Jan-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

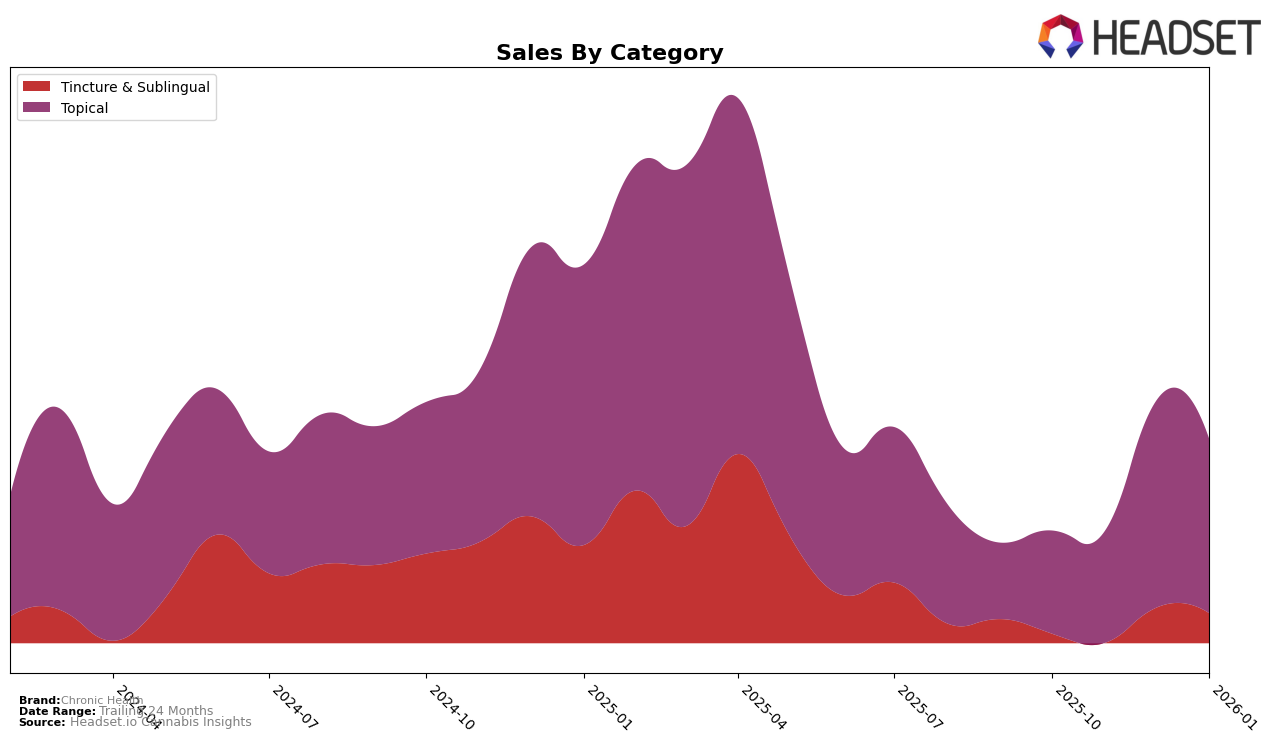

Chronic Health has shown a consistent presence in the Arizona market, particularly in the Tincture & Sublingual category, where it maintained a steady ranking of 2nd and 3rd place from October 2025 through January 2026. This stability in ranking suggests a strong customer base and brand loyalty in this category. Despite a slight dip in sales from October to November, the brand saw a rebound in December, indicating a positive response to market conditions or potential holiday demand. However, the brand's absence from the top 30 in other states or categories during this period might suggest areas for growth or increased competition elsewhere.

