Feb-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

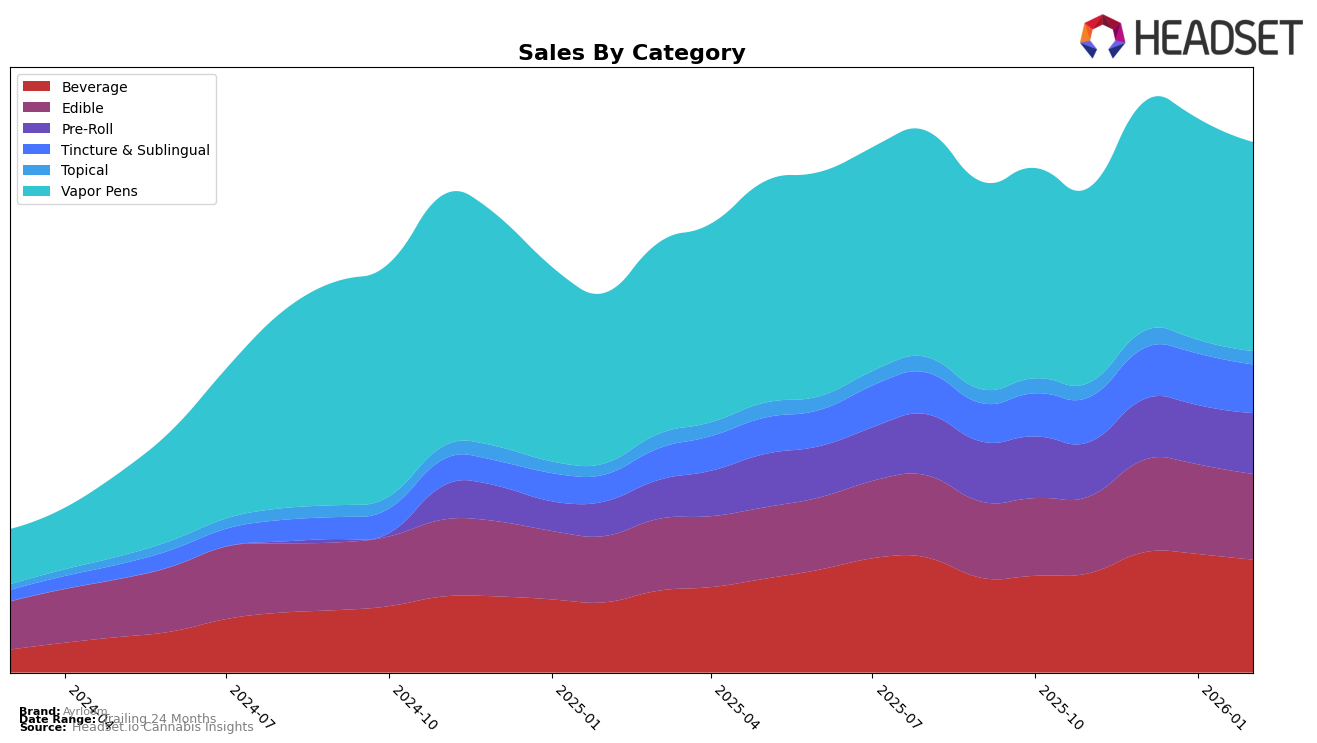

Ayrloom has demonstrated a strong and consistent performance across several product categories in New York. Notably, the brand has maintained a dominant position in the Beverage, Tincture & Sublingual, and Topical categories, consistently holding the number one spot from November 2025 through February 2026. This indicates a robust market presence and a strong consumer preference in these segments. The Vapor Pens category also shows a steady performance with Ayrloom holding the second rank consistently over the same period, suggesting a reliable demand for their products. However, in the Pre-Roll category, Ayrloom fluctuated slightly, moving from the eighth position in November 2025 to the seventh in January 2026, before reverting back to eighth in February 2026. This slight movement might indicate competitive pressures or shifting consumer preferences within this category.

In the Edible category, Ayrloom has maintained a stable position at sixth place throughout the observed months, indicating a consistent level of performance and consumer interest. While this is commendable, it presents an opportunity for Ayrloom to explore strategies that could potentially elevate its ranking further. Interestingly, the consistent absence of Ayrloom from the top 30 brands in other states or provinces may suggest a strategic focus on the New York market, or it could highlight potential areas for market expansion. The brand's ability to sustain high rankings in multiple product categories within a single state underscores its strong brand presence and consumer loyalty in New York.

Competitive Landscape

In the competitive landscape of vapor pens in New York, Ayrloom consistently holds the second rank from November 2025 to February 2026, demonstrating a strong and stable market presence. Despite facing stiff competition from leading brands like Jaunty, which maintains the top position, Ayrloom's sales figures show a robust performance, indicating a well-entrenched consumer base. While Fernway remains steady at third place, Ayrloom's sales are consistently higher, suggesting a significant competitive edge. Meanwhile, Mfny (Marijuana Farms New York) trails behind in fourth place, with sales figures notably lower than Ayrloom's. This data highlights Ayrloom's strong positioning and potential for continued growth in the New York vapor pen market.

Notable Products

In February 2026, Ayrloom's top-performing product was the CBD/THC 1:2 Up Honeycrisp Apple Cider, maintaining its consistent number one rank from previous months with sales of 33,077 units. The CBD/THC 1:2 Half & Half Lemonade Iced Tea UP secured the second spot, showing a steady improvement from third place in January 2026. The CBD/THC 1:2 Root Beer held third place, having swapped ranks with the Lemonade Iced Tea UP since December 2025. Notably, the CBD/THC 1:2 Orange Creamsicle Up Soda debuted in fourth position, indicating strong initial performance. Meanwhile, the CBD/THC 1:2 Up Black Cherry Sparkling Water dropped to fifth place, continuing its decline from the previous months.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.