Jan-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

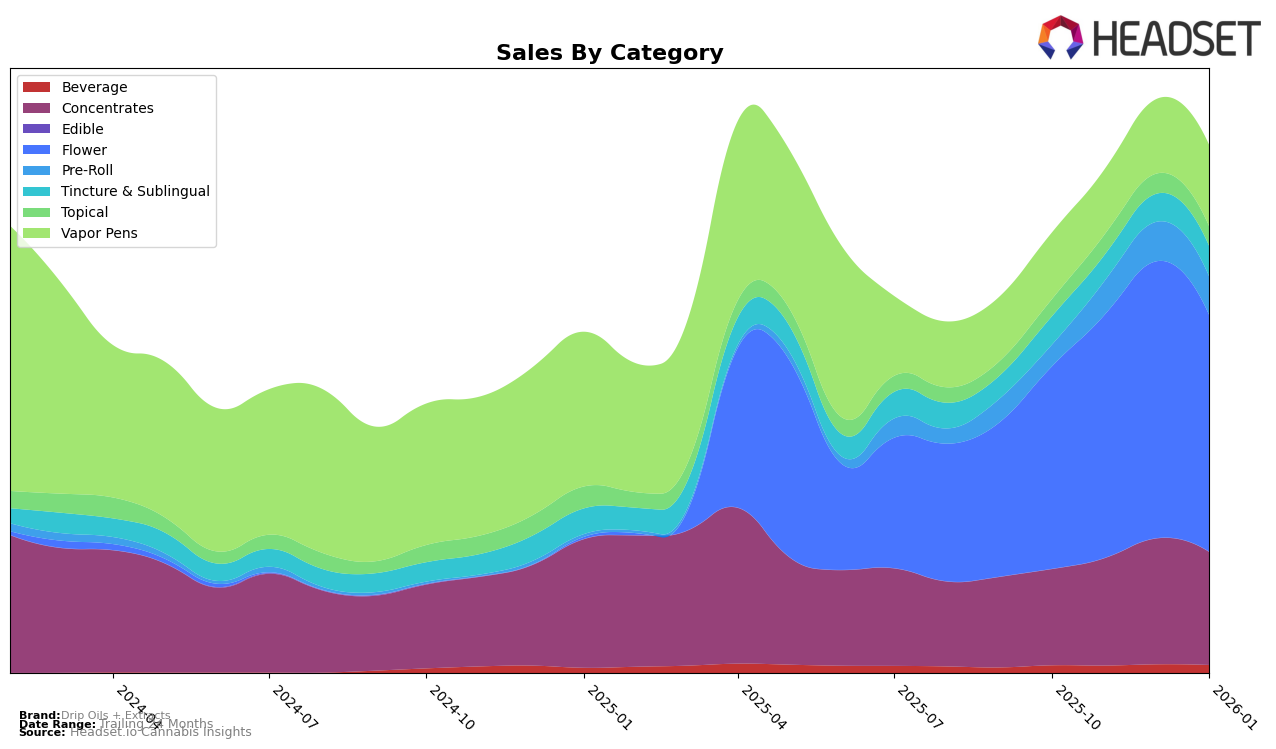

Drip Oils + Extracts has shown a consistent performance in the Arizona market, particularly within the Concentrates and Tincture & Sublingual categories. In Concentrates, the brand maintained a top-five position, peaking at rank 3 in December 2025, before slightly dropping to rank 4 in January 2026. This stability is indicative of a strong foothold in the category, supported by a notable increase in sales from October to December 2025. The brand's dominance in the Tincture & Sublingual category is even more pronounced, consistently holding the top rank over the observed months, highlighting their leadership and possibly a loyal consumer base in this segment.

