Sep-2024

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

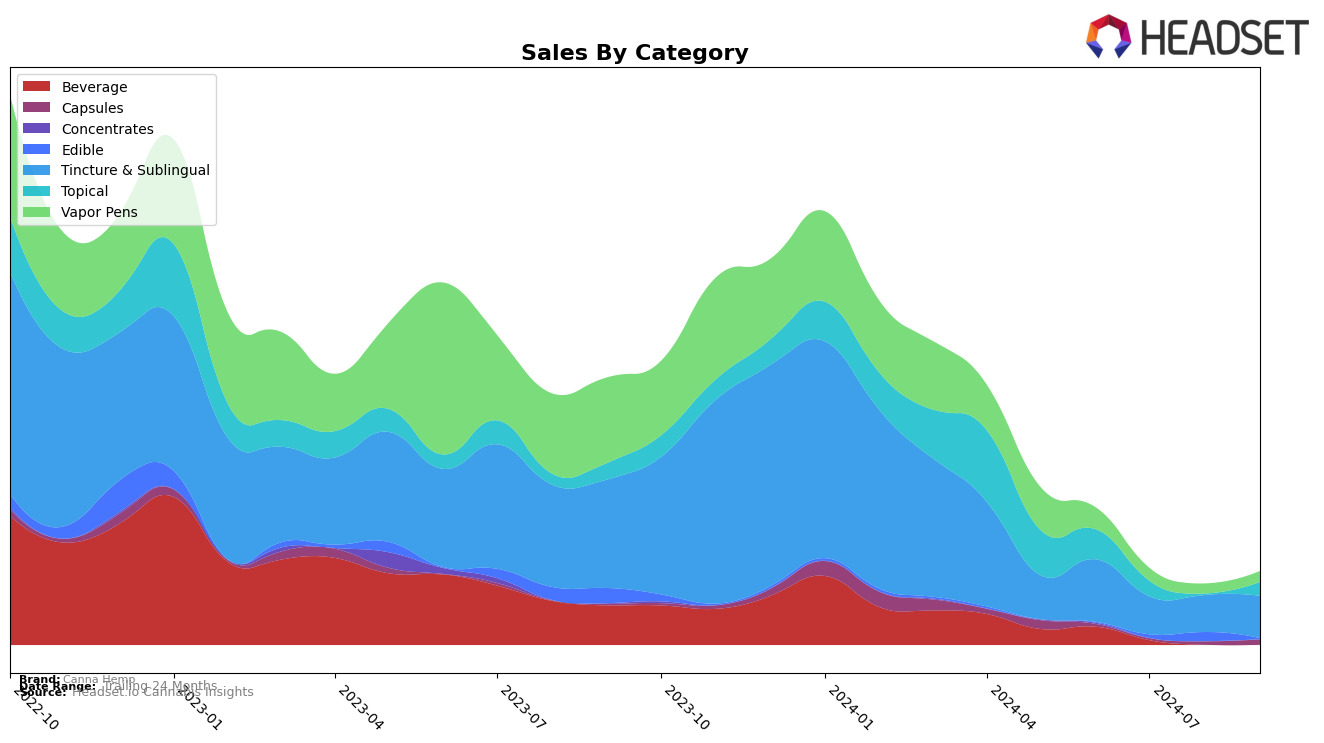

Canna Hemp has shown a notable presence in the Tincture & Sublingual category within Nevada as of June 2024, where it achieved a commendable 4th place ranking. However, subsequent months indicate that Canna Hemp did not maintain a position within the top 30 brands in this category, suggesting a decline or increased competition in the market. This drop-off could highlight challenges in sustaining their market share or possibly shifts in consumer preferences within the state.

The absence of Canna Hemp from the top 30 rankings in July, August, and September 2024 in Nevada raises questions about their strategic positioning and market adaptability. While the initial ranking in June underscores their potential and consumer interest, the lack of subsequent data might suggest a need for reinvigorated marketing efforts or product innovation to regain traction. Observing these trends could provide insights into the competitive dynamics within the Tincture & Sublingual category and offer a glimpse into potential areas of improvement for Canna Hemp.

Competitive Landscape

In the Nevada Tincture & Sublingual category, Canna Hemp experienced a notable shift in its competitive positioning over the summer of 2024. Initially ranked 4th in June, Canna Hemp's absence from the top 20 in subsequent months suggests a significant decline in market presence. This contrasts sharply with Spiked Flamingo, which maintained a consistent 3rd place ranking throughout the same period, indicating robust and growing sales. Meanwhile, City Trees emerged in the rankings by September, securing the 4th position, which may have further impacted Canna Hemp's market share. These dynamics highlight a competitive landscape where Canna Hemp faces increasing pressure from both established and emerging brands, necessitating strategic adjustments to regain its footing in the Nevada market.

Notable Products

In September 2024, the top-performing product from Canna Hemp was the CBD Calm Distillate Disposable (0.5g) in the Vapor Pens category, climbing from fourth place in August to first place with sales reaching 75 units. The CBD Elixir - Relief MCT Oil Tincture (1000mg CBD, 30ml) maintained its strong position, holding steady at second place for two consecutive months, with a significant increase in sales to 67 units. The CBD/CBG 2:1 Relief Cream (500mg CBD, 250mg CBG, 2oz) entered the rankings for the first time, securing the third position. The CBD Oil Sleep Tincture (1000mg CBD, 30ml) dropped from second to fourth place, while the CBD Capsules 30-Pack (735mg CBD) remained consistent at fifth place. This month saw notable shifts in product rankings, with the introduction of new entrants and changes in consumer preferences.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.