Jan-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

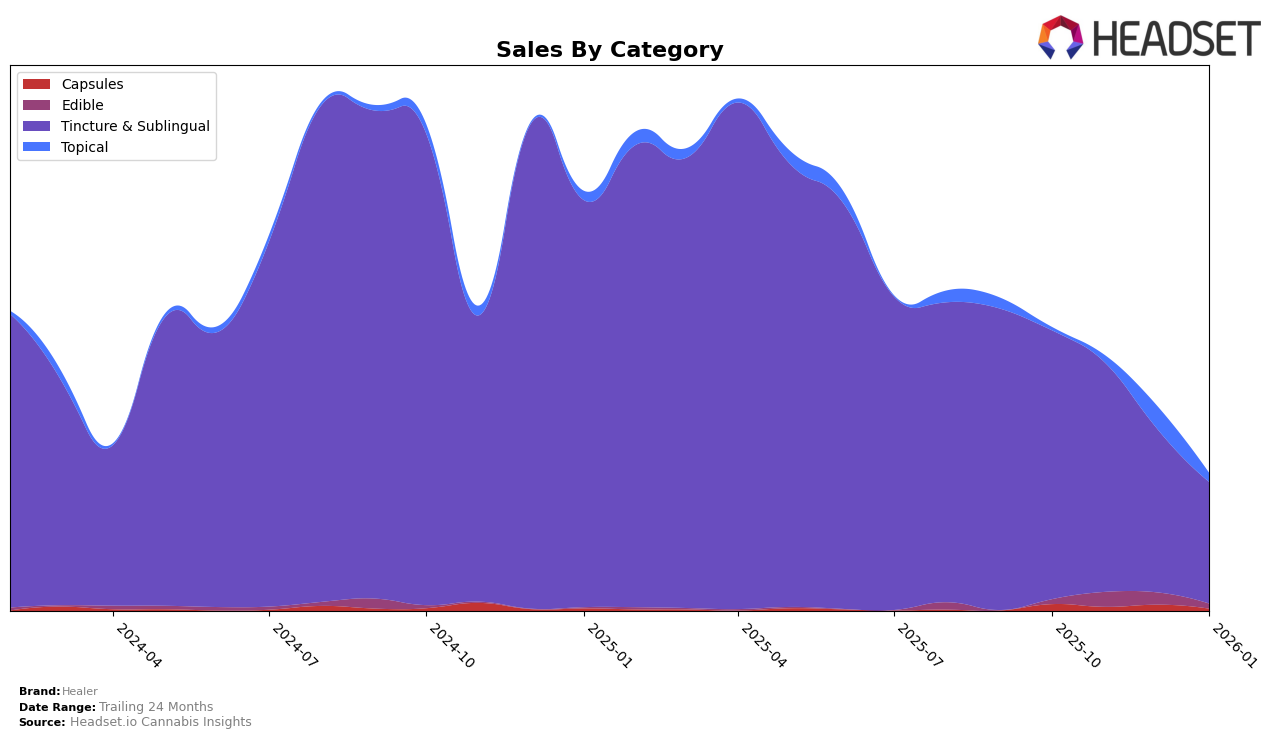

Healer has shown a consistent presence in the Maryland market within the Tincture & Sublingual category. Despite a decline in sales from October 2025 to January 2026, where the figures dropped from $28,605 to $12,888, Healer maintained a strong position in the rankings, starting at first place in October and November 2025, and only slightly slipping to second place by December 2025 and January 2026. This stability in ranking, even amidst decreasing sales, suggests a robust market presence and possibly a loyal customer base in Maryland, which may be compensating for the overall market fluctuations.

Notably, Healer's absence from the top 30 brands in other states or categories during this period could be seen as a potential area for growth or a limitation in their market reach. The focus on Maryland's Tincture & Sublingual category might indicate a strategic emphasis or a niche specialization that Healer is leveraging. This concentrated performance highlights both an opportunity for expansion into other regions and categories and a need to explore diversification strategies to mitigate the impact of sales decline within a single market.

