Dec-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

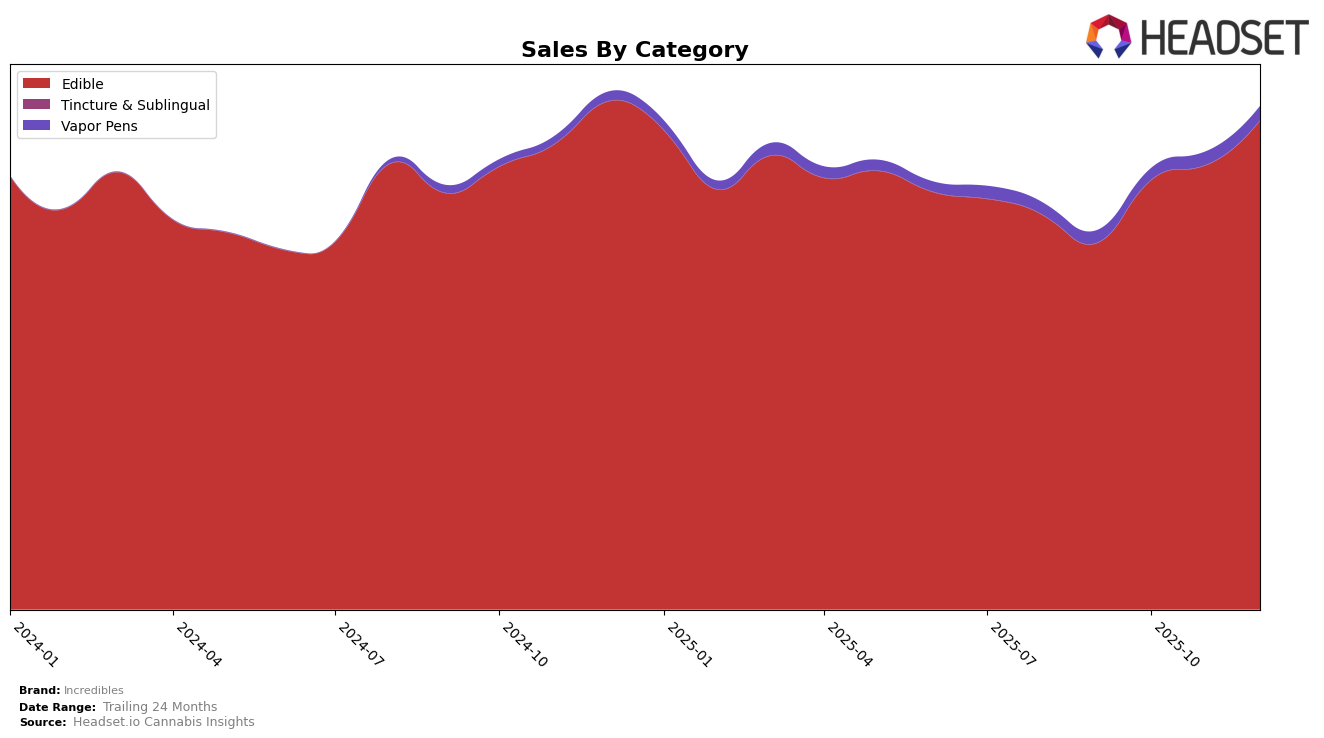

Incredibles has shown varied performance across different states and categories, with notable successes and areas for improvement. In Illinois, the brand has consistently maintained a strong presence in the Edible category, achieving the top rank in both October and December 2025. This indicates a robust market position and consumer preference. Similarly, in Ohio, Incredibles has maintained the number one spot throughout the last four months of 2025, suggesting a strong foothold in the state's edible market. On the other hand, in New York, the brand has hovered around the 19th position, indicating potential challenges in gaining a stronger market share. The consistent ranking in Colorado at ninth place suggests steady performance, although it may highlight an opportunity for growth in a competitive market.

The brand's performance in Maryland is particularly noteworthy, with a significant climb from fifth place in September to securing the top rank by November and December 2025. This upward trajectory suggests successful strategies or product offerings that resonate well with consumers in the region. Meanwhile, in Nevada, Incredibles has maintained a steady second position, indicating a stable and strong presence in the market. The consistent sixth-place ranking in New Jersey throughout the analyzed period shows a reliable yet stagnant performance, pointing to potential areas for strategic improvement. Overall, Incredibles showcases both strengths and opportunities for growth across different state markets, with some states showing clear dominance and others presenting challenges to overcome.

Competitive Landscape

In the highly competitive Illinois edible market, Incredibles has demonstrated impressive resilience and strategic prowess, consistently vying for the top spot against formidable competitors. In September 2025, Incredibles was ranked second, trailing behind Wyld, but by October, it had surged to the number one position, indicating a successful marketing or product strategy that resonated well with consumers. Although it briefly slipped back to second place in November, it reclaimed the top position in December, showcasing its ability to adapt and maintain consumer interest. Meanwhile, Wyld and Wana maintained consistent rankings, with Wyld alternating between first and second place and Wana holding steady at third. This dynamic suggests that while Incredibles faces stiff competition, its ability to oscillate between the top two positions highlights its strong brand presence and consumer loyalty in the Illinois market.

Notable Products

In December 2025, the top-performing product from Incredibles was the CBN/CBG/THC 1:1:2 Snoozzzierberry Gummies 10-Pack, maintaining its number one rank for four consecutive months with sales reaching 38,086. The THC/CBN 5:1 Snoozzzeberry Gummies 10-Pack also held steady at the second position, showing a consistent performance across the same period. Newly ranked in December was the Watermelon Smash Gummies 10-Pack, entering the list at the third position. The Pineapple Express Fast Acting Gummies 10-Pack improved its standing to fourth place from its previous fifth position in September. Meanwhile, the Summer Peach Gummies 10-Pack saw a slight dip, moving from fourth to fifth place by December.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.