Dec-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

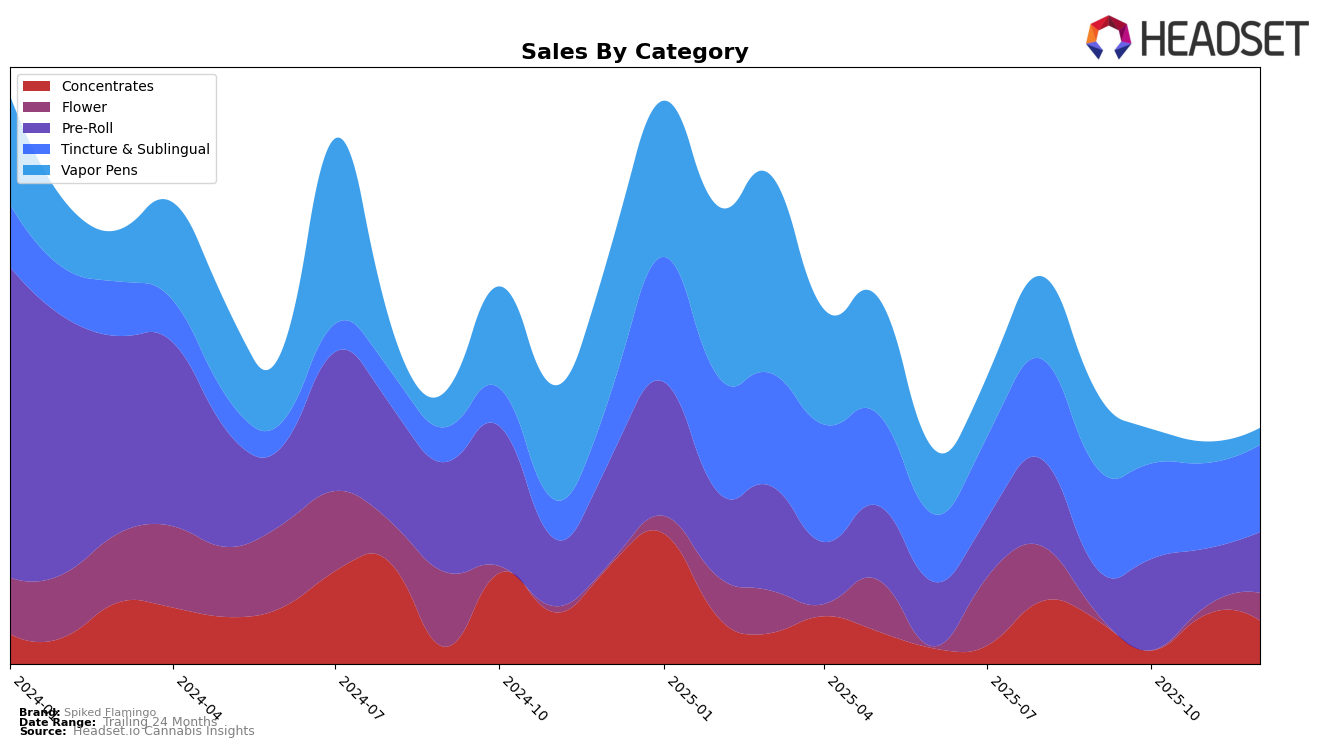

In the state of Nevada, Spiked Flamingo has shown varied performance across different cannabis product categories. Notably, the brand has maintained a consistent top position in the Tincture & Sublingual category, holding steady at rank 1 from September to December 2025. This indicates strong consumer loyalty or a leading product offering in this niche. However, in the Vapor Pens category, Spiked Flamingo has seen a downward trend, slipping from rank 32 in September to rank 53 by December. This decline could suggest increased competition or a shift in consumer preference within the state.

Interestingly, Spiked Flamingo's performance in the Concentrates category in Nevada showed a recovery after a dip, moving from rank 29 in October back to 18 by November and maintaining that position into December. This rebound might indicate a successful strategic adjustment or seasonal demand fluctuations. In contrast, the brand was not ranked in the top 30 for the Flower category until December, when it debuted at rank 77, which could be seen as a potential area for growth or a recent expansion into this product line. The Pre-Roll category experienced a positive movement, advancing from rank 42 in September to 27 by December, suggesting a growing market presence or product acceptance in this segment.

Competitive Landscape

In the Nevada Tincture & Sublingual category, Spiked Flamingo has consistently maintained its top position from September to December 2025, indicating strong brand loyalty and market presence. Despite a slight decline in sales from September to November, Spiked Flamingo's sales rebounded in December, suggesting effective marketing strategies or product offerings that resonate well with consumers. Competitors like Doctor Solomon's and City Trees have remained stable in their ranks at second and third positions, respectively, but their sales figures are notably lower than Spiked Flamingo's, with Doctor Solomon's showing a downward trend in December. This competitive landscape highlights Spiked Flamingo's robust market leadership, although the brand must remain vigilant to sustain its edge as competitors strive to close the sales gap.

Notable Products

During December 2025, the top-performing product for Spiked Flamingo was Zaam Cured Resin Badder (1g) in the Concentrates category, securing the number one rank with notable sales of 513 units. Unflavored Tincture (800mg) in the Tincture & Sublingual category maintained a strong position, ranking second, having previously ranked second in September and third in October. The CBD/THC 1:1 Anytime Hempseed Tincture (500mg CBD, 500mg THC) debuted in December at the third position, showcasing significant market entry in the Tincture & Sublingual category. Platinum Cake Infused Pre-Roll (1g) and Berry Gelato Infused Pre-Roll (1g) occupied the fourth and fifth ranks, respectively, indicating a robust demand for infused pre-rolls. These rankings highlight a shift towards concentrates and infused products, with tinctures maintaining steady performance over the months.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.