Jan-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

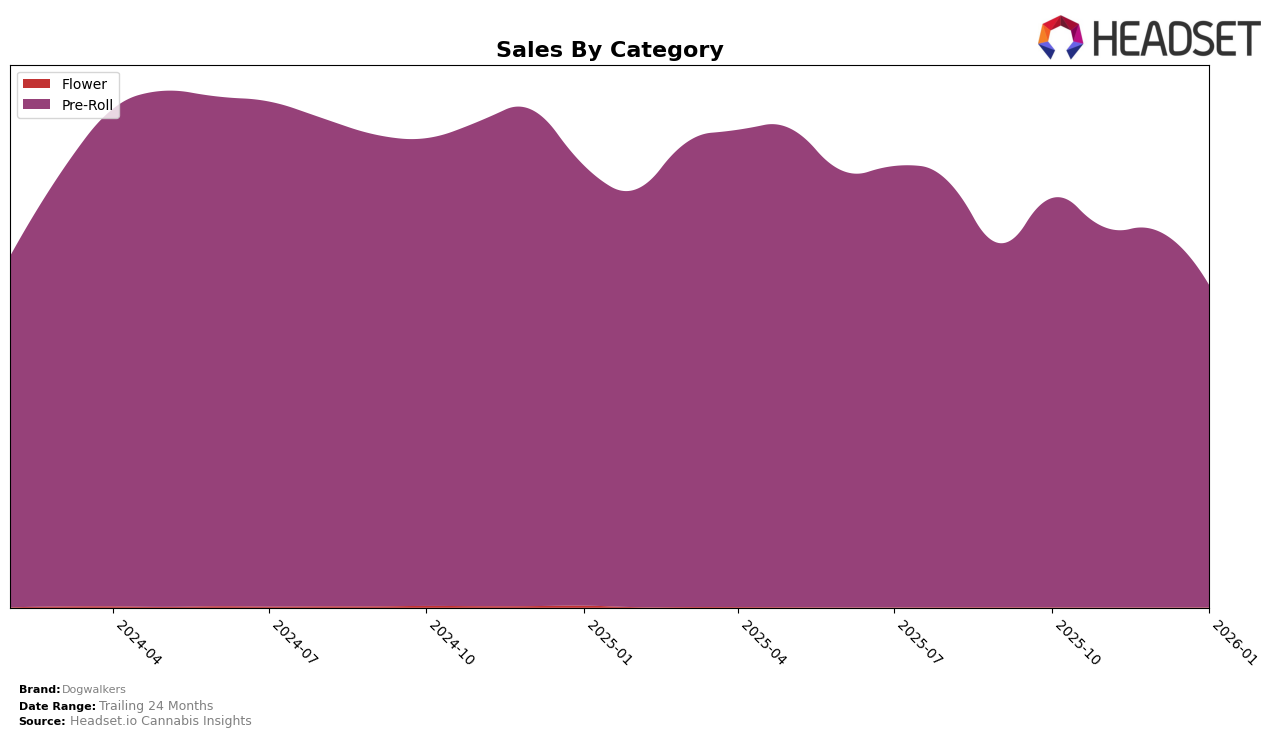

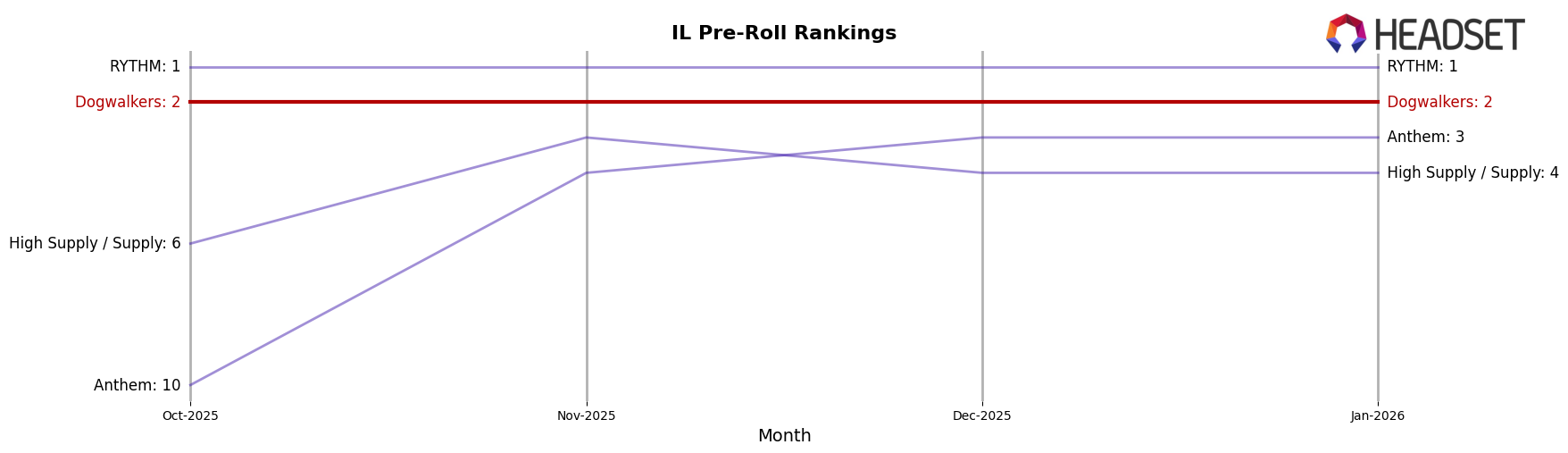

Dogwalkers has shown a varied performance across different states in the pre-roll category. In Illinois, the brand has maintained a stronghold, consistently ranking 2nd from October 2025 through January 2026. This stable ranking suggests a solid customer base and brand loyalty in the state. However, in Massachusetts, Dogwalkers experienced a decline, dropping from the 13th position in October 2025 to the 22nd by January 2026. This movement indicates potential challenges in maintaining market share or increased competition. Meanwhile, in Connecticut, Dogwalkers emerged in the rankings in November 2025, reaching the 9th position by January 2026, which marks a positive trend and suggests growing popularity.

In Nevada, Dogwalkers maintained a strong presence, holding the 2nd position for three consecutive months before slightly dropping to 3rd in January 2026. This minor change might indicate a slight shift in consumer preference or increased competition. In Maryland, the brand consistently held the 3rd position, showcasing steady performance and a robust market position. Conversely, in New York, the brand's ranking slipped from 16th to 18th over the same period, which could be a sign of fluctuating consumer interest or market dynamics. Notably, Dogwalkers did not appear in the top 30 rankings in Connecticut in October 2025, but their emergence and subsequent climb in the following months highlight a successful market entry strategy.

Competitive Landscape