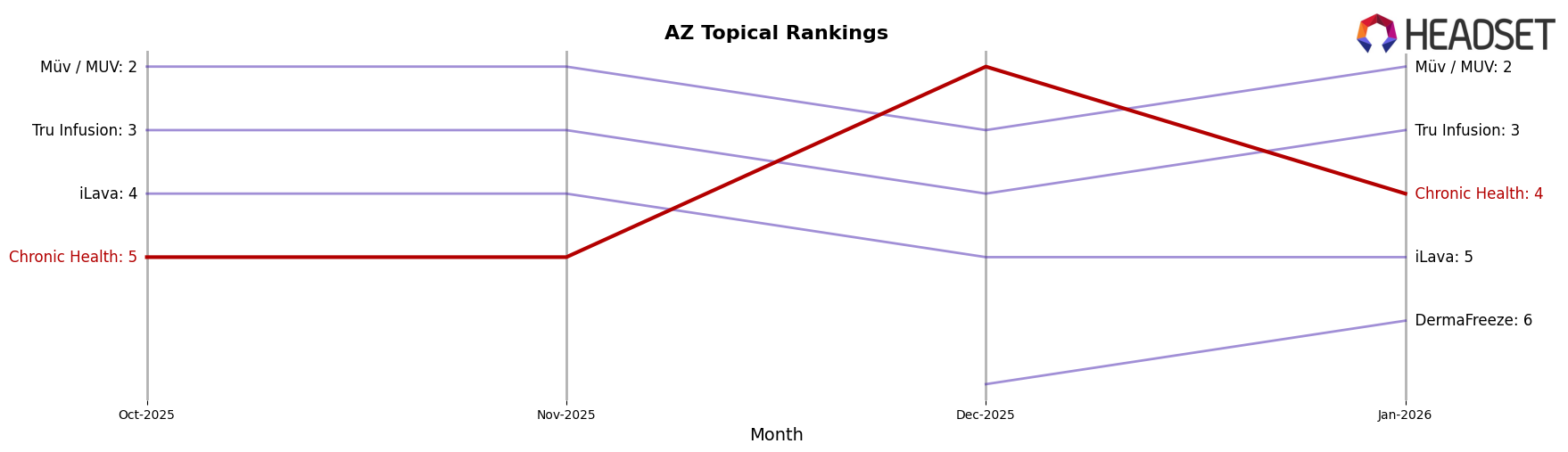

In the Topical category within Arizona, Chronic Health demonstrated a significant upward trend, moving from 5th in October and November to 2nd in December, before settling at 4th in January. This fluctuation highlights a competitive landscape but also underscores the brand's ability to capture market share effectively. The jump in sales from November to December could reflect successful promotional strategies or product launches. The absence of Chronic Health in the top 30 rankings in other states and categories suggests that while they are performing well in Arizona, there might be untapped potential or challenges in expanding their footprint across different markets and product categories.

Competitive Landscape

In the competitive landscape of topical cannabis products in Arizona, Chronic Health has shown notable fluctuations in its market position over the recent months. Initially ranked 5th in October and November 2025, Chronic Health surged to the 2nd position in December 2025, indicating a significant increase in consumer preference and sales momentum during that period. However, by January 2026, it experienced a slight decline, dropping to the 4th position. This fluctuation suggests a competitive and dynamic market environment. Brands like Müv / MUV and Tru Infusion consistently maintained higher ranks, with Müv / MUV holding the 2nd spot in both October and January, and Tru Infusion showing a steady performance, ranking 3rd in January. Meanwhile, iLava remained a close competitor, ranking just above Chronic Health in October and November. The entry of DermaFreeze into the top rankings in January, moving from outside the top 20 to 6th, further highlights the competitive pressures Chronic Health faces. These insights suggest that while Chronic Health has the potential to climb the ranks, maintaining its position requires strategic marketing and product differentiation in a rapidly evolving market.

Notable Products

In January 2026, the top-performing product for Chronic Health was the Indica THC Glycerin Tincture (100mg THC, 1oz) in the Tincture & Sublingual category, maintaining its number one rank for four consecutive months with sales of 582 units. The CBD/THC 1:1 Sleep Well Tincture (100mg CBD, 100mg THC, 1oz) rose to second place from third in December 2025, showing a strong upward trend. The CBD/THC 1:1 Glycerin Tincture (100mg CBD, 100mg THC, 1oz) dropped to third place, indicating a slight decline in popularity. The CBD/THC 1:1 Pain Relief Ointment (175mg CBD, 175mg THC, 2oz) remained consistently in fourth place across the months. A new entrant, the CBD/THC 1:1 Pain Relief Ointment (350mg CBD, 350mg THC, 4oz), debuted at fifth place, suggesting growing interest in higher potency topical products.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.