Jan-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

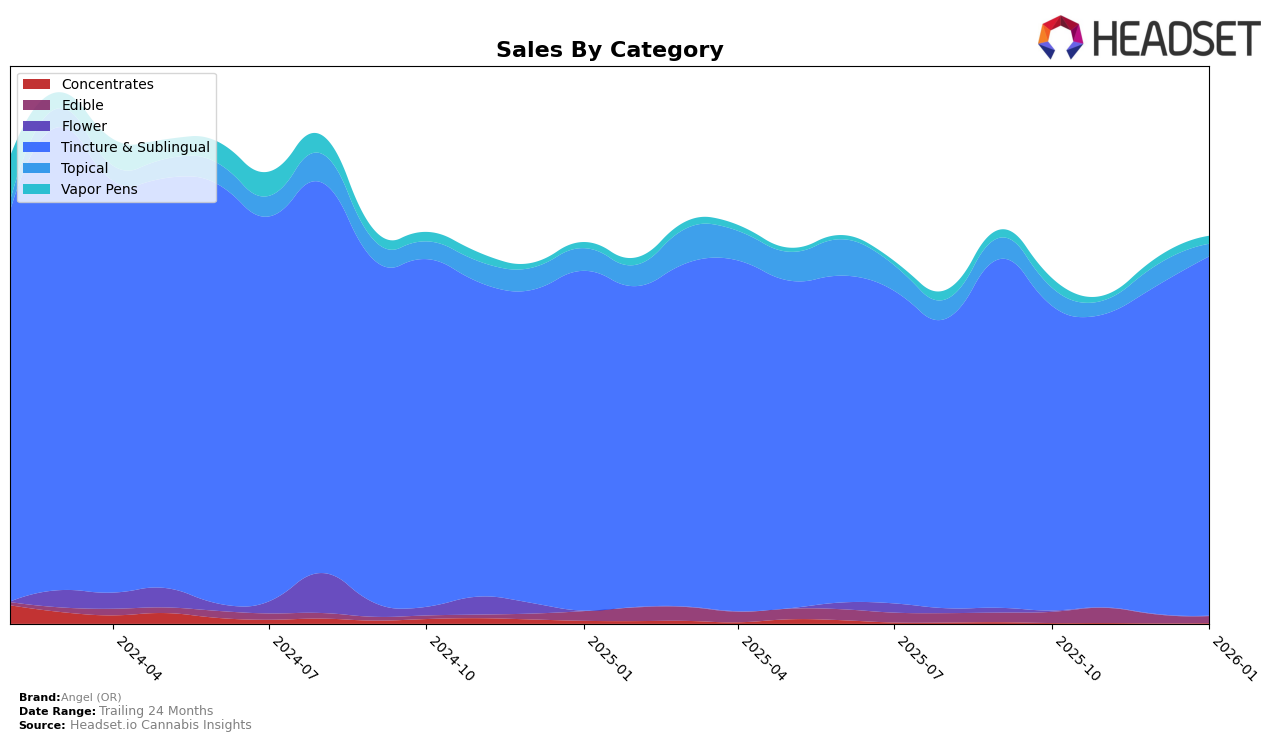

Angel (OR) has demonstrated consistent dominance in the Tincture & Sublingual category within Oregon. Over the four-month period from October 2025 to January 2026, Angel (OR) maintained the number one rank in this category, showcasing a solid hold on the market. The brand's sales trajectory in this category is noteworthy, with a steady increase culminating in a significant sales figure in January 2026. This upward trend indicates a strong consumer preference and possibly effective product positioning or marketing strategies that are resonating well with the audience in Oregon.

In contrast, Angel (OR)'s performance in the Topical category in Oregon presents a more varied picture. The brand was ranked fifth in October 2025, but it did not make it to the top 30 in November 2025, suggesting a drop in either market presence or consumer demand during that month. However, Angel (OR) managed to rebound to sixth place by December 2025. This fluctuation could be indicative of competitive pressures, seasonal demand changes, or internal challenges that might have affected their positioning. Such variations highlight the competitive nature of the Topical category and suggest areas where the brand may need to focus its efforts to stabilize and potentially improve its market position.

Competitive Landscape

In the Oregon Tincture & Sublingual category, Angel (OR) has consistently maintained its top position from October 2025 to January 2026, showcasing its strong market presence and consumer preference. Despite a slight dip in sales from October to November 2025, Angel (OR) experienced a significant rebound in December 2025 and continued to grow in January 2026, indicating a positive sales trajectory. In contrast, competitors like Farmer's Friend Extracts and Hapy Kitchen have fluctuated between the second and third ranks, with Farmer's Friend Extracts briefly dropping to third place in December 2025. This competitive dynamic highlights Angel (OR)'s robust market strategy and brand loyalty, as it continues to outperform its rivals in both rank and sales growth.

Notable Products

In January 2026, Angel (OR) maintained its top-performing product, THC Unflavored Tincture (1000mg), as the leader in the Tincture & Sublingual category with sales of 1360 units. The CBD/THC 1:1 Flavorless Hemp Tincture secured the second position, showing a consistent rise from the fourth place in October 2025 to second in December 2025 and maintaining this rank in January. The CBD/THC/CBN/CBG 1:1:1:1 Rainbow Children Tincture held steady in third place since November, after dropping from second in October. The CBD Flavorless Hemp Tincture remained in fourth place, despite a slight dip in sales from November to December. Notably, the CBD/CBN 1:1 Lavender ZZZ Formula Tincture Drop entered the rankings in January, securing the fifth position, indicating a positive market reception.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.