Jan-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

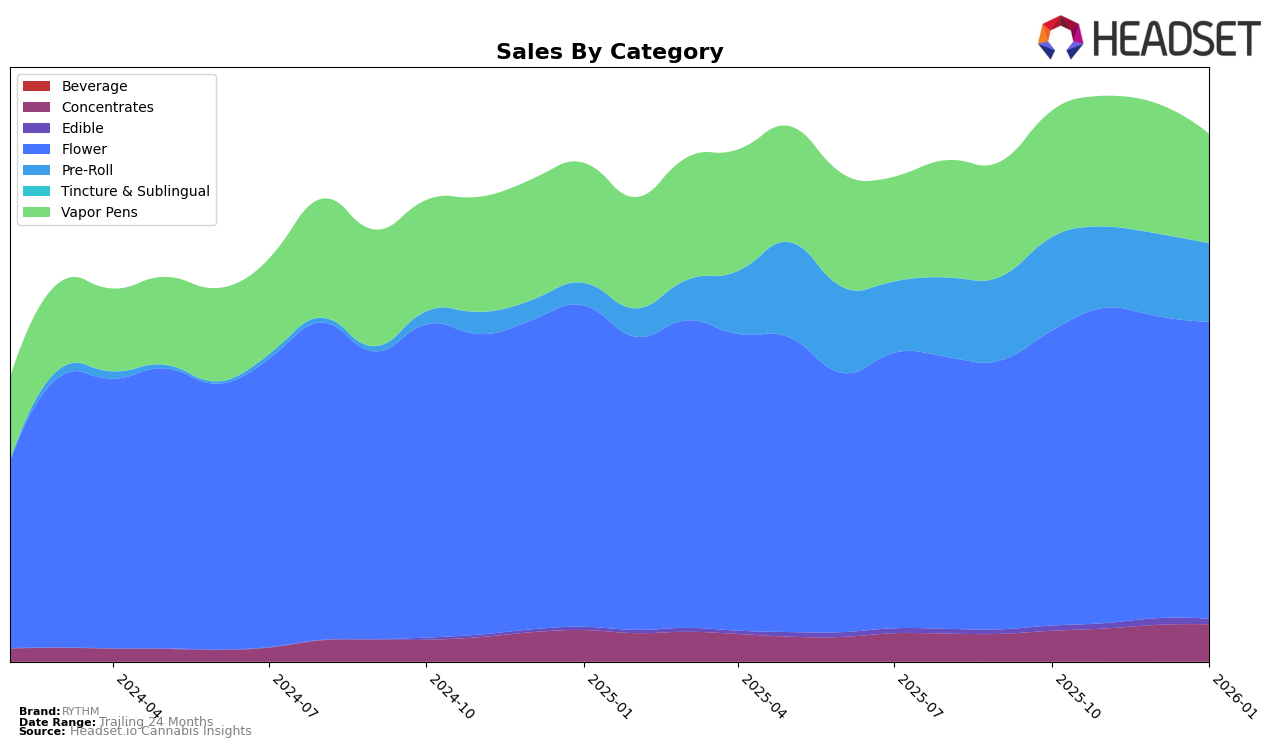

RYTHM has shown a dynamic performance across various states and categories over recent months. In Illinois, RYTHM has maintained a strong presence in the Flower category, consistently holding the second position from October 2025 to January 2026. Their performance in the Pre-Roll category is particularly noteworthy, where they have consistently ranked first. However, their Vapor Pens category in Illinois saw a slight dip from fourth to fifth place in January 2026, indicating a potential area for improvement. Meanwhile, in Connecticut, RYTHM's Flower category surged to the third position by January 2026, marking a significant upward trend from not being in the top 30 in October 2025.

In Maryland, RYTHM's Flower category has seen some fluctuation, peaking at the first position in November 2025 before settling back to third in January 2026. Their Pre-Roll category remained stable at the second position throughout the period, indicating a consistent consumer preference. In Nevada, RYTHM's Flower category performance is dominant, consistently holding the top rank, while their Vapor Pens category dropped out of the top 30 after November 2025. This drop might be a concern for RYTHM as it suggests a decrease in market share or consumer interest in that particular category in Nevada. Overall, RYTHM's performance is marked by both strongholds and potential areas for growth across different states and categories.

Competitive Landscape

In the competitive landscape of the Illinois flower category, RYTHM consistently holds the second position from October 2025 through January 2026, showcasing its strong market presence. Despite its stable rank, RYTHM faces stiff competition from High Supply / Supply, which maintains the top spot with significantly higher sales figures. Meanwhile, Daze Off has shown a positive trend by climbing from fourth to third place in November 2025 and sustaining that position, indicating a potential threat to RYTHM's rank if this trend continues. Additionally, Simply Herb has demonstrated a notable recovery by moving from seventh to fourth place by January 2026, which could further intensify competition. These dynamics suggest that while RYTHM remains a strong contender, it must innovate and strategize to maintain its position amidst rising competitors in the Illinois market.

Notable Products

In January 2026, Animal Face (3.5g) maintained its position as the top-performing product for RYTHM, achieving consistent rank 1 with sales of 33,921 units. Brownie Scout (3.5g) also showed stability, retaining its second position throughout the months. Notably, Brownie Scout (2.83g) emerged as a new contender, securing the third spot in January. Remix - Pineapple Express Infused Pre-Roll 5-Pack (2.5g) debuted at rank 4, indicating a strong entry into the market. Remix - Watermelon Z Infused Pre-Roll 5-Pack (2.5g) returned to the rankings at position 5, after being absent in the previous months, showing a slight decrease in sales from its October position.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.