Jan-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

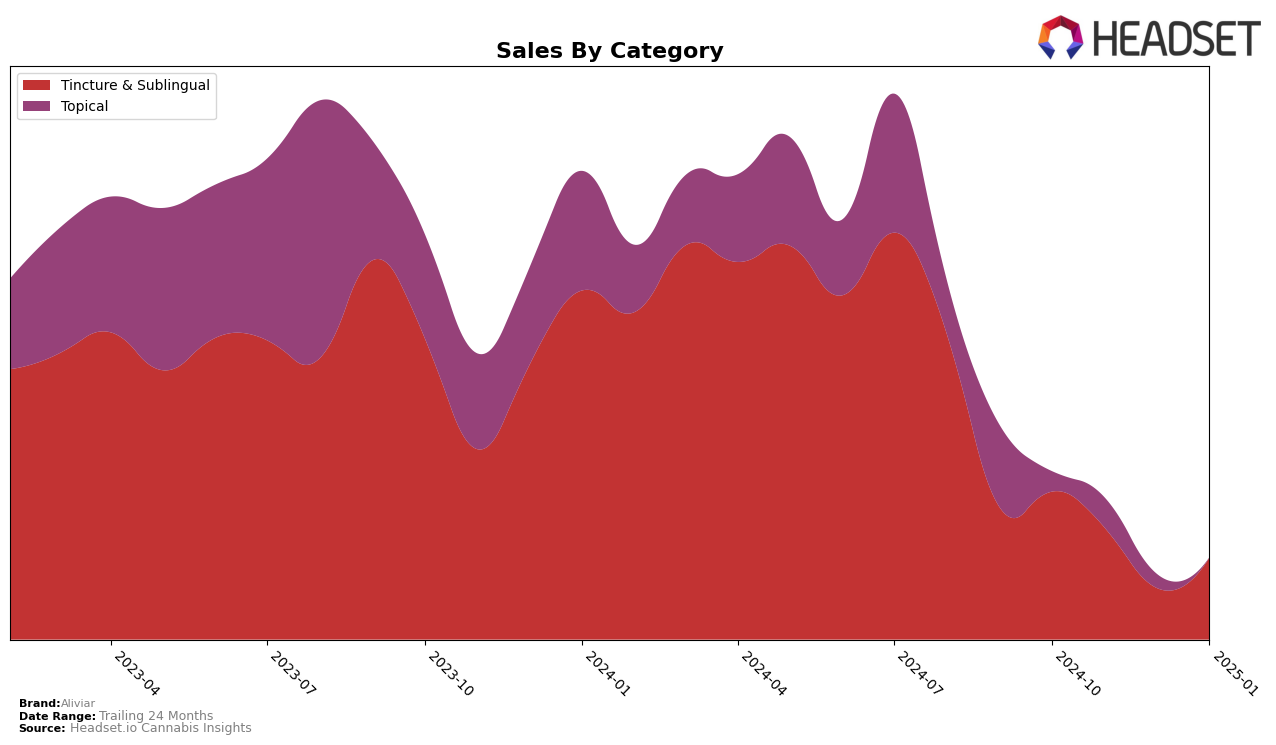

Aliviar has demonstrated a notable presence in the Tincture & Sublingual category within Colorado. In October 2024, the brand secured the 7th position, indicating a strong foothold in this particular segment. However, in the following months of November and December 2024, as well as January 2025, Aliviar did not maintain a position within the top 30 brands. This absence could suggest a decline in market visibility or increased competition in the category. Despite the initial strong ranking, the lack of subsequent data points to potential challenges in sustaining market momentum or shifts in consumer preferences.

Analyzing Aliviar's performance across different states and categories reveals a mixed trajectory. While the initial data from Colorado provided a promising start, the absence of rankings in later months across other regions may indicate either a strategic withdrawal or a need for enhanced marketing efforts. The brand's initial sales figure in October 2024 was $12,776, which could have been a peak driven by specific campaigns or seasonal demands. The lack of ranking data in subsequent months suggests that Aliviar is either focusing its efforts elsewhere or facing heightened competition, which may require strategic adjustments to regain market presence.

Competitive Landscape

In the competitive landscape of the Tincture & Sublingual category in Colorado, Aliviar experienced a notable decline in its market presence, as evidenced by its absence from the top 20 rankings after October 2024. Initially ranked 7th in October, Aliviar's drop in visibility suggests a significant decrease in sales momentum compared to its competitors. For instance, Stratos maintained a stable position within the top 5 from October 2024 to January 2025, indicating consistent consumer preference and potentially more robust marketing strategies. Meanwhile, SUM Microdose showed resilience by improving its rank from 8th to 7th in November and December, before dropping out of the top 20 in January. These dynamics highlight the competitive pressures Aliviar faces, emphasizing the need for strategic adjustments to regain and sustain its market share in this category.

Notable Products

In January 2025, Aliviar's top-performing product was the CBD/THC/CBN 5:1:1 Sleep Tincture, which climbed to the number one rank with sales reaching 209 units, up from its consistent second-place rank in previous months. The CBD/THC 20:1 Calm Tincture, previously holding the top spot, dropped to second place despite maintaining strong sales figures. The CBD/THC 2:1 Lavender Cream advanced to the third position, showing improvement from its fourth-place ranking in December 2024. The CBD/THC 2:1 Scented Cream maintained its fourth-place position, indicating stable performance. Notably, the CBD/THC 2:1 Sport Cream did not rank in January 2025, showing a decline from its fourth-place rank in November 2024.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.