Jan-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

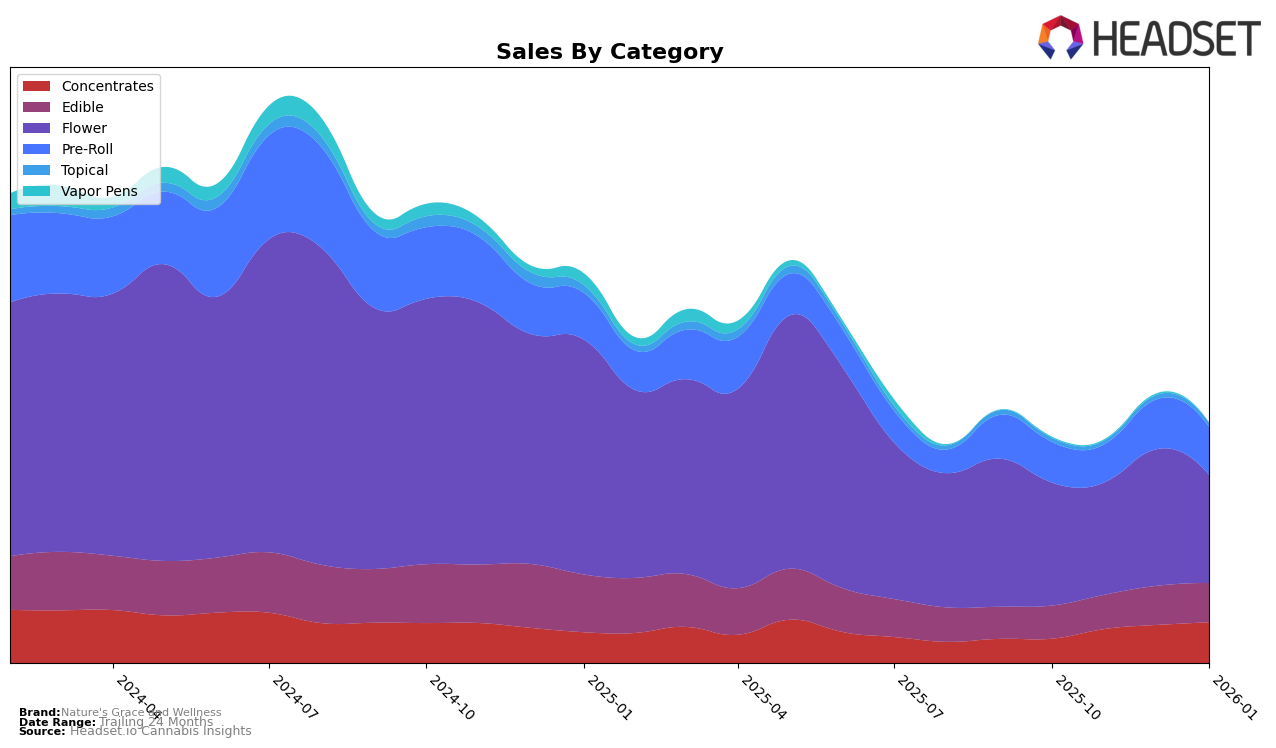

Nature's Grace and Wellness has demonstrated notable performance in the Illinois market, particularly within the Concentrates category. Over the span from October 2025 to January 2026, the brand climbed from the 7th to the 3rd position, showcasing a consistent upward trajectory. This movement is indicative of a strong market presence and growing consumer preference in this category. The Edible category also saw a positive shift, with the brand improving its rank from 18th to 16th. Such advancements, although modest, suggest a gradual strengthening in their product appeal. However, in the Flower category, the brand experienced fluctuations, dropping from 13th to 14th before briefly reaching 11th, indicating potential volatility or increased competition in this segment.

In the Pre-Roll category, Nature's Grace and Wellness achieved a commendable rise from the 11th to the 9th position by January 2026 in Illinois. This improvement highlights the brand's capability to capture a larger share of the market in this segment. Despite the positive trends in some categories, it's noteworthy that the brand's absence from the top 30 in other states or provinces may point to areas needing strategic focus or expansion. The overall sales figures reflect a robust performance, especially in Concentrates, where sales increased consistently over the months. Such data underscores the brand's potential and the importance of continued efforts to maintain and enhance its market position across different categories and regions.

Competitive Landscape

In the competitive Illinois flower market, Nature's Grace and Wellness has experienced fluctuations in its ranking over the past few months, indicating a dynamic market position. Despite a slight dip in sales from October 2025 to January 2026, the brand managed to climb to the 11th rank in December 2025 before settling back to 14th in January 2026. This suggests a temporary boost in consumer preference or promotional success during the holiday season. Meanwhile, Cresco Labs maintained a relatively stable position, consistently ranking around 12th to 13th, showcasing a steady consumer base. Interestingly, Find. made a notable leap from 18th in December 2025 to 12th in January 2026, indicating a significant increase in consumer interest or effective marketing strategies. 93 Boyz experienced a decline from 10th to 15th over the same period, possibly reflecting a shift in consumer preferences or competitive pressures. Lastly, Revolution Cannabis showed a gradual improvement in rank, moving from 20th to 16th, suggesting a positive trend in brand visibility or product acceptance. These competitive dynamics highlight the importance for Nature's Grace and Wellness to continuously innovate and adapt to maintain and improve its market position.

Notable Products

In January 2026, the top-performing product for Nature's Grace and Wellness was the Orange Dark Chocolate Macro Bar (50mg), which climbed to the number one rank from fifth place in December 2025, achieving sales of 5089 units. The Birthday Cake White Chocolate Macro Bar (50mg) held steady in the second position, maintaining its strong sales performance with 5073 units sold. The Mint Cookie Milk Chocolate Crunch Macro Bar (50mg) saw a slight drop, moving to third place from second, while the Key Lime Pie White Chocolate Macro Bar (50mg) experienced a decline in rank from third to fourth. Notably, the Slims XL - Goon Berries Pre-Roll (1g) entered the rankings for the first time, securing the fifth position.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.