Jan-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

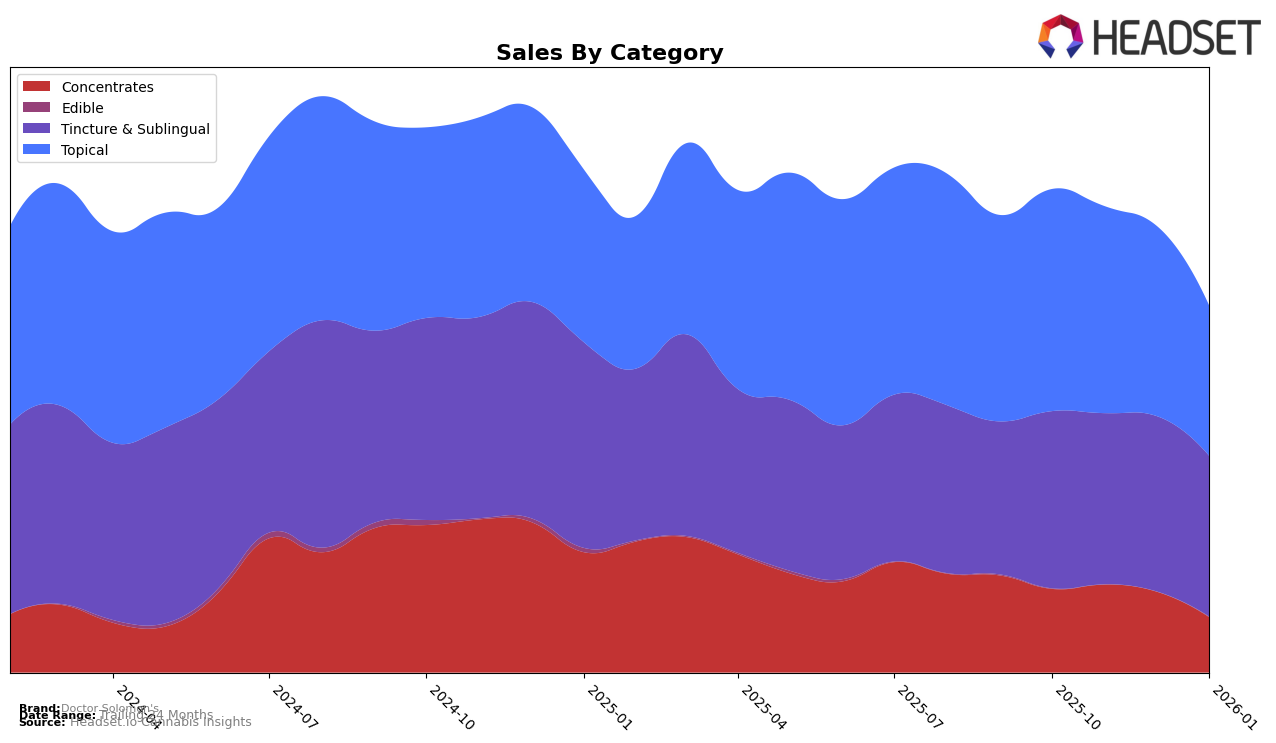

Doctor Solomon's has demonstrated a strong presence in the Illinois market, consistently maintaining the top spot in the Tincture & Sublingual category from October 2025 through January 2026. This steady performance highlights the brand's established foothold in this category within the state. In the Topical category, Doctor Solomon's also holds a commendable position, consistently ranking second. However, there has been a noticeable decline in sales from October 2025 to January 2026, which could suggest increased competition or changing consumer preferences. In Maryland, Doctor Solomon's has demonstrated resilience in the Tincture & Sublingual category, rising to the top position by December 2025 and maintaining it through January 2026. This upward movement indicates a growing acceptance and preference for their products among consumers in the state.

In Massachusetts, Doctor Solomon's has shown variability in the Topical category, where they slipped from third place in October 2025 to being out of the top 30 by January 2026. This drop suggests potential challenges in maintaining market share or possibly shifting consumer trends. Meanwhile, in Nevada, the brand has maintained a stable position in the Tincture & Sublingual category, consistently ranking second. This consistency indicates a strong consumer base and steady demand for their offerings. In New Jersey, while Doctor Solomon's maintained a top-three position in the Tincture & Sublingual category, they did not appear in the top 30 for Topicals by January 2026, indicating a significant decline in that segment. This diverse performance across states and categories highlights the dynamic nature of the cannabis market and the varying consumer preferences that Doctor Solomon's navigates.

Competitive Landscape

In the competitive landscape of the Tincture & Sublingual category in Nevada, Doctor Solomon's has consistently maintained its position as the second-ranked brand from October 2025 through January 2026. Despite a slight decline in sales from October to December 2025, Doctor Solomon's has shown resilience with a rebound in January 2026. This stability in rank highlights its strong market presence, even as it faces stiff competition from the top-ranked Spiked Flamingo, which has consistently held the number one spot. Meanwhile, City Trees remains a steady competitor at the third rank, with sales figures showing a positive upward trend over the same period. Notably, Vlasic Labs emerged in January 2026, securing the fourth position, indicating potential shifts in the competitive dynamics. These insights suggest that while Doctor Solomon's holds a strong position, continuous innovation and strategic marketing will be crucial to maintain its rank and address the evolving competitive pressures in the Nevada market.

Notable Products

In January 2026, Doctor Solomon's top-performing product was the CBD/THC 1:1 Restore Transdermal Lotion (100mg CBD, 100mg THC, 1oz) in the Topical category, maintaining its first-place ranking from December 2025 with sales of 1546 units. The CBD/THC 1:1 Restore Transdermal Lotion (200mg CBD, 200mg THC, 1.8oz) followed closely in second place, having improved from its third-place position in the previous two months. The CBD/THC 3:1 Unwind Transdermal Balm (135mg CBD, 45mg THC) moved up to third place, consistently climbing from its fourth-place position since October 2025. The THC/CBN 1:1 Doze Drops Tincture (50mg THC, 50mg CBN, 15ml) dropped to fourth place, despite a strong second-place finish in December 2025. A new entry, the Indica THC Rich RSO Syringe (1g), debuted in fifth place, marking its first appearance in the rankings.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.