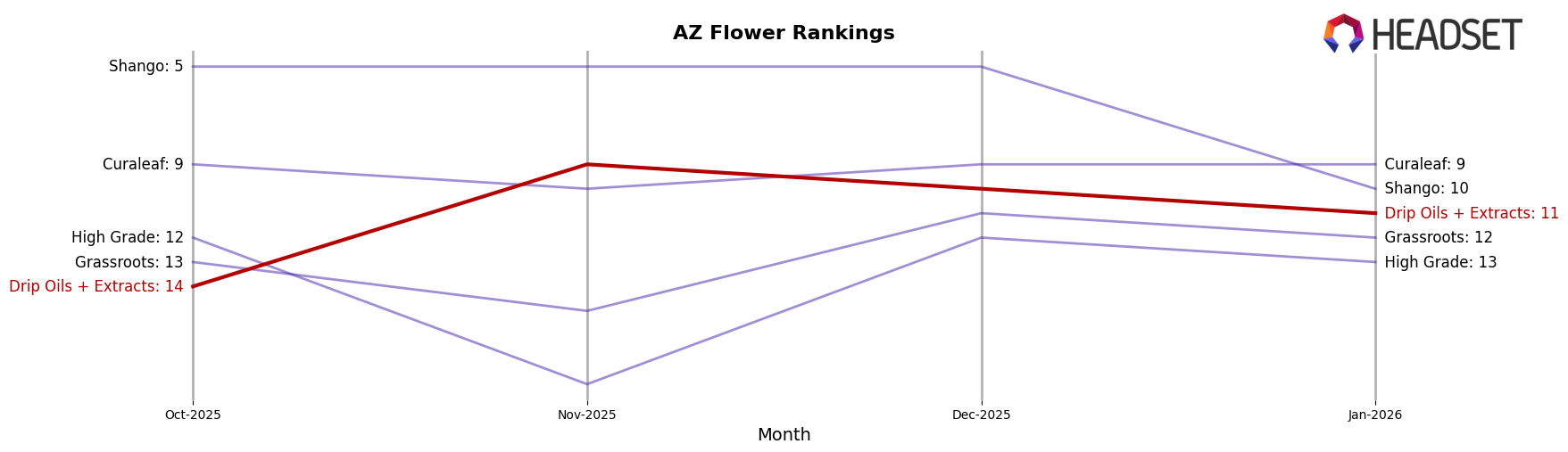

In other categories, Drip Oils + Extracts has experienced varied levels of success. In the Flower category, they improved their ranking from 14th in October 2025 to 9th in November, though they experienced a slight decline to 11th by January 2026. This indicates a competitive landscape where they are making strides but still have room for growth. The Pre-Roll category saw a positive trajectory, moving from outside the top 30 to 25th place by January 2026, which suggests growing consumer interest. However, in the Vapor Pens category, despite a slight improvement from 21st to 19th place, the brand has not yet broken into the top tier, indicating potential challenges or opportunities for further market penetration. Meanwhile, their consistent top ranking in the Topical category suggests a strong brand presence and product acceptance among consumers in Arizona.

Competitive Landscape

In the competitive landscape of the flower category in Arizona, Drip Oils + Extracts has demonstrated notable fluctuations in its market position from October 2025 to January 2026. Initially ranked 14th in October, the brand made a significant leap to 9th place in November, indicating a strong upward trend in sales performance. However, by January 2026, Drip Oils + Extracts experienced a slight decline, settling at 11th place. This dynamic shift highlights the competitive pressure from brands like Shango, which consistently held a top 5 position until a drop to 10th in January, and Curaleaf, maintaining a steady 9th rank. Meanwhile, Grassroots and High Grade hovered around the lower ranks, providing a competitive buffer for Drip Oils + Extracts. These insights suggest that while Drip Oils + Extracts has shown resilience and growth potential, maintaining its competitive edge will require strategic efforts to navigate the volatile market dynamics in Arizona's flower category.

Notable Products

In January 2026, the top-performing product for Drip Oils + Extracts was the High THC RSO Syringe (1g) in the Concentrates category, maintaining its first-place position for four consecutive months with sales of 2905. The Waffle Cone (3.5g) from the Flower category climbed back to second place after a dip to fifth in December 2025, showing a significant increase in sales. SFV OG (3.5g), also in the Flower category, made its debut in the rankings at third place, indicating strong market entry. Cherry Paloma (3.5g) dropped from third to fourth place, reflecting a decrease in sales compared to the previous month. Bubba Cookies (3.5g) held steady at fifth place, maintaining its position from the previous month.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.