May-2024

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

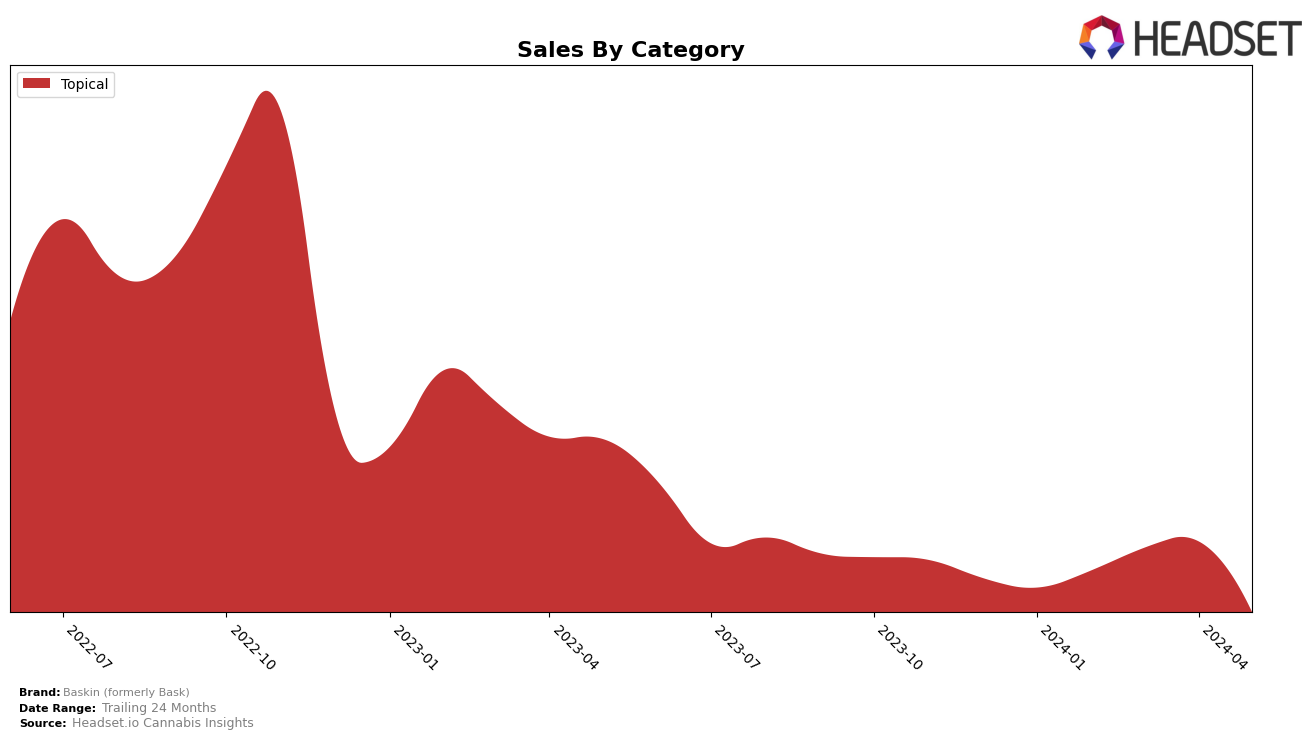

Baskin (formerly Bask) has shown significant performance fluctuations across various states and categories. In Nevada, the brand has seen a notable rise in the Topical category, moving from 7th place in February 2024 to 4th place in March 2024. However, by May 2024, the brand fell out of the top 30 rankings, indicating potential volatility or increased competition in the market. This movement suggests that while Baskin has the capacity to climb the ranks quickly, maintaining a top position may require additional strategic efforts.

Sales trends for Baskin in Nevada's Topical category reveal a steady increase from $13,140 in February 2024 to $19,264 in April 2024. Despite this upward trajectory, the brand's inability to stay within the top 30 in May 2024 could be a cause for concern. The data indicates that while Baskin can achieve significant short-term success, sustaining long-term growth and market presence might be challenging. This performance pattern underscores the need for continuous innovation and adaptation to maintain consumer interest and market share.

Competitive Landscape

In the Nevada Topical category, Baskin (formerly Bask) has shown notable fluctuations in rank over the past few months, indicating a dynamic competitive landscape. In February 2024, Baskin held the 7th position, which improved to 4th in March, but slightly dropped to 5th in April. By May, Baskin was not in the top 20, suggesting a significant decline in market presence. This volatility contrasts with Canna Hemp, which entered the top 20 in April at 8th position, and The Real McCoy (NV), which has consistently remained in the top 10, albeit with some fluctuations. The Real McCoy (NV) started at 4th in February, dropped to 7th in March, returned to 4th in April, and fell to 8th in May. These trends suggest that while Baskin has had moments of strong performance, it faces stiff competition and needs to strategize effectively to regain and maintain a top position in the Nevada Topical market.

Notable Products

In May-2024, the top-performing product from Baskin (formerly Bask) was the CBD/THC 3:1 Transdermal Cream (375mg CBD, 151mg THC) in the Topical category, maintaining its first-place ranking from March-2024. The CBD/THC 1:1 Eucalyptus Balm (100mg CBD, 100mg THC 1.7oz) ranked second, consistent with its position in April-2024. The CBD/THC 1:3 Joy & Release Transdermal Cream (125mg CBD, 375mg THC) dropped to third place, despite having been the top product in both February and April-2024. The CBD Body Wellness Cream (400mg CBD) rose to fourth place from its fifth position in February and April-2024. Notably, the CBD/THC 1:1 Balance & Relief Cream (250mg CBD, 250mg THC) entered the rankings for the first time in May-2024, securing the fifth spot.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.