Jan-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

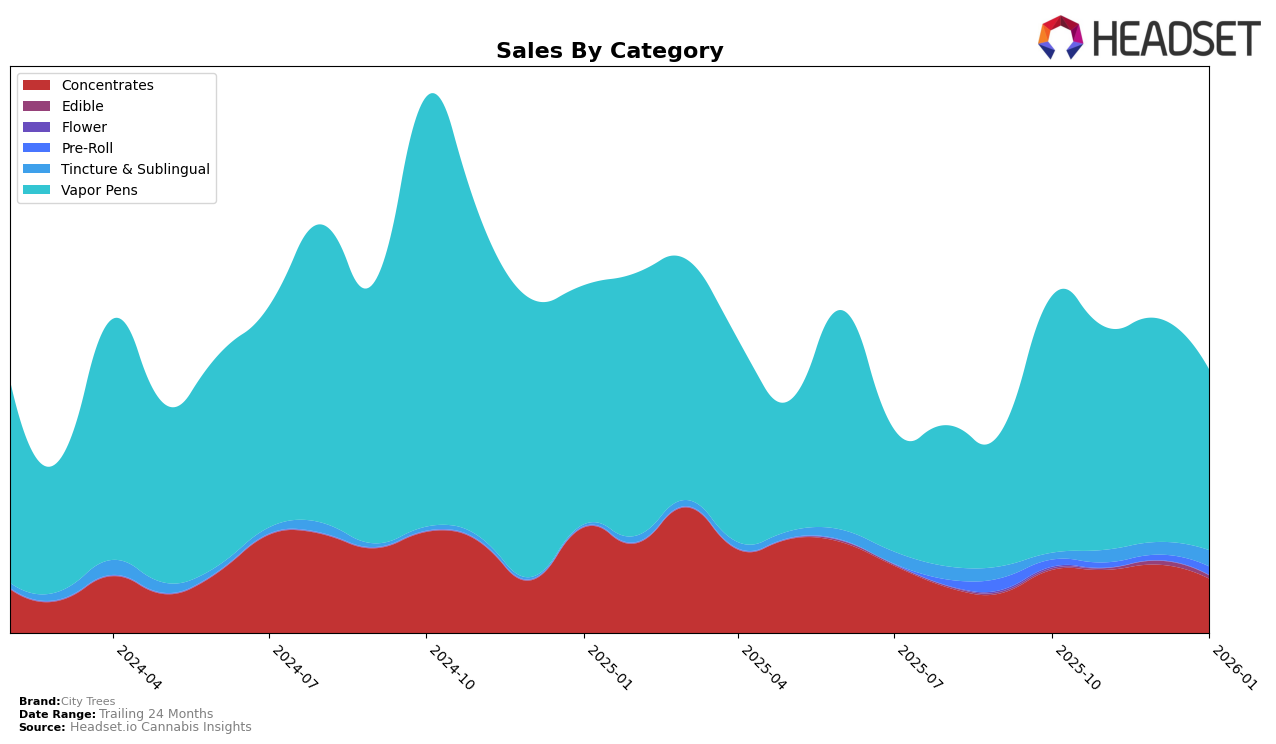

City Trees has shown varied performance across different cannabis product categories in Nevada. In the Concentrates category, the brand maintained a steady third-place ranking from October through December 2025 but experienced a notable drop to sixth place by January 2026. This decline could be indicative of increased competition or shifting consumer preferences. Conversely, in the Tincture & Sublingual category, City Trees consistently held the third spot throughout the same period, suggesting a stable demand for their products in this category. The Vapor Pens category presented a more fluctuating performance, with City Trees starting at tenth place in October, briefly improving to seventh in December, and then falling back to twelfth by January. Such variability in rankings may reflect the dynamic nature of the vapor pen market in Nevada.

Despite the ups and downs in category rankings, City Trees demonstrated a noteworthy sales trajectory in certain areas. For instance, while their Concentrates sales peaked in December 2025, there was a significant decrease by January 2026, aligning with their drop in ranking. On the other hand, the Tincture & Sublingual category not only maintained a consistent rank but also witnessed a steady increase in sales from October to January, which may indicate growing consumer loyalty or effective product positioning. The Vapor Pens category, however, saw a decline in sales from October to January, mirroring the brand's fluctuating rankings and suggesting potential challenges in maintaining market share. These trends highlight the importance of strategic adjustments to sustain and enhance City Trees' market presence across different product categories in Nevada.

Competitive Landscape

In the competitive landscape of vapor pens in Nevada, City Trees experienced notable fluctuations in rank over the last few months, indicating a dynamic market position. In October 2025, City Trees held the 10th position, but slipped to 12th in November. However, a significant improvement was observed in December when City Trees climbed to the 7th rank, before dropping back to 12th in January 2026. This volatility in ranking suggests that while City Trees can achieve strong market presence, it faces stiff competition from brands like TRENDI, which, despite a decline, maintained a higher rank than City Trees in October and November. Meanwhile, Sauce Essentials consistently trailed City Trees, indicating a competitive but slightly weaker position. The entry of Bad Batch Extracts into the top 20 in January, rising to the 14th position, highlights the potential for emerging brands to disrupt the market, posing a challenge to City Trees' market share. These dynamics underscore the importance for City Trees to leverage strategic marketing and product innovation to maintain and enhance its competitive edge in Nevada's vapor pen category.

Notable Products

In January 2026, the top-performing product for City Trees remained the Biscotti Pre-Roll (1g) in the Pre-Roll category, maintaining its first-place rank consistently since October 2025 with a sales figure of 2259 units. The LV Confidential Distillate Cartridge (1g) in the Vapor Pens category saw a notable rise to second place from its previous fourth position in December 2025, with sales climbing to 1089 units. The Banana Kush Distillate Cartridge (1g) debuted strongly, securing the third rank in January with impressive sales. The Fruity Pebbles OG Distillate Cartridge (1g) dropped to fourth place from second in November and December 2025, indicating a slight decline in sales performance. Mango Haze Distillate Cartridge (1g) completed the top five, slipping from third in December to fifth in January.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.