Jan-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

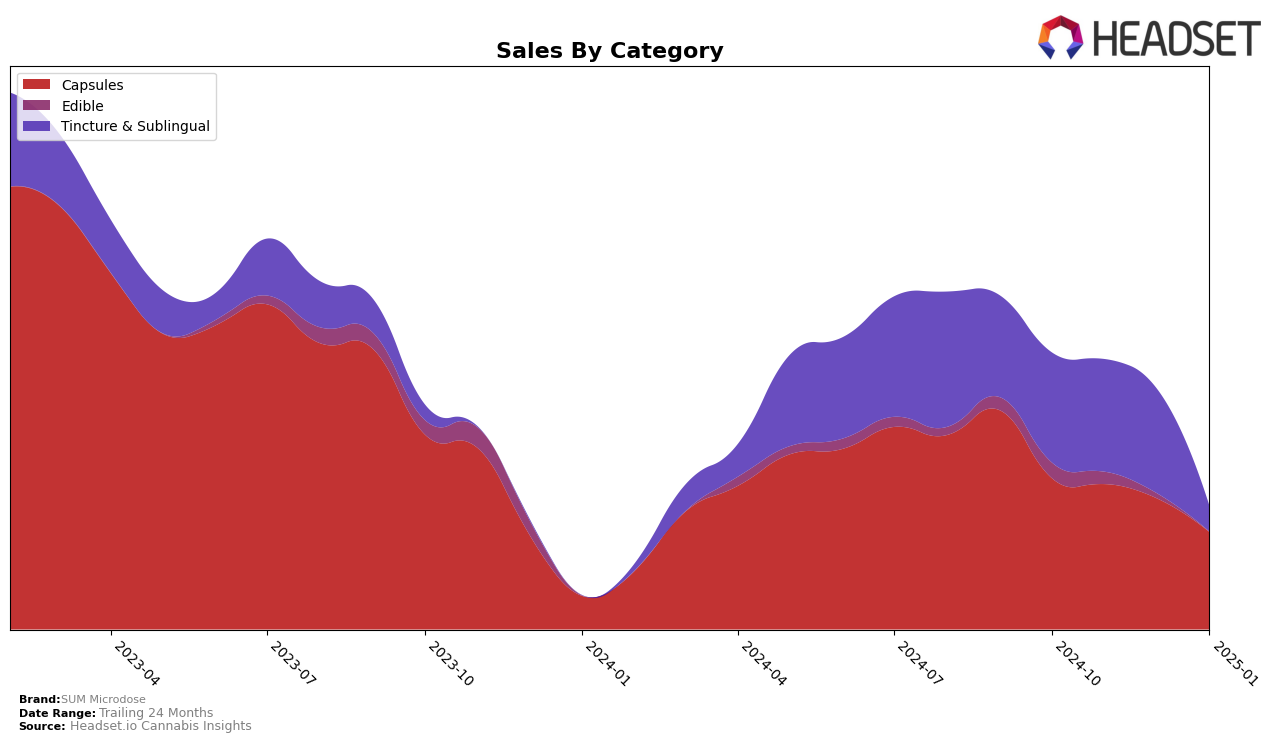

SUM Microdose has demonstrated a consistent presence in the Colorado market, particularly in the Capsules category. Over the months from October 2024 to January 2025, the brand maintained a strong position, ranking third for three consecutive months before slightly dropping to fourth place in January. Despite this slight dip, SUM Microdose has shown resilience in a competitive market. The sales figures reflect a gradual decline from October through January, indicating potential challenges or market saturation that they may need to address to regain their top-three status.

In the Tincture & Sublingual category, SUM Microdose held its ground in Colorado with rankings of eighth and seventh over the initial months, maintaining the seventh position through December. However, by January, they were not listed in the top 30, which suggests a significant drop in their competitive standing. This absence from the top rankings could be a point of concern, highlighting the need for strategic adjustments to regain visibility and market share. The sales trend over these months shows a fluctuating pattern, with a peak in November before tapering off, indicating potential volatility in consumer demand or competitive pressures.

Competitive Landscape

In the competitive landscape of cannabis capsules in Colorado, SUM Microdose has experienced notable shifts in its market position over recent months. While maintaining a consistent third-place rank from October to December 2024, SUM Microdose saw a decline to fourth place in January 2025. This change in rank is significant as it indicates a competitive pressure from brands like Stratos, which improved its position from fourth to third place during the same period. Despite this, SUM Microdose continues to hold a strong presence in the market, although its sales have shown a downward trend from October 2024 to January 2025. This trend suggests a need for strategic adjustments to regain momentum and counteract the rising competition from top players like Craft / Craft 710, which consistently holds the second rank with significantly higher sales figures. Understanding these dynamics is crucial for SUM Microdose to enhance its competitive strategies and potentially reclaim its previous standing in the market.

Notable Products

In January 2025, the top-performing product for SUM Microdose was the CBN/THC 2:1 Sleep Fast Acting Sublingual Tablets 40-Pack, which climbed to the number 1 rank with sales reaching 238 units. This product consistently held the 4th position in the preceding months, showcasing a significant rise in popularity. The CBD/THC 5:2 Calm Fast Acting Sublingual Tablets 40-Pack, which was previously ranked 1st in December 2024, fell to the 2nd position in January 2025. The CBD/THC 1:1 Focus Sublingual saw an improvement in its ranking, moving from 5th in December to 3rd in January. Meanwhile, the Energy Sublingual 40-Pack, despite being a top contender in previous months, dropped to the 4th position with a notable decrease in sales.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.