Jan-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

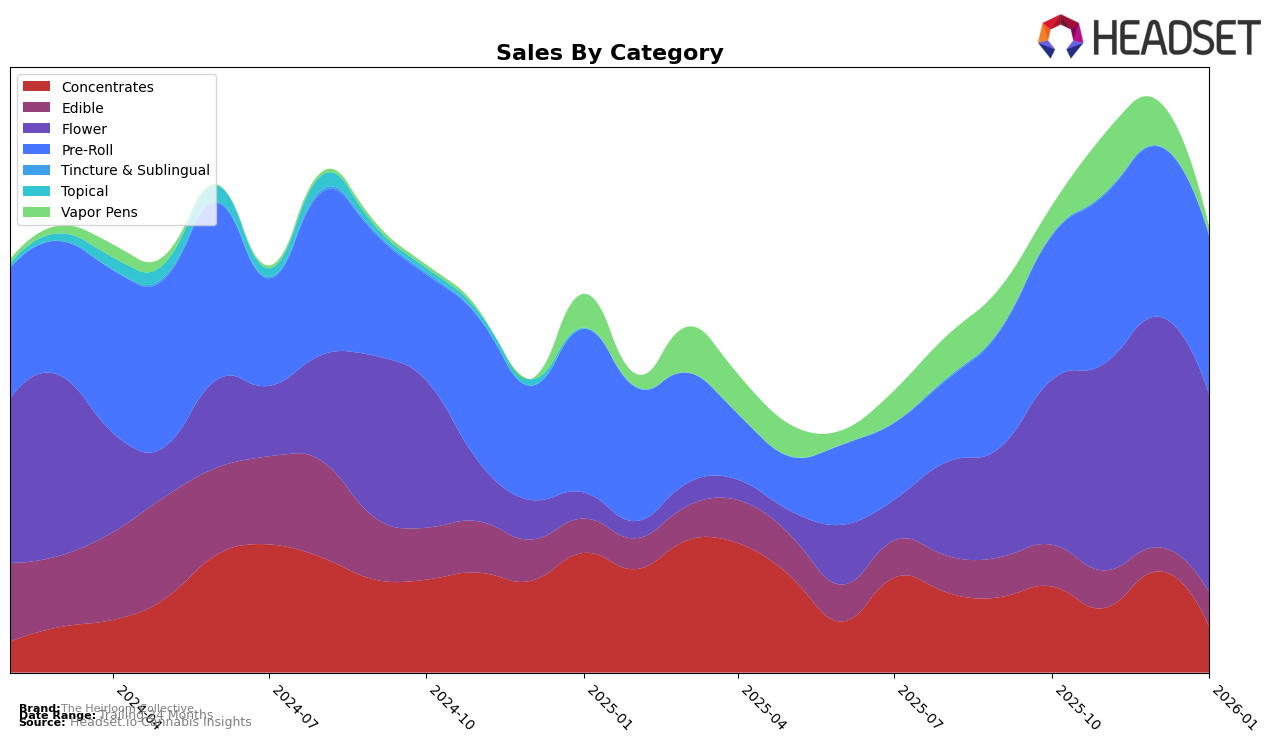

The Heirloom Collective has shown varied performance across different product categories in Massachusetts. In the Concentrates category, the brand experienced a notable rise in December 2025, achieving an 8th place ranking, but faced a significant drop by January 2026, falling to 21st position. This fluctuation suggests a potential challenge in maintaining consistent consumer interest or competition within the category. Meanwhile, their performance in the Edible category remained relatively stable, hovering around the 40th rank, indicating a steady, albeit modest, presence in this market segment. The Flower category saw some positive movement with a peak in November 2025, reaching the 52nd position, although it slightly declined by January 2026. This suggests that while there is interest in their flower products, it may be challenging to sustain higher rankings consistently.

In the Pre-Roll category, The Heirloom Collective demonstrated a consistent performance, maintaining a steady 35th rank from December 2025 to January 2026, which indicates a stable consumer base for these products. However, the Vapor Pens category tells a different story, as the brand was not ranked in the top 30 by January 2026, highlighting a potential area for improvement or increased competition. The fluctuations and rankings across these categories provide insight into the brand's market dynamics and consumer preferences in Massachusetts. While some categories show promise, others suggest areas where the brand may need to strategize for better market penetration and consumer engagement.

Competitive Landscape

In the competitive landscape of the Massachusetts flower category, The Heirloom Collective has demonstrated a notable upward trajectory in brand rank from October 2025 to January 2026. Initially positioned at rank 66 in October 2025, The Heirloom Collective improved its standing to rank 55 by January 2026, reflecting a positive trend in market presence. This upward movement is significant when compared to competitors like Cookies and Khalifa Kush, both of which experienced fluctuations in their rankings, with Cookies dropping out of the top 50 in December 2025 and Khalifa Kush maintaining a relatively stable but lower rank. Meanwhile, Glorious Cannabis Co. and Local Roots maintained higher ranks but showed variability, with Glorious Cannabis Co. dropping from rank 29 in October 2025 to 60 by January 2026. The Heirloom Collective's consistent improvement in rank suggests a strengthening market position, likely driven by strategic initiatives that have resonated well with consumers, positioning them favorably against these competitors.

Notable Products

In January 2026, the top-performing product from The Heirloom Collective was Kitchen Sink (3.5g) in the Flower category, which rose to the number one rank with sales of 2914 units. Kitchen Sink Pre-Roll (1g) in the Pre-Roll category, which held the top spot in December 2025, moved to second place. Peanutbutter Lady (3.5g), also in the Flower category, maintained its third position from the previous month. Orange Kush Cake (3.5g) entered the rankings at fourth place, while Mana Pre-Roll (1g) debuted in fifth place. Notably, Kitchen Sink (3.5g) showed a consistent upward trend, improving from third place in October and November 2025 to first place in January 2026.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.