Jan-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

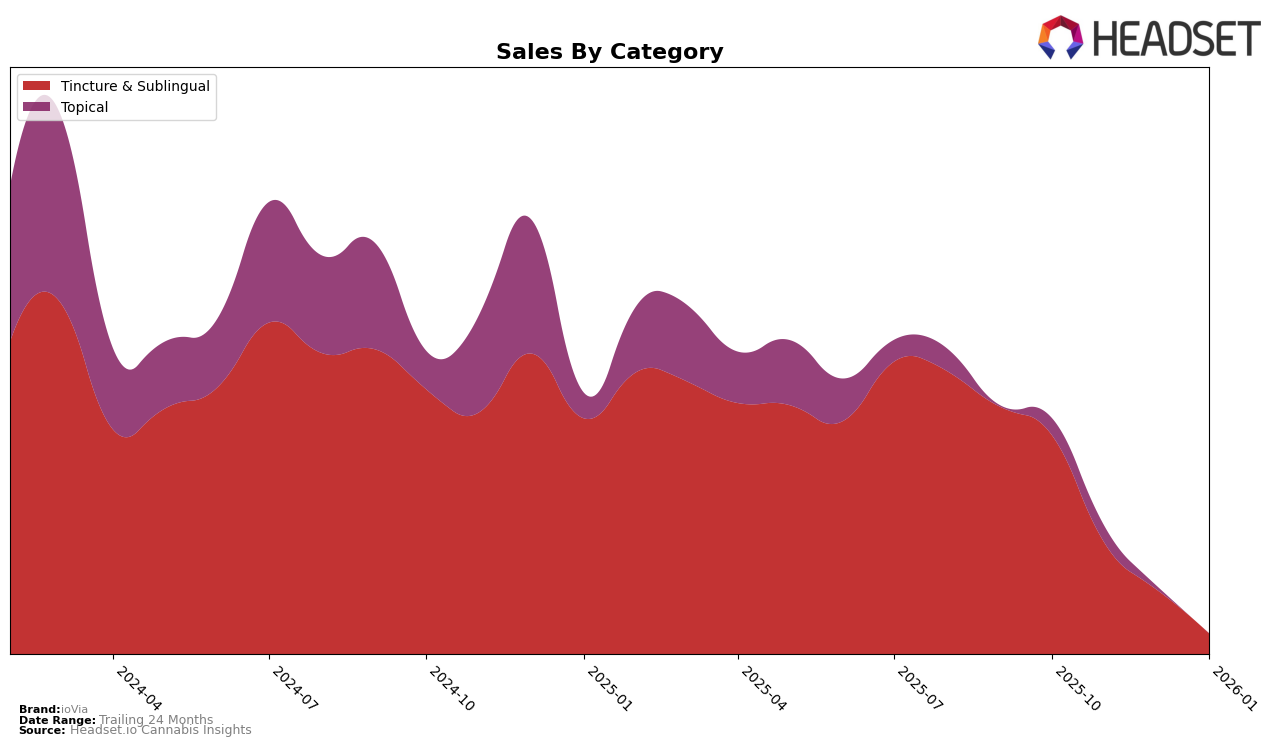

ioVia has shown varied performance across different states and categories, with notable fluctuations in rankings. In Colorado, ioVia has been a significant player in the Tincture & Sublingual category. However, their ranking has experienced a downward trend from October 2025, where they held the 3rd position, to January 2026, where they dropped out of the top 30. This decline is reflected in their sales figures, which decreased steadily over the months. The absence of a ranking in January suggests a significant loss in market presence or a shift in consumer preferences within the state.

The performance of ioVia in other states or categories is not detailed here, but the data from Colorado indicates potential challenges the brand might be facing in maintaining its competitive edge. The movement out of the top 30 in the state's Tincture & Sublingual category could imply increased competition or changing market dynamics. While the specific causes of this decline are not provided, understanding these trends could be crucial for stakeholders looking to navigate the evolving cannabis market landscape.

```Competitive Landscape

In the competitive landscape of Colorado's Tincture & Sublingual category, ioVia has experienced notable fluctuations in its market position, which could have significant implications for its sales trajectory. Starting from a strong third place in October 2025, ioVia's rank slipped to fourth in November and further declined to seventh by December, before dropping out of the top 20 by January 2026. This downward trend contrasts with the performance of competitors like Stratos, which maintained a stable rank around the fifth and sixth positions, and Care Division, which showed resilience by climbing back to fifth place in January 2026 after a brief dip. The sales figures reflect these shifts, with ioVia's sales decreasing significantly from October to December, while Stratos and Care Division managed to sustain relatively stable sales volumes. This suggests that ioVia may need to reassess its market strategies to regain its competitive edge and stabilize its sales performance in this dynamic market.

Notable Products

In January 2026, the Hi-THC Tincture (100mg) maintained its top position as the best-selling product for ioVia, despite a notable drop in sales to 57 units. The CBD:THC 1:1 Precision Dose (100mg CBD, 100mg THC) climbed to second place, showing a steady increase from its debut at fourth in December 2025. The CBD/THC 20:1 Tincture (190mg CBD, 10mg THC) held strong at the third position, though its sales figures continued a downward trend. The CBD/THC 1:1 Lavender Restorative Bath Soak (100mg THC, 100mg CBD, 17.6oz) slipped from third to fourth place, reflecting a slight decrease in demand. Meanwhile, the CBD/THC 1:1 Tea Tree Restorative Bath Soak (100mg CBD, 100mg THC) re-entered the rankings at fifth, indicating a resurgence in interest.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.