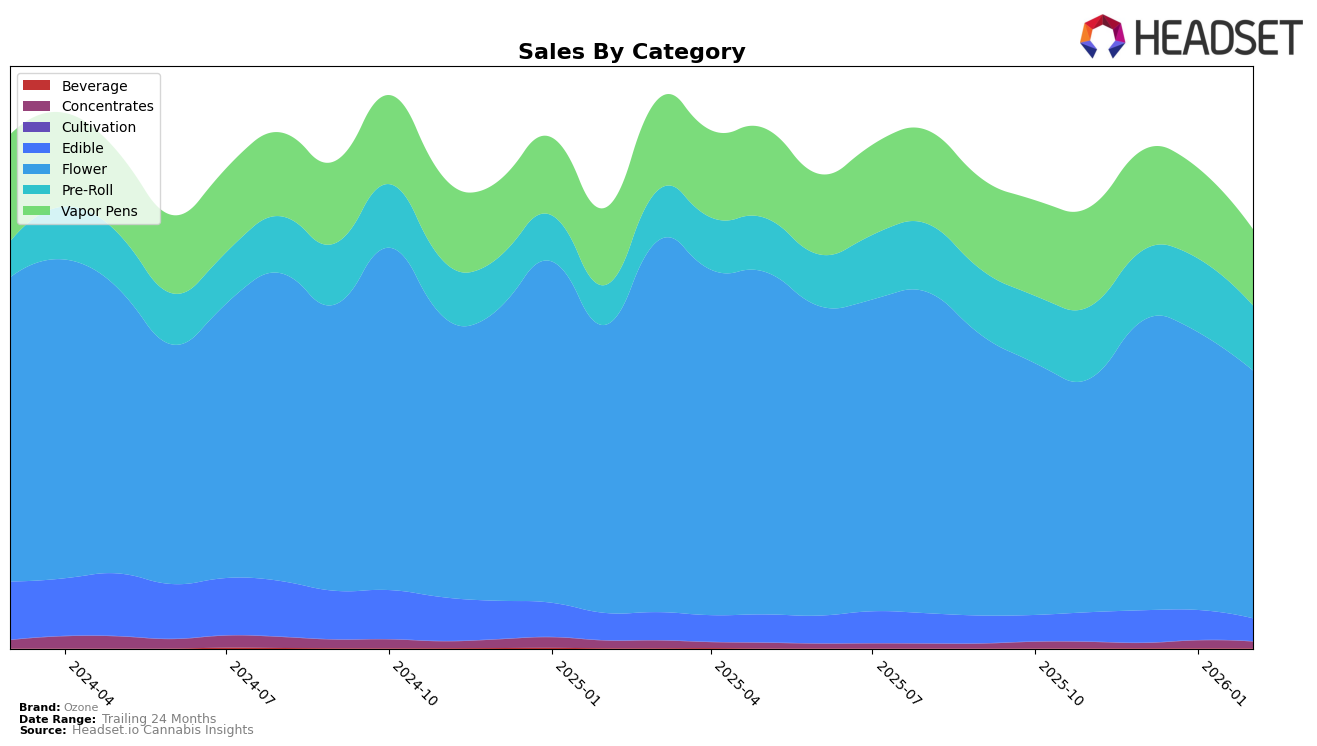

Ozone has shown varied performance across different states and product categories. In Illinois, Ozone's Flower category experienced a downward trend in rankings, moving from 5th in November 2025 to 8th by February 2026. Despite this decline, the sales figures remained relatively robust, indicating a consistent consumer base. The Pre-Roll category in Illinois also saw a drop in rankings, from 7th to 12th over the same period, which suggests a potential shift in consumer preference or increased competition. Interestingly, Ozone's Vapor Pens in Illinois experienced a slight improvement in rank from 16th in January to 15th in February, reflecting a positive reception in that category.

Meanwhile, in Massachusetts, Ozone's Flower category showed a significant improvement, jumping from 21st place in November 2025 to 8th by February 2026, highlighting a growing market presence. However, in New Jersey, Ozone's Edible category did not make it into the top 30 by February 2026, which could indicate a challenge in maintaining visibility or demand in that segment. On the other hand, Ozone's Flower and Pre-Roll categories in New Jersey remained strong, consistently holding top positions, with Flower maintaining the 1st rank since January 2026 and Pre-Roll also securing the 1st position from January onwards, demonstrating dominance in these categories. This dynamic performance across states and categories underscores Ozone's varied market strategies and consumer engagement levels.

Competitive Landscape

In the New Jersey flower category, Ozone has demonstrated a remarkable upward trajectory in its market positioning. Starting from a rank of 5th in November 2025, Ozone surged to the top spot by January 2026, maintaining this leading position into February 2026. This ascent can be attributed to strategic market maneuvers and possibly enhanced product offerings, as evidenced by a significant increase in sales from November to December 2025. In contrast, Clade9, which consistently held the 3rd position through November and December 2025, only managed to climb to 2nd place by January 2026, trailing behind Ozone. Meanwhile, Garden Greens, which initially led the market in November 2025, experienced a decline, dropping to 6th place by January 2026 before recovering slightly to 3rd in February 2026. This dynamic shift highlights Ozone's effective strategies in capturing market share and suggests a robust competitive edge over its rivals in the New Jersey flower market.

Notable Products

In February 2026, the top-performing product for Ozone was Assorted Berry Soft Chews 10-Pack (100mg) in the Edible category, climbing to the number one rank with sales of 5750 units. The Blood Orange Pectin Gummies 10-Pack (100mg) debuted in the second position, indicating strong initial demand. Butterstuff Pre-Roll (1g) re-entered the rankings at third place, having been absent in previous months. Strawberry Soft Chews 10-Pack (100mg) maintained its fourth position from January 2026, despite a slight decrease in sales. Butterstuff Popcorn (7g) experienced a drop from its leading position in December 2025 to fifth place in February 2026, showing significant variability in its sales performance over recent months.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.