Jan-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

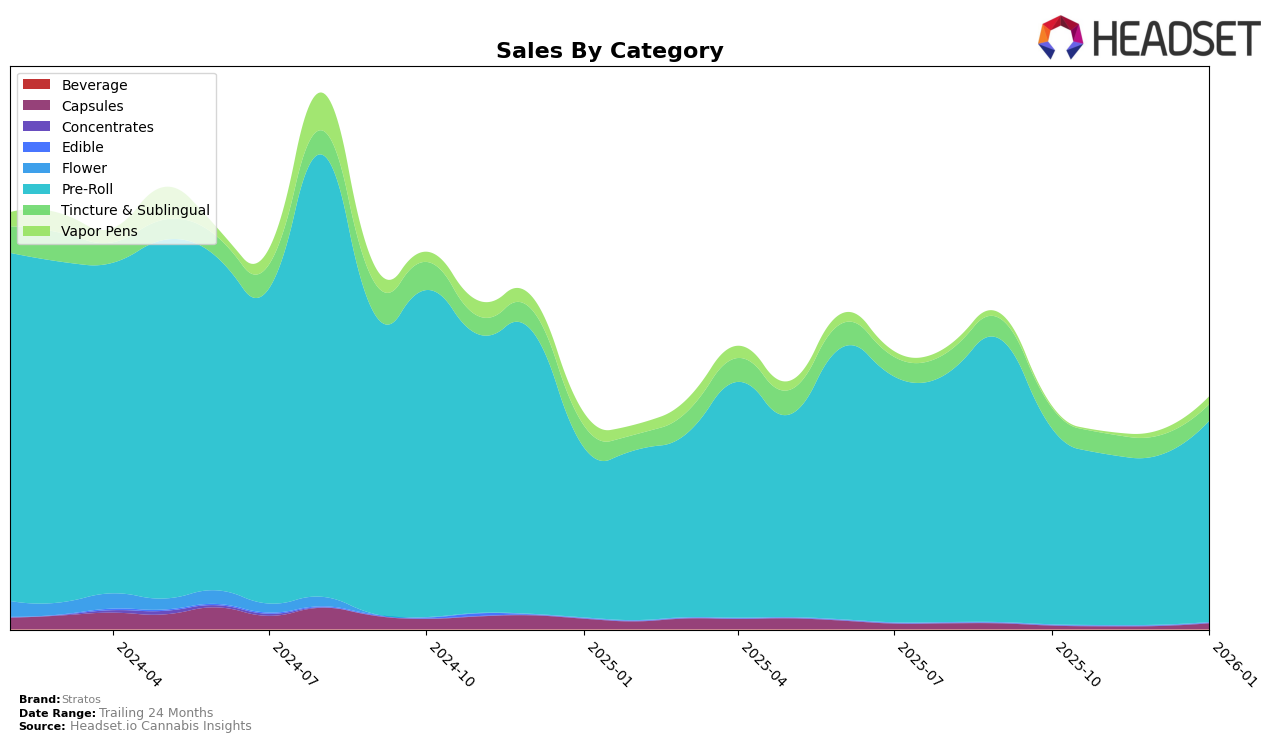

Stratos has demonstrated a noteworthy performance in the Colorado market, particularly in the Pre-Roll category. Over the past few months, their ranking has shown a positive trend, moving from 20th in October 2025 to 16th by January 2026. This upward movement suggests a strengthening position in the competitive landscape of Pre-Rolls within the state. However, it is important to note that while there was an improvement in their rank, sales figures experienced fluctuations, with a dip in November and December before rebounding in January. This indicates potential market volatility or strategic adjustments that might have impacted their sales trajectory.

In contrast, Stratos has maintained a steady presence in the Tincture & Sublingual category in Colorado. Consistently ranking between 5th and 6th place from October 2025 to January 2026, the brand has shown stability in this segment. Despite the stable rankings, there was a noticeable decline in sales from November to January, which could suggest challenges in sustaining consumer interest or shifts in consumer preferences. The absence of Stratos from the top 30 in other states or provinces for these categories highlights potential areas for growth and expansion outside of Colorado.

Competitive Landscape

In the competitive landscape of the Colorado pre-roll market, Stratos has shown a dynamic performance with notable fluctuations in rank and sales over the past few months. Starting from October 2025, Stratos was ranked 20th, and despite a dip to 21st in December, it impressively climbed to 16th by January 2026. This upward trend suggests an effective strategy in regaining market position, especially when compared to competitors like Natty Rems, which experienced more volatility, dropping out of the top 20 in November before recovering to 17th in January. Meanwhile, Be One Kind consistently improved its rank, peaking at 14th in January, indicating a strong competitive presence. Lowell Herb Co / Lowell Smokes maintained a steady position slightly ahead of Stratos, suggesting a stable consumer base. These shifts highlight the competitive nature of the market and the importance for Stratos to continue leveraging its strategies to maintain and improve its standing amidst strong competitors.

Notable Products

In January 2026, the top-performing product from Stratos was Jupiter Joint Moon Melon Infused Pre-Roll (1g) in the Pre-Roll category, reclaiming its position as the best-seller with a notable sales figure of 2097 units. Following closely was Jupiter Joint Pandora's Peach Infused Pre-Roll (1g), which improved its rank from third in November 2025 to second place. Slow Burn Bazookies #10 Infused Pre-Roll (1g) made a significant leap, moving from fifth in October 2025 to third in January 2026. Jupiter Joints Solar Burst Infused Pre-Roll (1g) slipped from its second-place rank in November 2025 to fourth in January 2026. Lastly, Slowburn Tally Man Infused Pre-Roll (1g) maintained a steady presence in the rankings, consistently holding onto the fifth spot since December 2025.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.