Jan-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

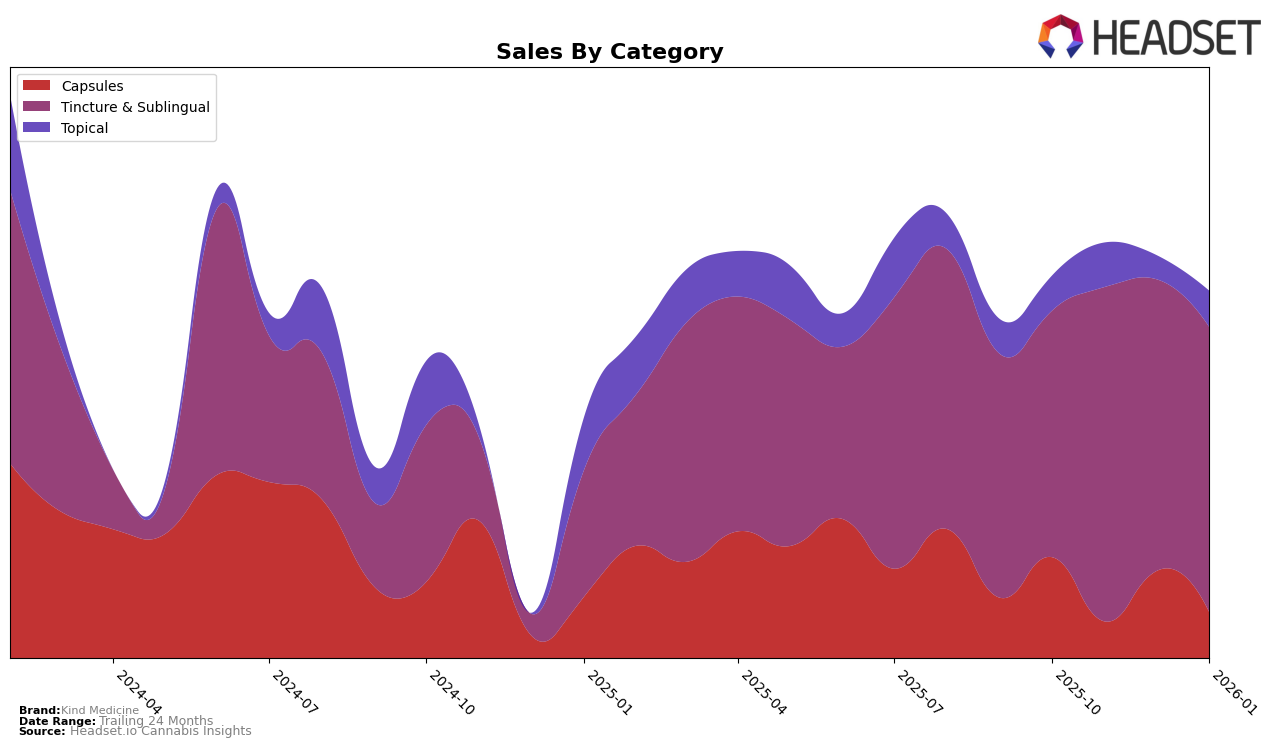

Kind Medicine has shown a consistent performance in the California Tincture & Sublingual category over the past few months. Beginning with a rank of 20 in October 2025, the brand improved its position to 18 in November, briefly dropping back to 20 in December before climbing to 17 by January 2026. This upward trend in rankings indicates a strengthening market presence, despite a slight fluctuation in December. The brand's sales figures reflect a similar pattern, with a notable increase from October to November, followed by a slight dip in December and a stabilization in January. The ability to maintain and improve rank in a competitive market suggests a robust strategy in place for Kind Medicine.

While Kind Medicine has maintained a presence in the top 30 brands within the California Tincture & Sublingual category, it is worth noting that the brand's performance in other states and categories is not mentioned, indicating that it may not have reached the top 30 in those areas. This could be an opportunity for Kind Medicine to explore and expand its market reach beyond California. The brand's consistent performance in its home state could serve as a foundation for strategic growth initiatives aimed at increasing its footprint in other markets. The focus on California's rankings and sales trends provides a snapshot of Kind Medicine's current standing, leaving room for exploration of its potential in untapped regions.

Competitive Landscape

In the competitive landscape of the California Tincture & Sublingual category, Kind Medicine has shown a steady improvement in its ranking from October 2025 to January 2026, moving from 20th to 17th position. This upward trajectory is notable, especially when compared to competitors like Carter's Aromatherapy Designs (C.A.D.), which experienced a decline from 17th to 19th place over the same period. Despite High Power maintaining a relatively stable position, Kind Medicine's sales figures have shown resilience, particularly in January 2026, where they nearly matched High Power's sales despite the latter's higher ranking. Meanwhile, Moods Spray and Saida continue to dominate the upper ranks, with Saida showing a strong upward sales trend. This competitive analysis highlights Kind Medicine's potential to climb further up the ranks if it continues its current trajectory, especially in a market where some competitors are experiencing fluctuations or declines in sales.

Notable Products

In January 2026, the top-performing product from Kind Medicine was the Sativa Tincture 800mg THC 30ml, maintaining its first-place ranking from November 2025, with sales reaching 163 units. The Indica Tincture 800mg THC 30ml dropped to second place after leading in December 2025, while the Indica Tincture 1000mg THC 30ml climbed to third, showing a slight improvement from its fourth-place finish in December. The CBD/THC 25:1 Pet Tincture 500mg CBD 20mg THC 30ml held steady in fourth place, consistent with its December ranking. The Menthol Formula Rub 150mg THC 50ml entered the rankings for the first time in January 2026, securing the fifth position.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.