Competitive Landscape

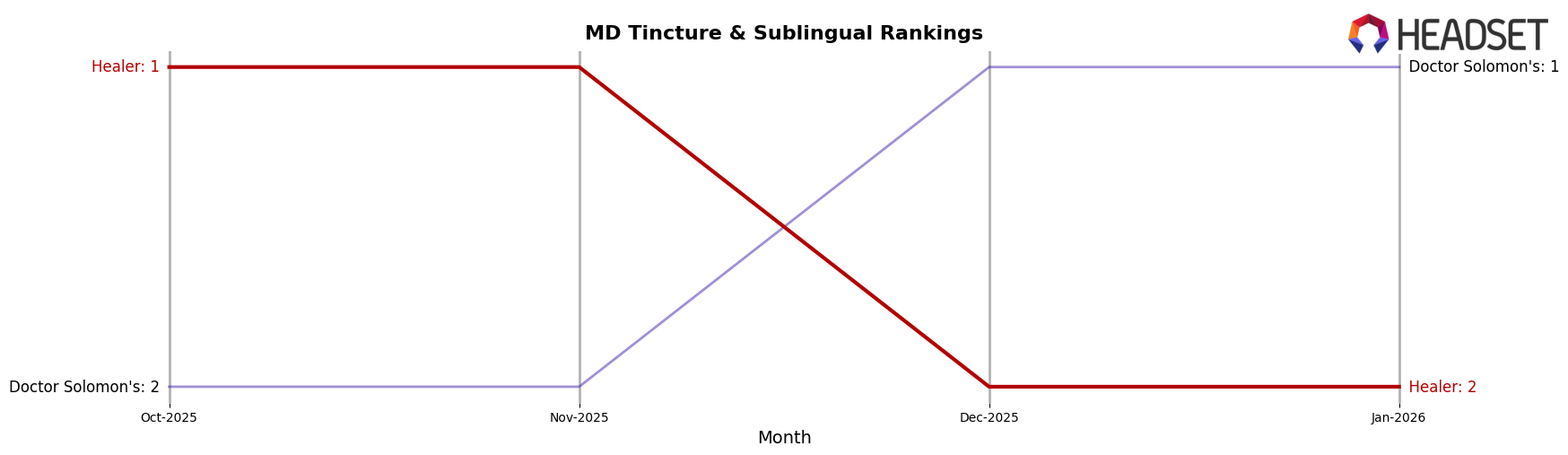

In the Maryland Tincture & Sublingual category, Healer experienced a notable shift in its competitive positioning from October 2025 to January 2026. Initially leading the market in October and November 2025, Healer held the top rank, but by December 2025 and January 2026, it slipped to the second position. This change in rank coincided with a significant decline in sales, suggesting a potential loss of market share or consumer preference. Meanwhile, Doctor Solomon's maintained a consistent presence, initially in second place but rising to the top spot in December 2025 and January 2026. This competitor's steady sales performance and eventual overtaking of Healer indicate a strong brand presence and possibly more effective marketing or product appeal during this period. The shifts in ranking and sales dynamics highlight the competitive pressures Healer faces and underscore the importance of strategic adjustments to regain its leading position in the Maryland market.

Notable Products

In January 2026, the THC/THCA 1:1 Pain Relief Tincture maintained its top position in Healer's lineup, continuing its lead since November 2025, despite a decrease in sales to 73 units. The THC/THCa 6:1 Night Tincture held steady in second place, consistent with its ranking from the previous months. Notably, the THC/THCa 6:1 Night Tincture with 526.44mg THC moved up to third place from fourth in December 2025. The CBD/THC/THCA/CBDA 1:1:1:1 Balance Tincture reappeared at fourth place, having not been ranked in November and December 2025. Finally, the THC/THCA 4:1 Uplift Tincture debuted in the rankings at fifth place for January 2026.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.