Oct-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

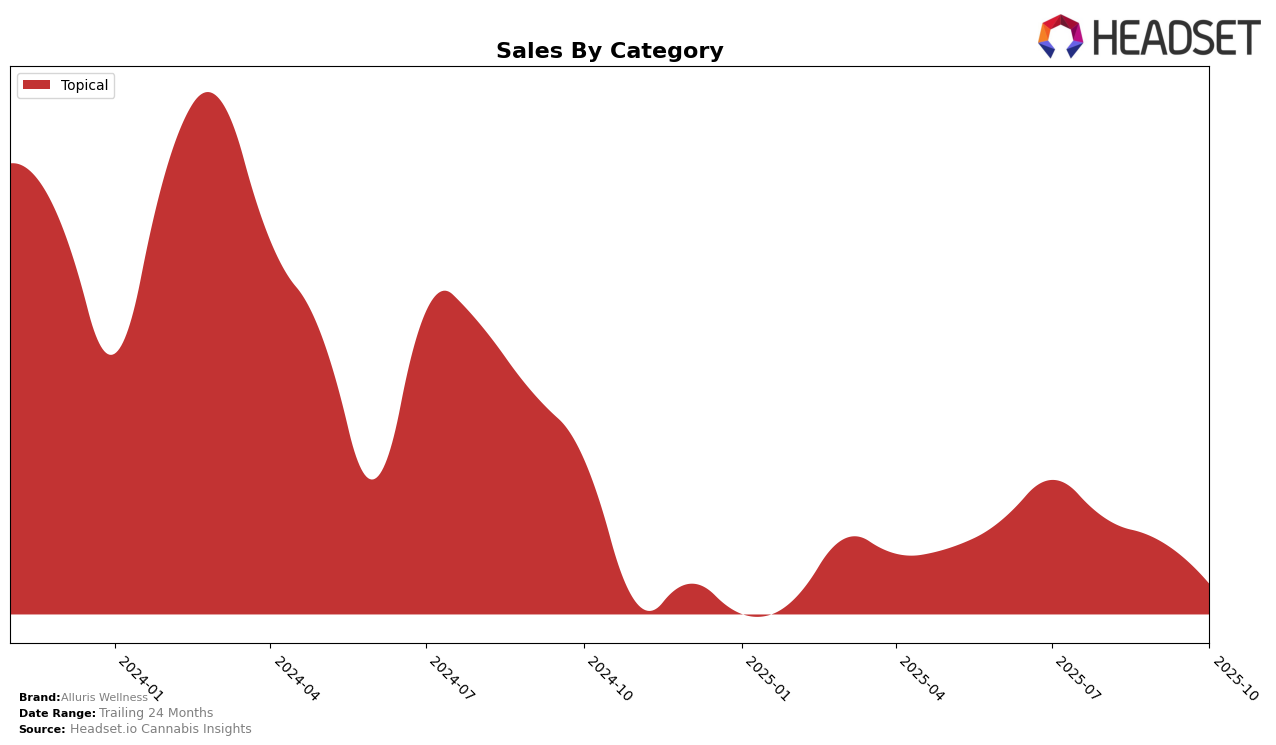

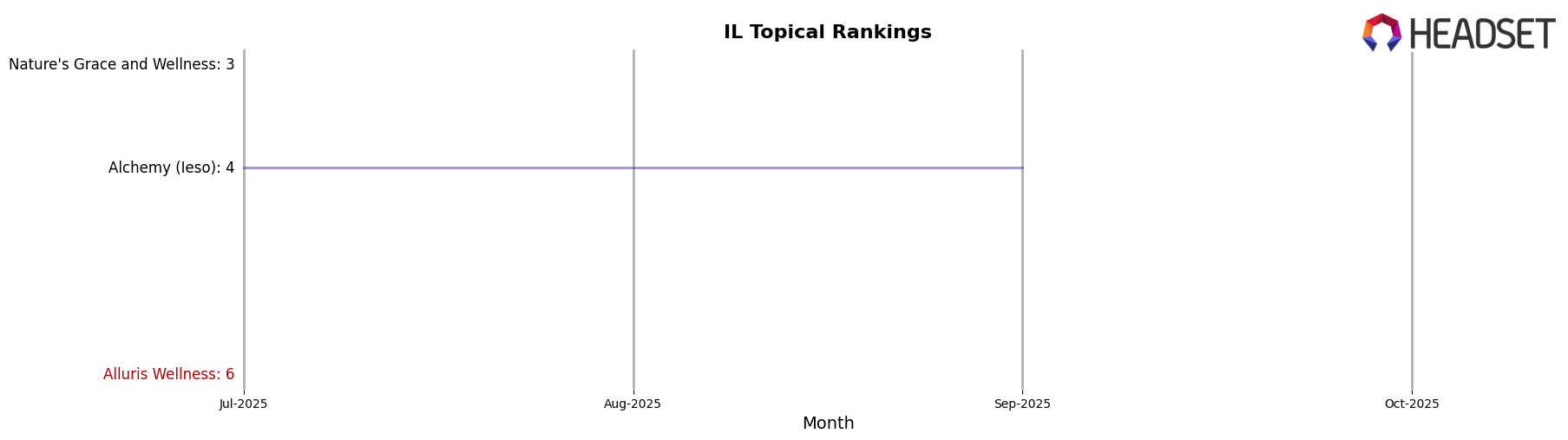

In the state of Illinois, Alluris Wellness has demonstrated a notable presence in the Topical category. As of July 2025, the brand was ranked 6th, indicating a strong position within the state's market. However, it is important to note that for the months of August, September, and October 2025, Alluris Wellness did not appear in the top 30 rankings. This absence could suggest a decline in market performance or increased competition within the Topical category in Illinois. The brand's sales in July were recorded at $10,940, but without subsequent rankings or sales data for the following months, it is difficult to determine the exact trajectory of their performance.

The lack of rankings in the later months across the states and categories could be indicative of challenges faced by Alluris Wellness in maintaining its competitive edge. While the initial ranking in July 2025 in Illinois was promising, the absence from the top 30 in subsequent months might suggest a need for strategic adjustments or a shift in consumer preferences. This pattern highlights the dynamic nature of the cannabis market and the importance for brands to continually innovate and adapt to remain relevant. The performance of Alluris Wellness across different states and categories would benefit from a closer examination to identify underlying factors contributing to these trends.

Competitive Landscape

In the Illinois topical cannabis market, Alluris Wellness experienced a notable absence from the top 20 rankings from August to October 2025, following a 6th place rank in July. This decline in visibility suggests a potential decrease in market traction relative to competitors. In contrast, Nature's Grace and Wellness held a strong position at 3rd place in July, though it also disappeared from the rankings in subsequent months, indicating a similar challenge. Meanwhile, Alchemy (Ieso) maintained a consistent 4th place rank from July through September, showcasing stability and possibly capturing market share that Alluris Wellness might have lost. These dynamics highlight the competitive pressures Alluris Wellness faces in maintaining its market position and underscore the importance of strategic adjustments to regain visibility and sales momentum.

Notable Products

In October 2025, the top-performing product for Alluris Wellness was the CBD/THC/CBG 1:1:1 Soothe Lotion in the Topical category, maintaining its number one rank from the previous months despite a decrease in sales to 166 units. This product has consistently held the top spot since July 2025, showcasing its strong market presence. Notably, while its sales have decreased from 332 units in July 2025, it continues to outperform other products in its category. The consistent ranking highlights its popularity and consumer preference. Overall, the Soothe Lotion remains a staple in Alluris Wellness's product lineup.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.