Jan-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

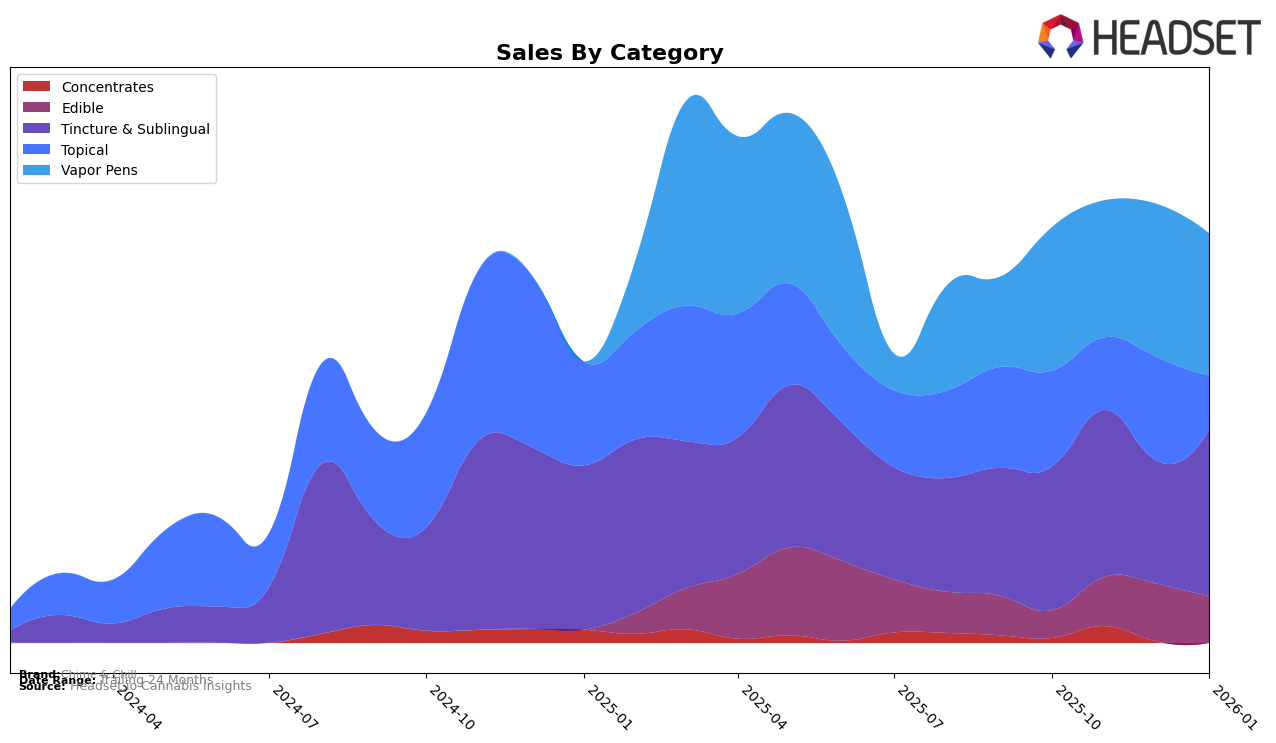

Chime & Chill has shown consistent performance in the New York market within the Tincture & Sublingual category. Over the four-month period from October 2025 to January 2026, the brand maintained a steady ranking, consistently placing 13th, except for a slight improvement to 12th in November. This stability suggests a solid customer base and steady demand for their products, despite fluctuations in sales figures. For instance, there was a noticeable sales increase in November, followed by a dip in December, yet the brand managed to regain its sales momentum by January.

While Chime & Chill's performance in New York is noteworthy, their absence from the top 30 in other states or provinces indicates potential areas for growth or challenges in penetrating those markets. This could be seen as a strategic opportunity for the brand to expand its reach and explore new territories. Additionally, the consistency in their ranking within New York's Tincture & Sublingual category highlights the importance of maintaining product quality and customer satisfaction to retain their position in a competitive landscape.

Competitive Landscape

In the competitive landscape of the Tincture & Sublingual category in New York, Chime & Chill has shown consistent performance, maintaining a steady rank of 13th from October 2025 through January 2026. This stability contrasts with the fluctuating ranks of competitors such as Harney Brothers Cannabis, which improved from 10th to 8th before settling back to 9th, indicating a stronger market presence. Meanwhile, Jumbodose and Canna Dots experienced rank volatility, with Jumbodose dropping out of the top 20 by December 2025, and Canna Dots appearing in December at 12th but missing in other months. Chime & Chill's sales saw a notable dip in December 2025, but rebounded in January 2026, suggesting resilience amidst competitive pressures. The presence of FLWR CITY, entering the rankings at 12th in January 2026, adds further competition, highlighting the dynamic nature of this market segment.

Notable Products

In January 2026, the top-performing product for Chime & Chill was the KO - CBD Double Dose Tincture (4500mg CBD, 30ml) in the Tincture & Sublingual category, maintaining its first-place ranking for four consecutive months with sales of 265 units. The CBD Hello Honeydew Live Resin Cartridge (1g) in the Vapor Pens category climbed back to the second position from fourth in December 2025, showing a notable increase in popularity. The KO- CBD The Money Melon Distillate Disposable (1g) dropped to third place from its second-place ranking the previous month. The CBD/CBN 2:1 PM Lotion (300mg CBD, 150mg CBN) fell to fourth place in January 2026, continuing its decline from second place in October 2025. A new entry, the CBD/CBG 2:1 AM Oral Solution (200mg CBD, 100mg CBG), debuted in fifth place, indicating growing interest in this category.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.