Dec-2023

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

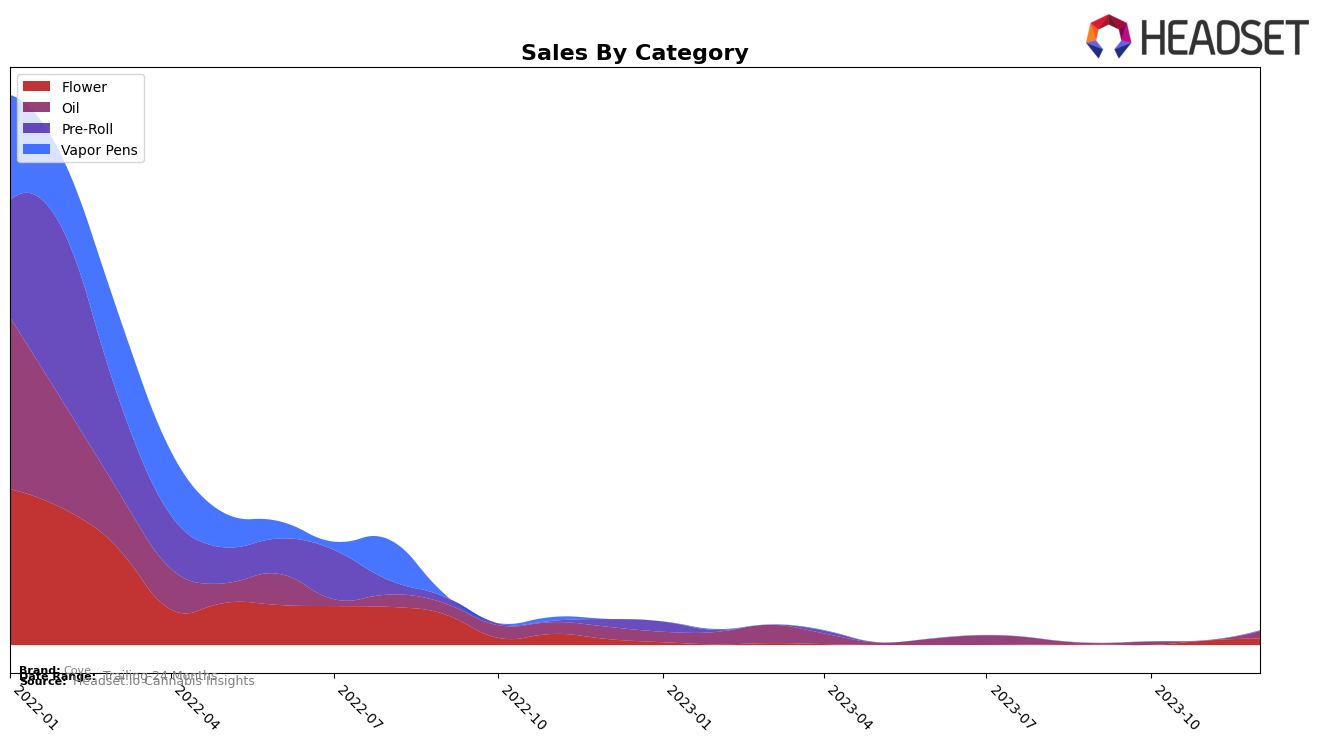

In Ontario, the cannabis brand Cove made noticeable progress in the oil category. In the span of a month, from September to October 2023, the brand improved its ranking from 50th to 46th. This is a positive trend, showing a good direction for the brand. However, the absence of data for the months of November and December indicates that Cove did not make it to the top 20 brands in the oil category during these months. The sales data shows a significant increase from September to October, but further details are not provided.

On the other hand, in British Columbia, Cove made an appearance in the top 20 brands in the oil category in December 2023, securing the 18th rank. This is a commendable achievement for the brand, especially considering the competitive nature of the cannabis market. However, no ranking data is available for the preceding months, which may indicate that Cove was not among the top 20 brands during that period. The sales figure for December is provided, but additional sales details are not disclosed.

Competitive Landscape

In the British Columbia oil category, Cove has seen a notable change in its competitive landscape. While Cove did not rank in the top 20 in September, October, and November 2023, it managed to secure the 18th spot in December 2023. This indicates a positive upward trend for the brand. On the other hand, Sundial also managed to secure a spot in the top 20 in December 2023, but with a lower rank than Cove. Veryvell showed a consistent improvement in its ranking over the four months, moving up from 26th to 16th. XMG and ufeelu both saw a decline in their rankings over the same period, indicating a potential shift in consumer preferences. These changes in rankings and sales among Cove's competitors could have significant implications for Cove's future performance in this market.

Notable Products

In December 2023, the top-performing product from Cove was the Rise Co2 Cartridge (0.5g), which rose to the first rank, recording sales of 79 units. The second-best performer was Reserve - Reflect (3.5g) from the Flower category, moving down from the first rank in November to the second rank in December. The third position was taken by High CBD Oil (20ml) from the Oil category, which saw a drop in ranking from the first position in October to the third in December. This shift in rankings indicates a growing preference for Vapor Pens over Flower and Oil categories. It's notable that despite the changes in rankings, all top products managed to maintain their positions within the top three across the last quarter of 2023.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.