Jan-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

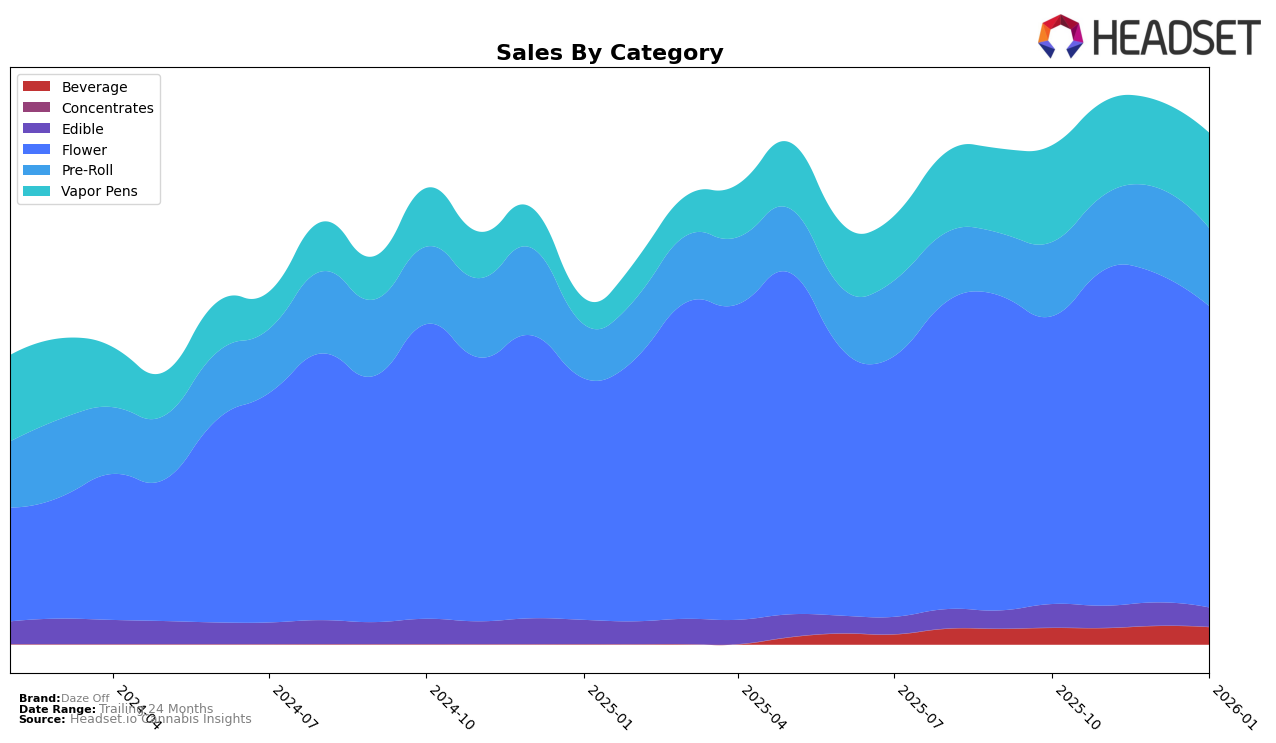

In examining the performance of Daze Off across various states and categories, there are notable trends in their market presence. In Arizona, Daze Off's standing in the Flower category has not reached the top 30, indicating potential challenges in penetrating this market. Contrastingly, in California, the brand has shown consistent improvement in the Flower category, moving from 48th position in October 2025 to 31st by January 2026. This upward trajectory suggests a growing acceptance and potential for expansion in California's competitive market. Meanwhile, Daze Off's position in the Pre-Roll category in California has also improved, though not as dramatically, which could indicate room for strategic growth in this segment.

In Illinois, Daze Off exhibits strong performance across multiple categories. Particularly in the Beverage and Flower categories, the brand has maintained a robust presence, consistently ranking 3rd in both. This stability underscores a solid foothold in Illinois, possibly driven by consumer loyalty or effective marketing strategies. Conversely, their performance in the Edible category, while stable, shows less dominance, maintaining a ranking of 20th, which might suggest a need for innovation or differentiation to climb higher. In the Vapor Pens category, Daze Off's movement from 8th to 10th place over the observed months might warrant a closer examination of market dynamics or competitive pressures affecting this segment.

