Jan-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

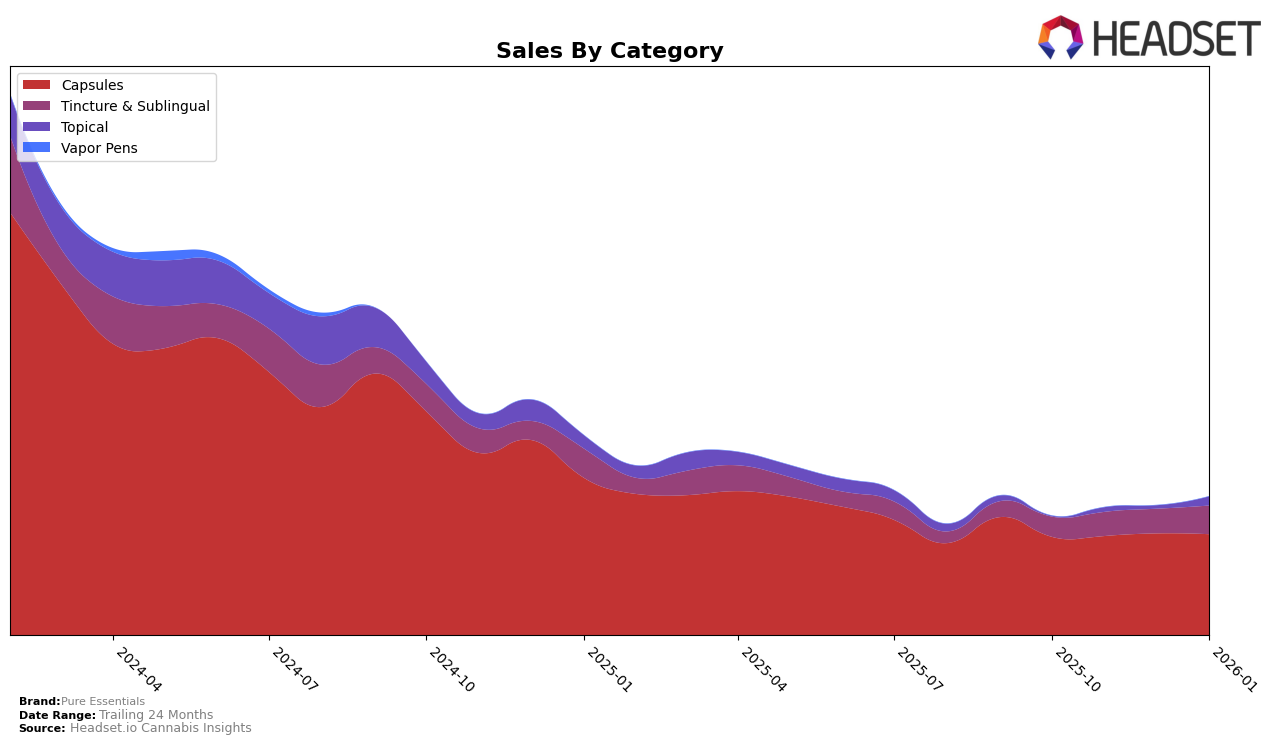

In the state of Illinois, Pure Essentials has maintained a consistent and strong performance in the Capsules category, holding steady at the 3rd position from October 2025 through January 2026. This stability is indicative of a robust market presence and consumer loyalty within this category. Notably, the brand experienced a slight uptick in sales from October to December 2025, before a minor decrease in January 2026, suggesting some seasonal or market-driven fluctuations. However, the consistent ranking highlights Pure Essentials' ability to sustain its competitive edge in the Capsules category.

Conversely, Pure Essentials' performance in the Tincture & Sublingual category in Illinois reveals a different dynamic. The brand did not appear in the top 30 rankings for October, November, or December 2025, but made a significant entry at the 5th position in January 2026. This leap into the top 5 suggests a successful strategic shift or marketing initiative that resonated with consumers. The absence from the rankings in the prior months indicates either a lack of focus or competitive pressure in this category, making the January entry all the more noteworthy. This performance could signal a potential area for growth and increased market penetration for Pure Essentials in the coming months.

Competitive Landscape

In the competitive landscape of the Illinois capsules market, Pure Essentials has maintained a consistent rank of 3rd place from October 2025 to January 2026. This stability in ranking suggests a solid foothold in the market, yet it also highlights the challenge of surpassing its competitors. Notably, 1906 has consistently held the top position, with sales figures significantly higher than those of Pure Essentials, indicating a strong brand presence and customer loyalty. Meanwhile, Avexia remains a steadfast competitor in 2nd place, with sales figures more than double those of Pure Essentials, suggesting a need for strategic marketing or product differentiation to close the gap. Although Pure Essentials has shown a slight increase in sales over the months, the absence of Breez from the rankings in January 2026 could present an opportunity for Pure Essentials to capture additional market share if it can capitalize on any shifts in consumer preference or availability.

Notable Products

In January 2026, Pure Essentials saw Sativa Momentum Capsules 10-Pack (100mg) maintain its top position, continuing its streak as the number one ranked product since October 2025 with sales reaching 564 units. Cronuts #4 Capsules 10-Pack (100mg) experienced a significant rebound, climbing back to the second position from fourth in December 2025, with notable sales of 520 units. The CBD/THC 1:1 Cherry Tincture (100mg CBD, 100mg THC, 30ml) remained steady in the third position, showing a slight increase in sales compared to December. Indica Night Capsules 10-Pack (100mg) held its ground at fourth, consistent with its ranking in December. The Indica Deep Sleep Night Capsules 10-Pack (100mg) entered the rankings at fifth place, indicating a positive reception in the market.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.