Jan-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

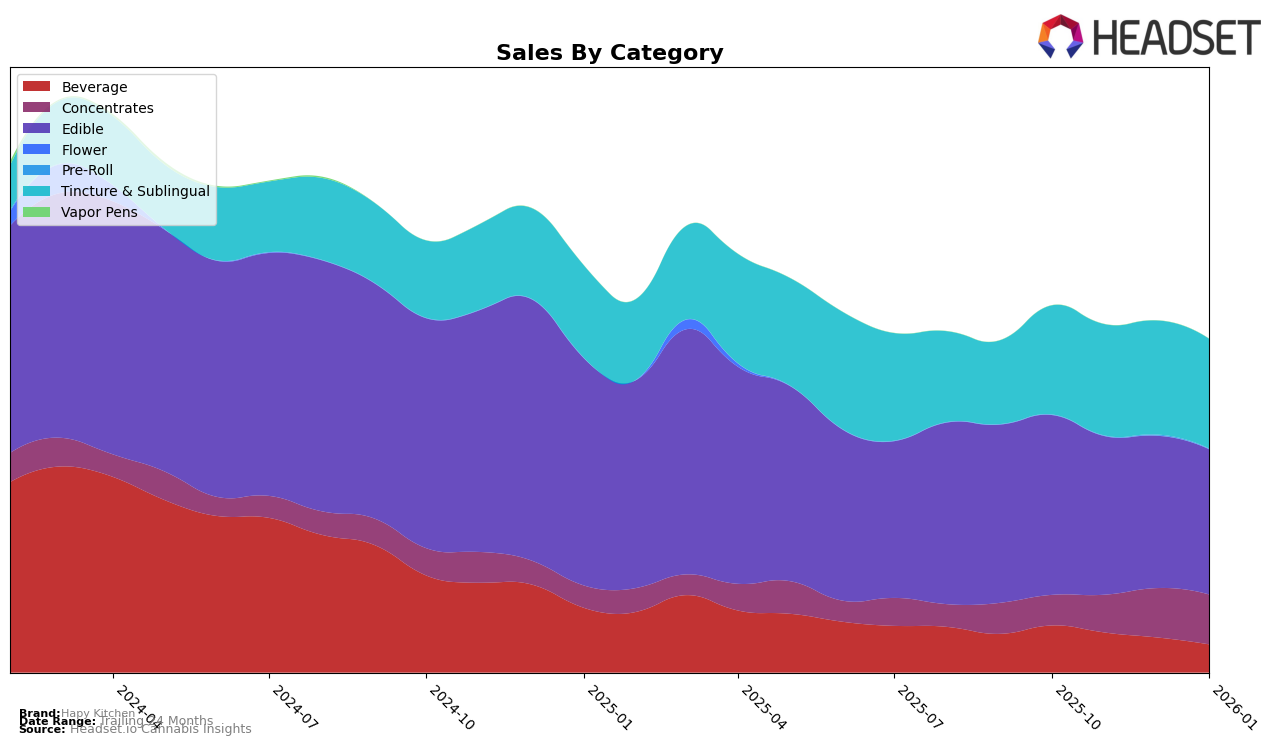

Hapy Kitchen's performance across various product categories in Oregon reveals some interesting trends. In the Beverage category, the brand maintained a relatively stable position, consistently ranking at 7th place, except for a slight dip to 8th in December 2025. This stability is notable despite a gradual decline in sales from October 2025 to January 2026, which suggests that while their market share may be stable, there could be underlying challenges in consumer demand or competition. Meanwhile, in the Tincture & Sublingual category, Hapy Kitchen showed a strong performance, consistently ranking within the top 3, peaking at 2nd place in December 2025. This indicates a robust presence in this niche, likely driven by consistent product quality or strong brand loyalty.

In the Edible category, Hapy Kitchen experienced a slight decline in rankings, moving from 12th in October and November 2025 to 15th in December before recovering slightly to 14th in January 2026. This movement suggests competitive pressure or shifting consumer preferences that the brand may need to address to regain its earlier standing. The Concentrates category paints a different picture, with Hapy Kitchen improving its position from 54th in October 2025 to 37th by January 2026. This upward trajectory indicates a successful strategy in this category, perhaps through new product introductions or effective marketing campaigns. However, it's worth noting that in both the Edible and Concentrates categories, not being in the top 30 for some months highlights areas where further growth and focus may be needed to enhance their market presence.

Competitive Landscape

In the competitive landscape of the Oregon edible market, Hapy Kitchen has experienced some fluctuations in its rank and sales over the past few months. Starting from October 2025, Hapy Kitchen held the 12th position, but by December 2025, it had slipped to 15th, only to recover slightly to 14th in January 2026. This decline in rank coincides with a consistent drop in sales, from a high in October 2025 to a lower figure in January 2026. In contrast, Feel Goods showed a positive trajectory, climbing from 14th to 12th place, with a notable increase in sales by January 2026. Meanwhile, Dr. Feel Good also improved its position from 15th to 13th, with a significant sales boost in December 2025. Bitz & Botz and Golden maintained relatively stable ranks, though Bitz & Botz experienced a sales spike in December 2025. These dynamics suggest that while Hapy Kitchen remains a strong player, it faces stiff competition from brands like Feel Goods and Dr. Feel Good, which are gaining traction in the market.

Notable Products

In January 2026, Hapy Kitchen's top-performing product was the Chocolate Brownie (100mg) in the Edible category, maintaining its number one ranking from December 2025 with sales of 2600 units. The Chocolate Brownie 2-Pack (100mg) held steady at the second position, despite a slight decrease in sales from December. The Toffee Crunch Blondie Brownie (100mg) rose to third place, improving from its consistent fourth-place finish in the previous two months. Conversely, the Muddy Buddy Wedding Cake Hash Rosin Cookie (100mg) dropped to fourth place after two months in third. The CBG/THC 1:1 Strawberry Lemon Drop Cookie (100mg CBG, 100mg THC) remained in fifth place, showing a minor sales decline compared to December.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.