Jan-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

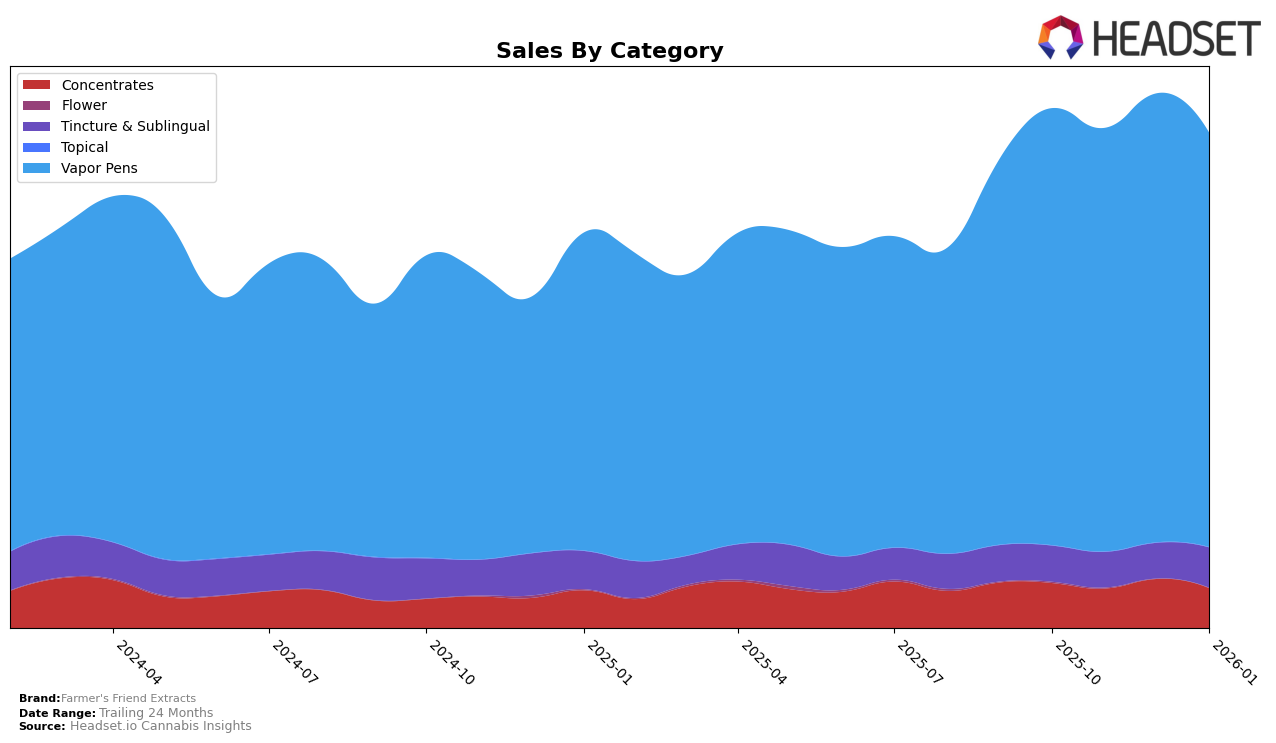

Farmer's Friend Extracts has shown a consistent presence in the Oregon market, particularly in the Concentrates category, where it maintained a ranking within the top 20 brands from October 2025 to January 2026. Despite a slight fluctuation between the 17th and 20th positions, the brand's sales in this category remained relatively stable, suggesting a steady demand. In the Tincture & Sublingual category, Farmer's Friend Extracts performed exceptionally well, consistently ranking in the top three, with a notable increase in sales in January 2026. This indicates a strong foothold and possibly a loyal customer base in this category within the state.

In the Vapor Pens category, Farmer's Friend Extracts demonstrated resilience by maintaining a rank between 6th and 7th place over the four-month period. Although there was a slight dip in sales towards January 2026, the brand's ability to stay within the top 10 suggests a competitive edge in the Oregon market. Notably, the absence of any rankings outside the top 30 in these categories indicates that Farmer's Friend Extracts is a significant player in each segment it participates in within the state. This consistent performance across multiple categories highlights the brand's versatility and adaptability in a competitive landscape.

Competitive Landscape

In the competitive landscape of vapor pens in Oregon, Farmer's Friend Extracts has maintained a consistent presence, ranking between 6th and 7th from October 2025 to January 2026. Despite a slight dip in sales in January 2026, Farmer's Friend Extracts has outperformed brands like NW Kind and Oregrown for most of this period. However, Oregrown showed a significant jump in January 2026, moving from 10th to 5th place, which could indicate a growing competitive threat. Meanwhile, Mule Extracts experienced a notable decline, dropping from 3rd to 9th place by January 2026, potentially opening up opportunities for Farmer's Friend Extracts to capture more market share. Consistent rankings and competitive sales figures suggest that Farmer's Friend Extracts is a stable player in the market, but the dynamic shifts among competitors highlight the importance of strategic positioning and marketing to maintain and improve its standing.

Notable Products

In January 2026, the top-performing product for Farmer's Friend Extracts was the Afternoon Punch Full Spectrum CO2 Cartridge (1g) in the Vapor Pens category, achieving the highest sales figure of 1620 units. Following closely were the Banana Poison Full Spectrum Co2 Cartridge (1g) and Frosted Runtz Full Spectrum CO2 Cartridge (1g), securing the second and third positions respectively. Elvis Full Spectrum CO2 Cartridge (1g) and Forbidden Fruit Full Spectrum CO2 Glass Cartridge (1g) rounded out the top five. Compared to previous months, these products showed a significant rise in rankings as they were not ranked in the last quarter of 2025. This upward trend indicates a growing consumer preference for Vapor Pens from Farmer's Friend Extracts in the new year.

```Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.