In the Illinois pre-roll category, Dogwalkers consistently held the second rank from October 2025 to January 2026, showcasing a stable position in the market despite fluctuations in sales. However, the brand experienced a notable decline in sales over this period, with a significant drop by January 2026. This decline contrasts with the performance of competitors like RYTHM, which maintained the top rank consistently, albeit with decreasing sales, and High Supply / Supply, which showed improved rankings from sixth to fourth, reflecting a positive sales trend. Additionally, Anthem demonstrated a remarkable rise in rank from tenth to third, accompanied by increasing sales, indicating a growing competitive pressure on Dogwalkers. These dynamics suggest that while Dogwalkers maintains a strong market presence, it faces challenges from competitors who are either stabilizing or improving their market positions.

Notable Products

In January 2026, the top-performing product from Dogwalkers was the Mini Dog - Animal Face Pre-Roll 5-Pack (1.75g) in the Pre-Roll category, maintaining its consistent number one rank since October 2025, despite a slight dip in sales to 18,215 units. The Big Dog - Animal Face Pre-Roll (0.75g) held its second-place position, showing a notable increase in sales compared to previous months. The Mini Dog - Afternoon Delight #4 Pre-Roll 5-Pack (1.75g) moved up to third place, climbing from fifth in the previous two months, reflecting a strong sales recovery. The Mini Dog - Afternoon Delight Pre-Roll 5-Pack (1.75g) re-entered the rankings at fourth place after its absence in November and December. Lastly, the Mini Dog - Brownie Scout Pre-Roll 5-Pack (1.75g) was ranked fifth, having been unranked in the prior months, indicating a resurgence in popularity.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.