Jan-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

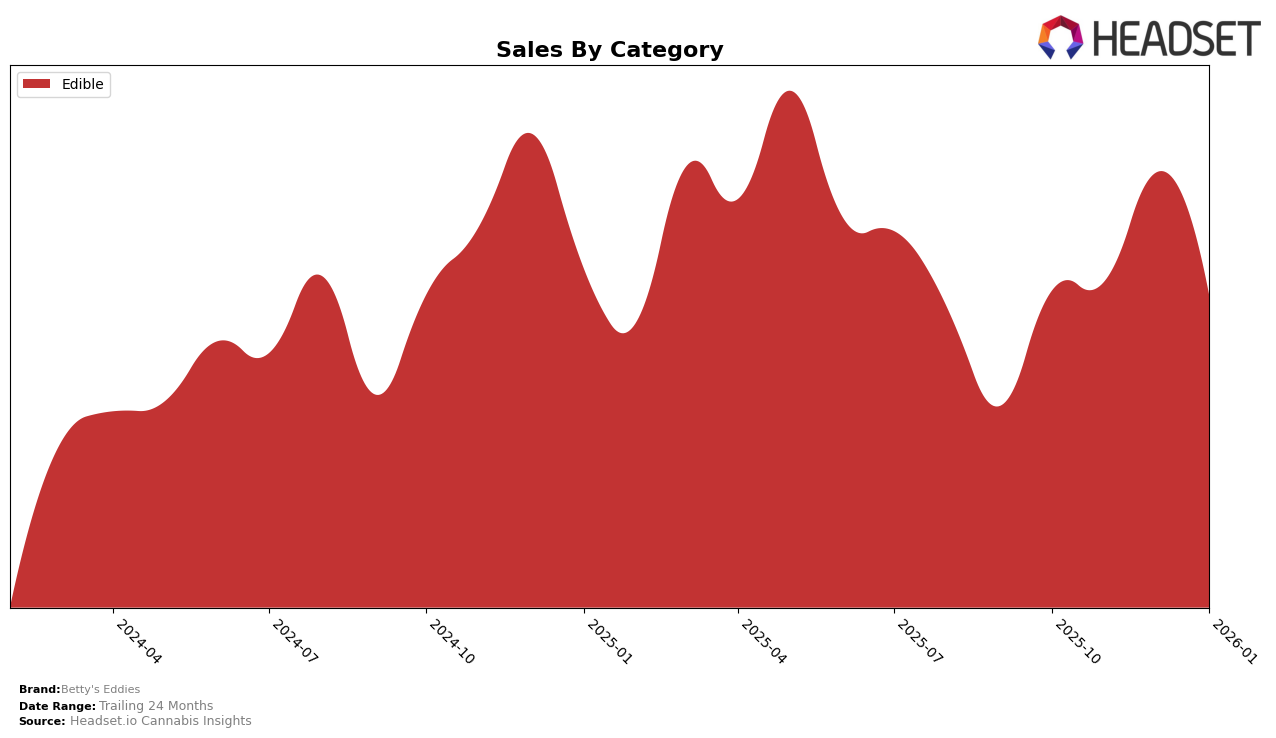

Betty's Eddies has demonstrated a strong presence in the Maryland edible market, consistently holding the top position from November 2025 through January 2026. This suggests a robust foothold and possibly a loyal customer base in the state. In contrast, their performance in Illinois shows a slight fluctuation, with rankings varying between 11th and 14th place over the same period. This indicates a more competitive environment or potential challenges in maintaining a stable market position. In Massachusetts, the brand has maintained a steady 4th place ranking, highlighting a consistent demand for their products, although the slight decline in sales from December 2025 to January 2026 might warrant attention.

Interestingly, while Betty's Eddies did not break into the top 30 edible brands in some states, their performance in key markets like Maryland and Massachusetts provides a solid foundation for potential growth. The brand's sales in Maryland have shown a notable upward trend, peaking in December 2025, which could be indicative of successful marketing strategies or product offerings that resonate well with consumers. Meanwhile, the consistent ranking in Massachusetts suggests that while the brand is not leading, it remains a strong contender in the edible category. Observing how Betty's Eddies navigates these dynamics could provide insights into their strategic priorities and market adaptability in the coming months.

Competitive Landscape

In the Maryland edible market, Betty's Eddies has demonstrated a strong competitive position, consistently holding the top rank from November 2025 to January 2026. This sustained leadership is indicative of their robust market presence and consumer preference. Notably, Betty's Eddies overtook Wyld, which was ranked first in October 2025 but dropped out of the top 20 in November 2025, and subsequently ranked third in December 2025 and January 2026. This shift highlights a significant competitive advantage for Betty's Eddies, as they maintained their top position even as Incredibles remained a strong contender, consistently ranking second from November 2025 to January 2026. The ability of Betty's Eddies to maintain its leading rank amidst such competition suggests a successful strategy in product differentiation and customer loyalty, which is crucial for sustaining sales momentum in a competitive market.

Notable Products

In January 2026, the top-performing product for Betty's Eddies was Bedtime Betty's - CBD/THC/CBN 2:1:1 Raspberry Creme Fruit Chews 10-Pack, maintaining its number one rank from the previous two months with sales of 12,565 units. The Bedtime Betty's - Lemon Agave Fruit Chews 10-Pack (50mg) held steady at the second position, despite a slight decline in sales compared to December 2025. The Lemon Agave Fruit Chews 10-Pack (100mg) improved its rank to third, showing consistent performance. Ache Away - CBD/THC/CBC 4:1:1 Cherry Fruit Chews remained in fourth place, while Goodtimes - Strawberry Full Spectrum Fruit Chews maintained its fifth rank since its entry in December 2025. Overall, the product rankings showed stability with minor fluctuations in sales figures.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.