May-2024

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

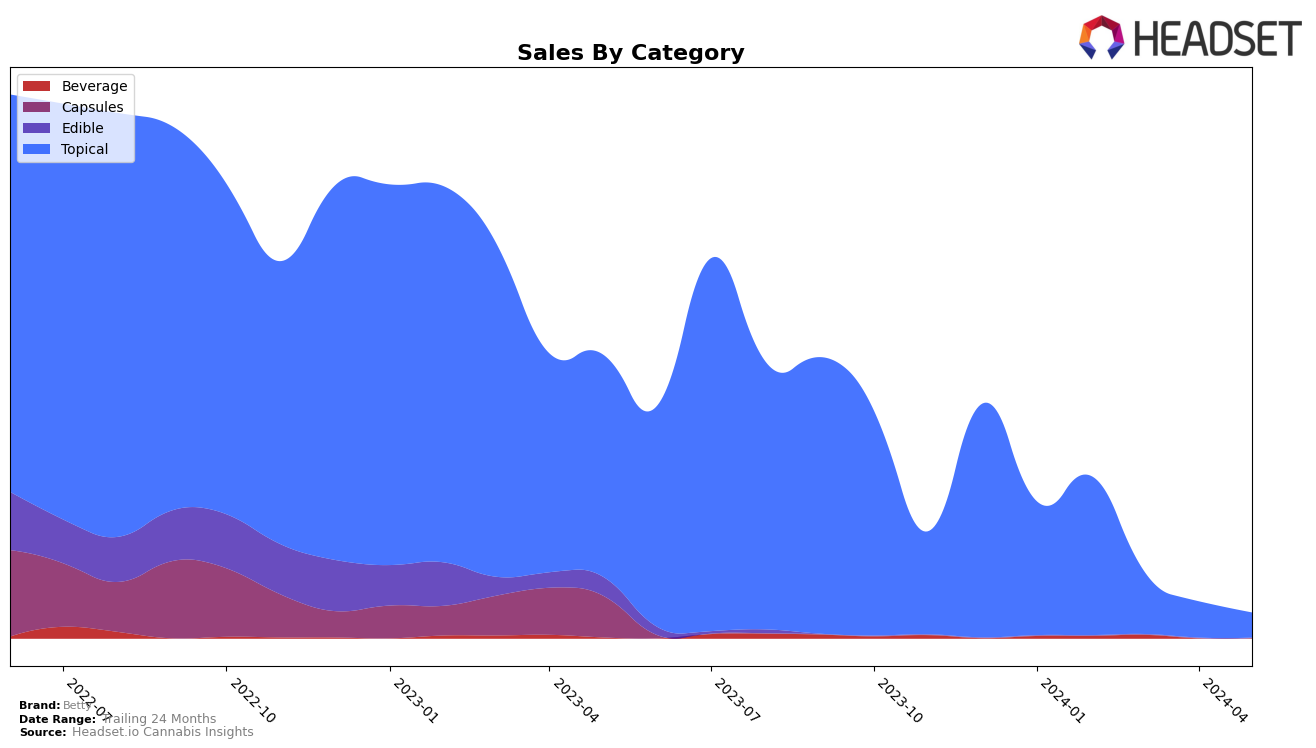

The performance of Betty in the Colorado market has shown notable fluctuations, particularly within the Topical category. In February 2024, Betty secured the 10th position, demonstrating significant presence among competitors. However, the absence of ranking data for subsequent months indicates that Betty did not maintain a position within the top 30 brands in this category, which may suggest a decline in market share or increased competition. This drop could be indicative of either a strategic shift in focus or challenges in maintaining consumer interest in the Topical category.

While the initial sales figure of $10,940 in February 2024 reflects a solid start, the lack of ranking in March, April, and May suggests that Betty's performance did not keep pace with other brands in Colorado. This trend could point to potential issues such as market saturation, changes in consumer preferences, or perhaps an insufficient product pipeline to sustain its early momentum. Understanding these dynamics is crucial for stakeholders looking to capitalize on Betty's initial success and address the factors that may have led to its subsequent decline in rankings.

Competitive Landscape

In the Colorado Topical category, Betty has experienced significant fluctuations in its ranking and sales performance over recent months. Betty ranked 10th in February 2024 but did not appear in the top 20 for March, April, or May 2024, indicating a notable decline in its market presence. In contrast, ioVia has shown more stability and even slight growth, moving from 8th place in February to 7th in March before settling at 9th in both April and May 2024. This consistent performance suggests that ioVia is maintaining a stronger foothold in the market. Additionally, Aliviar emerged in May 2024, ranking 10th, which could pose a new competitive threat to Betty. These shifts highlight the dynamic nature of the market and underscore the need for Betty to reassess its strategies to regain and sustain its competitive edge.

Notable Products

In May-2024, Betty's top-performing product was CBD:THC:CBG:CBN 4:2:1:1 Original Love Potion Intimacy Oil, maintaining its first-place ranking for four consecutive months with a sales figure of 35 units. The CBD/CBG/THC 50:10:1 Ginger Rose Detox Bath Soak rose significantly to the second position from fifth place in March-2024, showing a notable increase in popularity. Similarly, the CBD:THC 100:1 Eucalyptus Cooling Body Balm also climbed to the second spot, up from its fourth-place ranking in April-2024. The CBD:THC CBG:CBN 4:2:1:1 Vanilla Love Potion Body Oil dropped to third place from its second position in April-2024. Finally, the CBD:CBN:THC 2:2:1 Lavender Bedtime Body Balm, which was unranked in April-2024, secured the fourth position in May-2024.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.