Competitive Landscape

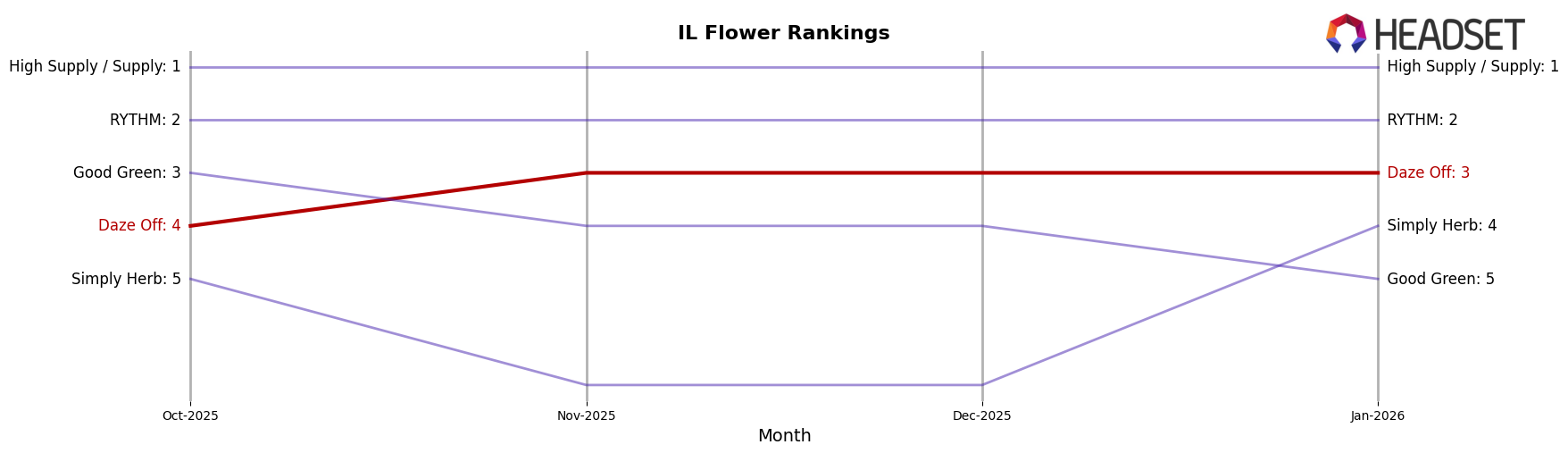

In the competitive landscape of the Flower category in Illinois, Daze Off has shown a notable upward trajectory in its market position. From October 2025 to January 2026, Daze Off improved its rank from fourth to third, maintaining this position through December and January. This advancement can be attributed to a significant increase in sales from October to December, before experiencing a slight dip in January. Despite this minor setback, Daze Off remains ahead of Good Green, which fell from third to fifth place over the same period. Meanwhile, High Supply / Supply and RYTHM consistently held the top two positions, with sales figures significantly higher than Daze Off's. The competitive dynamics suggest that while Daze Off is making strides, there is still a considerable gap to bridge to challenge the leading brands.

Notable Products

In January 2026, the top-performing product for Daze Off was the Hybrid Blend Nug Roll Pre-Roll (0.5g) in the Pre-Roll category, maintaining its number one position from December 2025 with sales of 8,471 units. The Sativa Blend Nug Roll Pre-Roll (0.5g) held steady at the second position, following its consistent ranking since November 2025. The Taste Buds - Blue Radberry Gummies 10-Pack (100mg) continued to rank third, showing stable performance in the Edible category over the past three months. The Indica Blend Nug Roll Pre-Roll (0.5g) re-entered the rankings at fourth place, marking its return since its absence in November and December 2025. Lastly, the Taste Buds - Strawberry Lemon-fade Shot (100mg THC, 2oz, 60ml) climbed back into the top five, securing the fifth spot after being unranked in December 2025.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.