Nov-2024

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

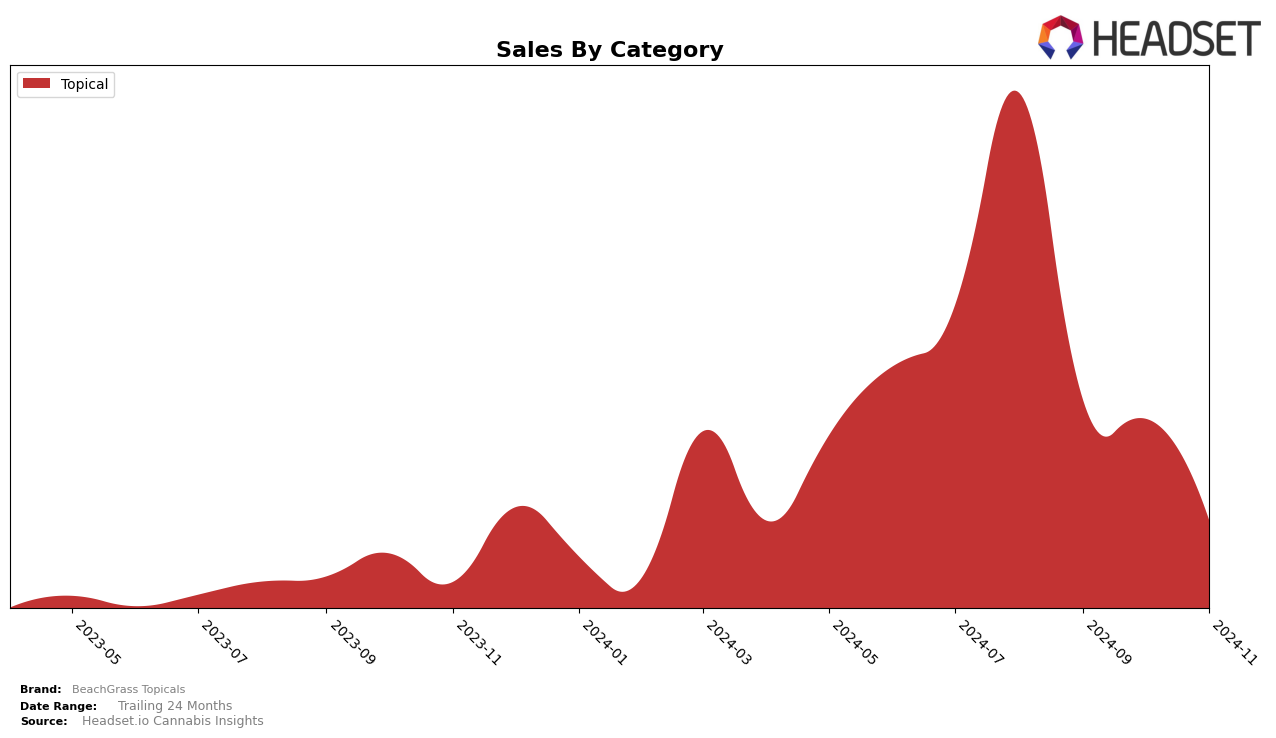

BeachGrass Topicals has shown notable performance in the state of Massachusetts within the Topical category. In August 2024, the brand held a strong position, ranking 6th, which indicates a solid presence in the market. However, the absence of rankings for September, October, and November suggests that the brand did not maintain a position within the top 30 during these months. This decline in visibility could point to increased competition or shifts in consumer preferences within the state.

While specific sales figures for the latter months are not disclosed, the initial sales figure in August was $23,769, providing a reference point for the brand's market size during that period. The absence of subsequent rankings highlights a potential area of concern or opportunity for BeachGrass Topicals to reassess their strategies or product offerings. Monitoring these trends could offer insights into the dynamics of the topical market in Massachusetts and guide future business decisions for the brand.

Competitive Landscape

In the Massachusetts topical cannabis market, BeachGrass Topicals started strong in August 2024 with a rank of 6, but its absence from the top 20 in subsequent months indicates a significant decline in competitive standing. This shift is particularly notable when compared to Doctor Solomon's, which improved its rank from 9 in August to 3 by October, reflecting a robust increase in sales. Meanwhile, The Heirloom Collective also dropped out of the top 20 after August, similar to BeachGrass Topicals, suggesting a competitive struggle among smaller brands. The upward trajectory of Doctor Solomon's highlights the challenges BeachGrass Topicals faces in maintaining market presence and suggests a need for strategic adjustments to regain its competitive edge in this evolving market.

Notable Products

In November 2024, BeachGrass Topicals' CBD/THC 1:1 Skin Loving Salve (250mg CBD, 250mg THC) maintained its top position as the number one selling product, continuing its streak from August. Despite a consistent decline in sales figures, with November sales recorded at 71 units, it remains the leading product. The CBD/THC 1:1 Sweet Frankie Lotion Bar (125mg CBD, 125mg THC) also retained its second-place ranking throughout the months from August to November. Notably, both products have consistently held their ranks, indicating stable consumer preference. This consistency in rankings highlights the sustained popularity of these topicals despite fluctuations in sales volumes.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.