Jan-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

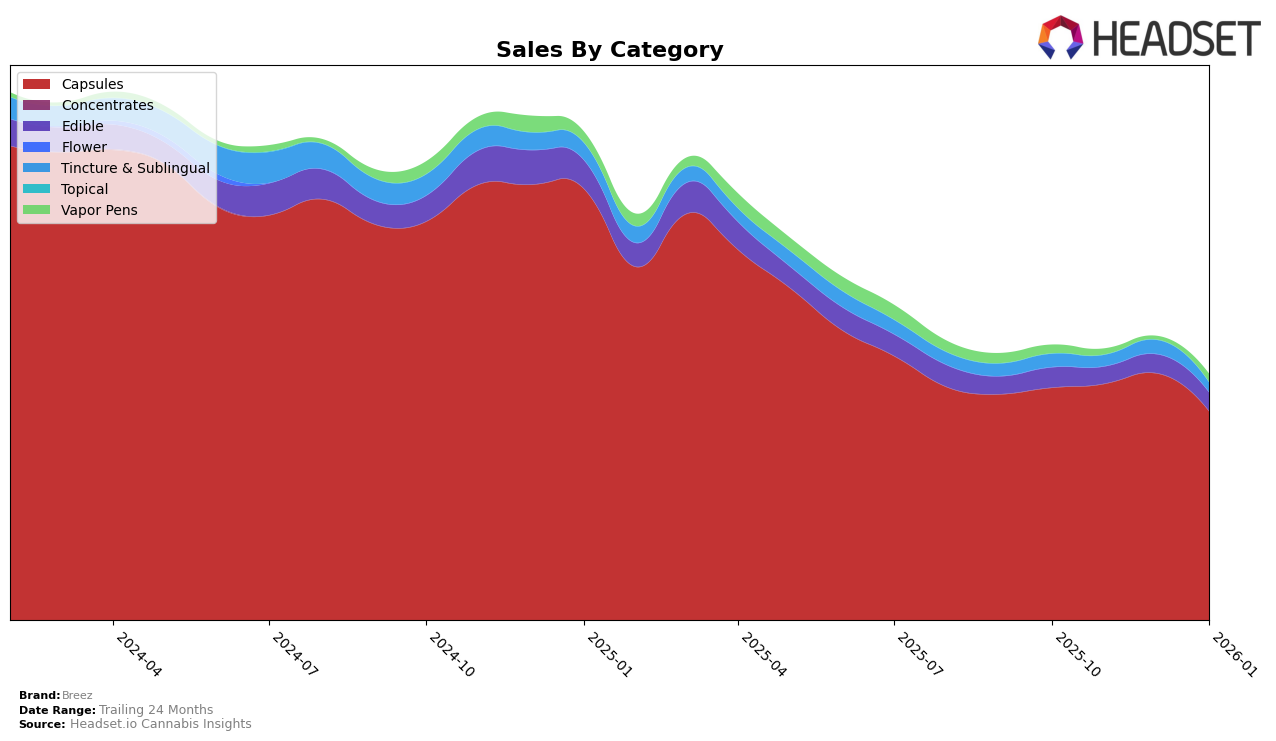

In the California market, Breez has demonstrated a strong performance in the Capsules category, consistently maintaining a top position. The brand held steady in the second rank for October and November 2025, rose to the first position in December 2025, and then returned to second in January 2026. This fluctuation indicates a competitive landscape but also highlights Breez's resilience and popularity in this category. In contrast, their performance in the Edible category shows a different trend, where Breez remained outside the top 30, with rankings in the 40s, indicating a potential area for growth. The Tincture & Sublingual category saw Breez drop out of the top 30 by January 2026, suggesting a decline in market presence or increased competition.

In Illinois, Breez's performance in the Capsules category was notable, maintaining a consistent fourth place until January 2026, when it fell out of the top 30, indicating a potential challenge in sustaining its market position. Meanwhile, the Vapor Pens category saw Breez fluctuate significantly, with rankings dropping out of the top 30 in December 2025 before re-entering at 76th position in January 2026. This volatility may suggest an opportunity for Breez to stabilize and potentially improve its standing in this category. The absence of Breez in the top 30 for certain months in these categories could point to either strategic shifts or increased competition that the brand needs to navigate.

Competitive Landscape

In the competitive landscape of the California cannabis capsules market, Breez has demonstrated notable fluctuations in its ranking and sales performance over the recent months. Breez maintained a steady second place in October and November 2025, but surged to the top spot in December 2025, before dropping back to second in January 2026. This temporary ascent to the number one position indicates a strong consumer response during the holiday season, potentially driven by promotional efforts or product launches. Despite this fluctuation, Breez consistently outperformed ABX / AbsoluteXtracts and Kikoko, which remained in third and fourth places respectively throughout the period. However, Breez faces stiff competition from Level, which reclaimed the top position in January 2026. This competitive dynamic suggests that while Breez is a strong contender, maintaining its lead will require strategic marketing and product innovation to consistently outperform its rivals in this rapidly evolving market.

Notable Products

In January 2026, the top-performing product for Breez was the Indica Extra Strength Tablet 50-Pack (1000mg) in the Capsules category, maintaining its number one rank from the previous two months with sales of 4855. The Hybrid Extra-Strength Tablet 50-Pack (1000mg) also held steady at the second position, although its sales saw a decline compared to December. Consistently ranked third was the Sativa Extra Strength Tablet 50-Pack (1000mg), which experienced a slight drop in sales. The Original Mint Tin 20-Pack (100mg) in the Edible category remained in fourth place, but it showed a notable increase in sales to 919. The Sativa Royal Mint 20-Pack (100mg) re-entered the rankings in January, securing the fifth position with improved sales figures.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.