Apr-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

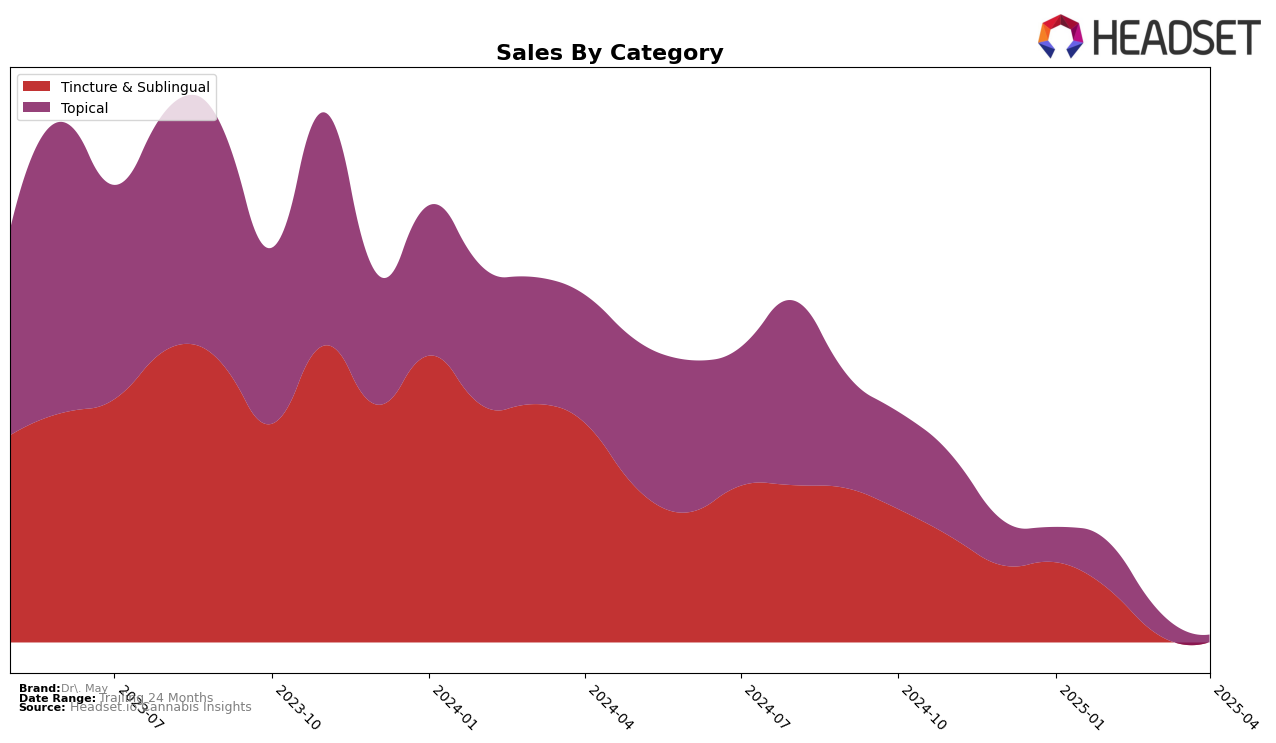

Dr. May, a notable brand in the cannabis industry, has shown varied performance across different states and categories. In California, Dr. May was ranked 19th in the Tincture & Sublingual category as of January 2025, with sales reaching $12,596. However, the absence of rankings in subsequent months suggests that the brand did not maintain a position within the top 30 in this category. This decline indicates a potential challenge in sustaining market presence or increasing competitive pressure in California's dynamic cannabis market.

The lack of data for other states or provinces implies that Dr. May might not have a significant footprint beyond California or within other product categories. This absence might reflect either a strategic focus on California or challenges in expanding their market share in other regions. The initial ranking in California, albeit not sustained, suggests that Dr. May had a promising start in the Tincture & Sublingual category, which could be an area for potential growth if strategic adjustments are made. Understanding these dynamics could be crucial for stakeholders looking to evaluate Dr. May's market strategies and future opportunities.

Competitive Landscape

In the competitive landscape of the Tincture & Sublingual category in California, Dr. May has faced notable challenges in maintaining its rank among top brands. In January 2025, Dr. May was ranked 19th, but by February, it had fallen out of the top 20, indicating a need for strategic adjustments to regain market presence. In contrast, Breez held a steady position at 14th in January, although it did not maintain this rank in subsequent months, suggesting potential volatility or market shifts. Meanwhile, Kind Medicine showed a positive trend, entering the top 20 in February at 18th and maintaining a presence through April, which could indicate a growing consumer preference or effective marketing strategies. These dynamics highlight the competitive pressure Dr. May faces and the importance of adaptive strategies to enhance its market position and sales performance in California's tincture and sublingual segment.

Notable Products

In April 2025, Dr. May's top-performing product was the CBD/THC 1:1 Balance 350 Formula Tincture, which regained its top rank after previously holding the first position in January and dropping to third in March. The CBD/THC 1:1 Balance Original Formula Topical Balm emerged as a strong contender, securing the second rank with notable sales of 20 units, despite being unranked in prior months. The CBD/THC 1:1 Balance Twist-Up Topical Balm maintained its second rank from February, demonstrating consistent performance across the months. Meanwhile, the CBD/THC 1:20 Relax Twist Up Balm experienced a decline, dropping from first place in March to fourth in April. The CBD/THC 20:1 Focus Formula Topical Balm entered the rankings for the first time in April, achieving the third position.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.