Feb-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

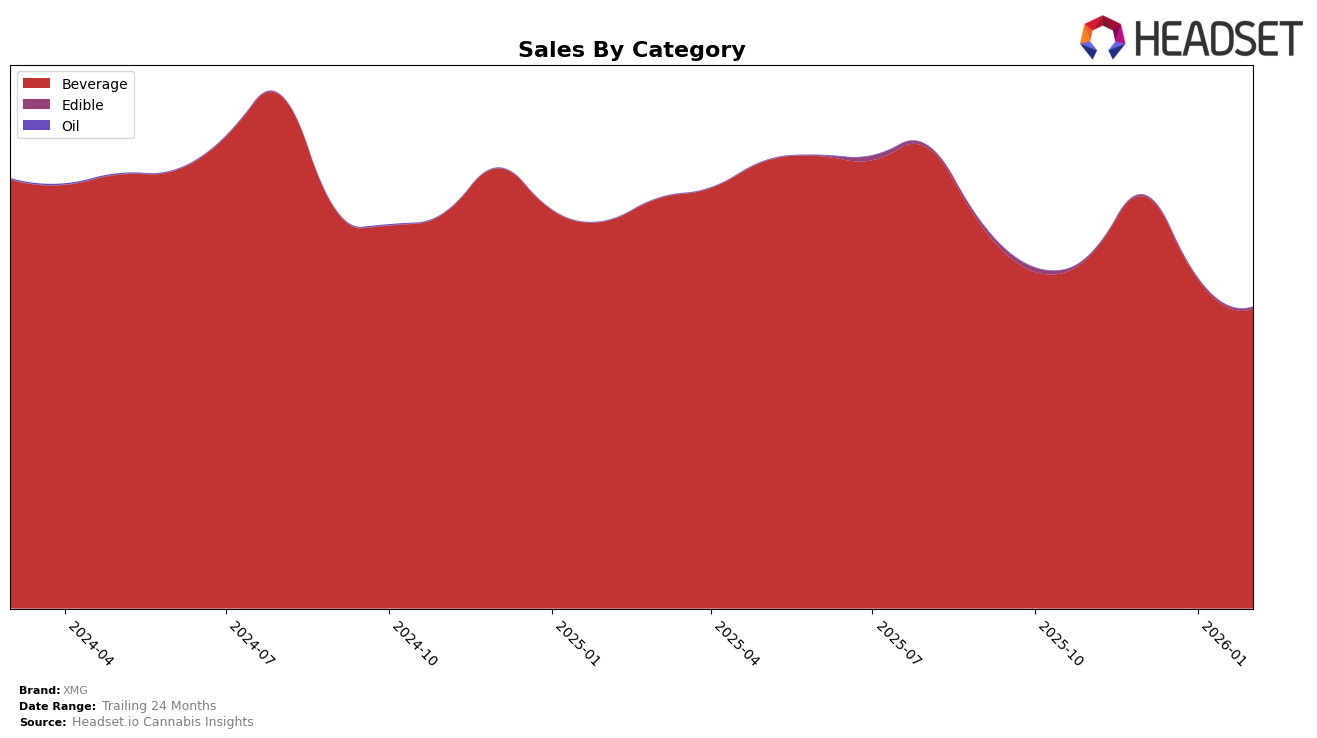

XMG has consistently demonstrated strong performance in the Beverage category across several Canadian provinces. In Alberta, XMG has maintained its top position from November 2025 through February 2026, a testament to its strong market presence and consumer preference. Similarly, in Ontario, XMG has also held the number one spot consistently over the same period. This consistent ranking indicates a robust brand loyalty and effective market strategies in these regions. However, it's interesting to note that despite being a top performer, there was a noticeable decline in sales figures from December 2025 to February 2026 in both provinces, suggesting potential seasonality or market saturation effects.

In British Columbia, XMG has consistently ranked second in the Beverage category, indicating strong competition in the region. While the brand has not broken into the top spot, maintaining a consistent ranking suggests a stable market share. Meanwhile, in Saskatchewan, XMG has mirrored its performance in Alberta and Ontario by holding the top position throughout the months analyzed. However, the absence of XMG from the top 30 brands in other states or provinces might indicate areas where the brand could focus on increasing its market penetration and brand visibility. Exploring these dynamics further could provide insights into regional consumer preferences and competitive landscapes.

Competitive Landscape

In the competitive landscape of the beverage category in Alberta, XMG has consistently maintained its top position from November 2025 through February 2026. Despite fluctuations in sales figures, XMG's dominance is evident as it continues to outperform competitors like Mollo and Sweet Justice. Notably, while Mollo experienced a slight decline in sales from December 2025 to February 2026, Sweet Justice saw a significant increase in December 2025, allowing it to surpass Mollo in rank. However, neither brand has managed to challenge XMG's leading position, highlighting XMG's strong market presence and consumer preference in the region.

Notable Products

In February 2026, XMG's top-performing product was Cream Soda (10mg THC, 355ml), maintaining its consistent number one rank since November 2025 with sales figures reaching 20,650 units. Cherry Cola (10mg THC, 355ml) also held steady in second place, mirroring its performance from previous months. Zero - Orange Soda (10mg THC, 355ml) secured the third position, continuing its upward trend from fourth place in November and December 2025. Plus - CBG/THC 1:1 Tropical Cream Float Sparkling Soda (10mg CBG, 10mg THC, 355ml) remained stable at fourth place, despite a slight dip in sales. Notably, Atomic Sours- CBG/THC 1:1 Foggy Peaches Sparkling Drink (10mg CBG, 10mg THC, 355ml, 12oz) entered the rankings for the first time in February 2026, debuting at fifth place.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.