Jan-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

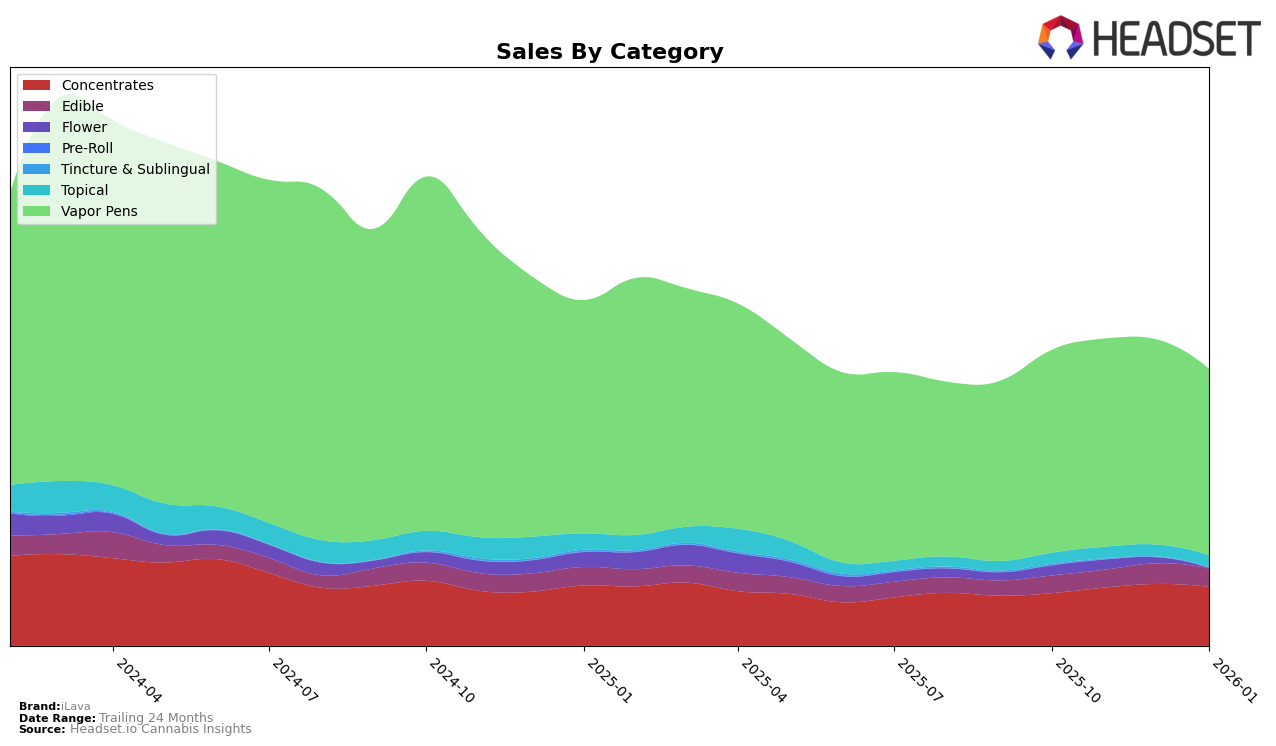

iLava has demonstrated a consistent performance in the Arizona market, particularly in the Concentrates and Topical categories. In Concentrates, iLava improved its ranking from 8th in October 2025 to 6th in December 2025, before settling back to 8th in January 2026. This indicates a competitive edge in a rapidly growing segment, with sales peaking in December. Similarly, in the Topical category, iLava maintained a strong position, consistently ranking 4th or 5th throughout the observed months. The steady sales growth in this category suggests a loyal customer base and effective product offerings.

In contrast, iLava's performance in other categories like Edibles and Vapor Pens shows room for improvement. The brand consistently ranked 27th or 28th in Edibles, indicating a need for strategic initiatives to increase market share. Vapor Pens saw a slight decline in ranking, moving from 9th in November 2025 to 11th by January 2026, with sales reflecting this downward trend. Notably, iLava's Flower category did not make it into the top 30 rankings after November 2025, highlighting a potential area for growth or reevaluation. These insights underscore the importance of tailored strategies to enhance brand presence and competitiveness across different product lines.

Competitive Landscape

In the competitive landscape of vapor pens in Arizona, iLava has experienced notable fluctuations in its market position from October 2025 to January 2026. Starting at rank 10 in October, iLava improved to rank 9 in November but then slipped to rank 11 in both December and January. This shift indicates a competitive pressure primarily from brands like Session Premium Cannabis (AZ), which consistently maintained a top 10 position, and Canamo, which overtook iLava in December. Despite these challenges, iLava's sales figures remained relatively stable, with a slight decline in January. Meanwhile, Mohave Cannabis Co. and GRAS Cannabis did not pose a significant threat, as they remained outside the top 10 throughout this period. The data suggests that iLava must strategize to regain its competitive edge, particularly against brands that have shown upward momentum in sales and ranking.

Notable Products

In January 2026, the top-performing product for iLava was Entourage Night - CBG/CBN/ Delta 9 THC 1:1:2 Indica Watermelon, which climbed to the number one spot in the Edible category, achieving sales of $1,368. ClearGold - Blue Widow Delta 9 THC Distillate Cartridge made its debut in the Vapor Pens category, securing the second rank. Entourage Night - CBG/CBN/THC 1:1:2 Wildberry Gummies dropped to the third position from its previous second rank in December. The Entourage Night - CBD/CBN/THC 1:1:2 Blackberry Gummies entered the rankings at fourth place, while Twilight - CBD/THC/CBG/CBC Blueberry Gummies moved to fifth. Notably, Entourage Night - CBG/CBN/ Delta 9 THC Indica Watermelon showed consistent performance, maintaining a top-three position in the previous months before reaching the peak in January.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.