Jan-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

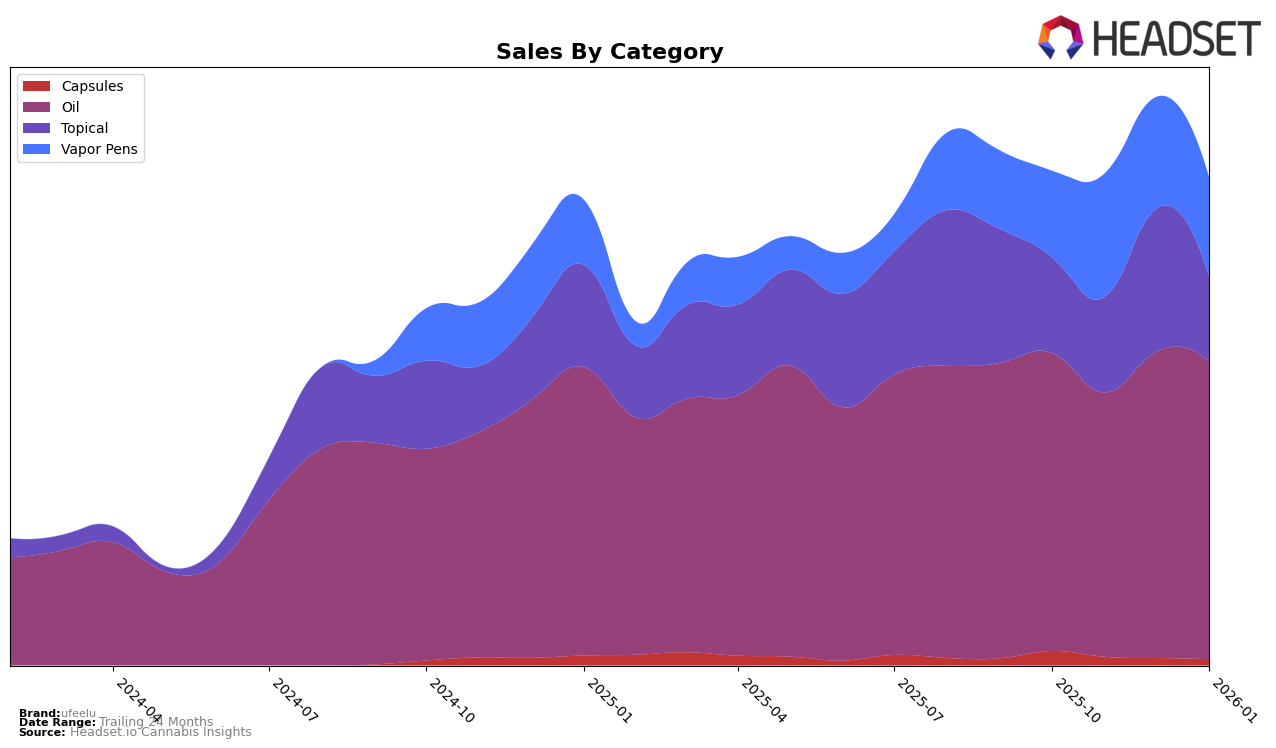

In the province of Ontario, ufeelu has maintained a consistent presence in the Oil category, holding steady at the 6th rank from October 2025 through January 2026. This stability suggests a strong foothold in the market, despite a slight fluctuation in sales figures, with a notable dip in November before recovering in the subsequent months. However, in the Topical category, there was a noticeable improvement in December, where ufeelu climbed to the 4th position, only to fall back to 6th in January. This indicates some volatility, possibly due to seasonal demand or competitive pressures. It's worth noting that in the Vapor Pens category, ufeelu did not make it into the top 30 rankings, highlighting a potential area for growth or strategic reevaluation.

In Saskatchewan, ufeelu has shown remarkable stability in the Oil category, consistently holding the 2nd rank across the observed months. This consistent high ranking, coupled with a gradual increase in sales from October to December, indicates a strong and growing consumer base. The Topical category also reflects stability, maintaining the 3rd rank throughout the period. However, unlike in Ontario, there is no presence of ufeelu in the Vapor Pens category within the top 30 rankings in Saskatchewan, suggesting a similar trend where ufeelu might need to explore opportunities or strengthen its market presence. Overall, ufeelu's performance across these categories and provinces highlights areas of strength and potential growth opportunities.

Competitive Landscape

In the competitive landscape of the Oil category in Ontario, ufeelu has maintained a consistent rank of 6th from October 2025 to January 2026. Despite this steady position, its sales figures have shown some fluctuations, with a notable dip in November 2025 followed by a recovery in the subsequent months. This stability in rank suggests that while ufeelu is holding its ground, it faces stiff competition from brands like NightNight, which consistently ranks higher at 4th place, and Glacial Gold, maintaining a 5th place rank. The sales figures of these competitors are significantly higher, with NightNight and Glacial Gold consistently outperforming ufeelu in terms of revenue. Additionally, Viola, ranked 7th, is closely trailing ufeelu, indicating a competitive pressure from both above and below in the rankings. This competitive environment highlights the need for ufeelu to strategize effectively to enhance its market share and sales performance in the coming months.

Notable Products

In January 2026, the top-performing product for ufeelu was the CBN/CBD 3:1 Relief Drops (30ml) in the Oil category, maintaining its first-place position from the previous month, although its sales decreased to 880 units. The CBD/CBG/CBC The Feel Stick (500mg CBD, 100mg CBG, 100mg CBC, 30g) in the Topical category slipped to second place, despite being the leader in December. Lavender Acai Tea Live Resin Disposable (1g) in the Vapor Pens category held steady in third place for the second consecutive month. The CBD/CBG 3:1 Calm Drops (30ml) in the Oil category improved its ranking to fourth place from fifth in December. Meanwhile, the CBN/CBD 3:1 Rest Drops (30ml), also in the Oil category, dropped to fifth place, continuing a downward trend from previous months.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.