Feb-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

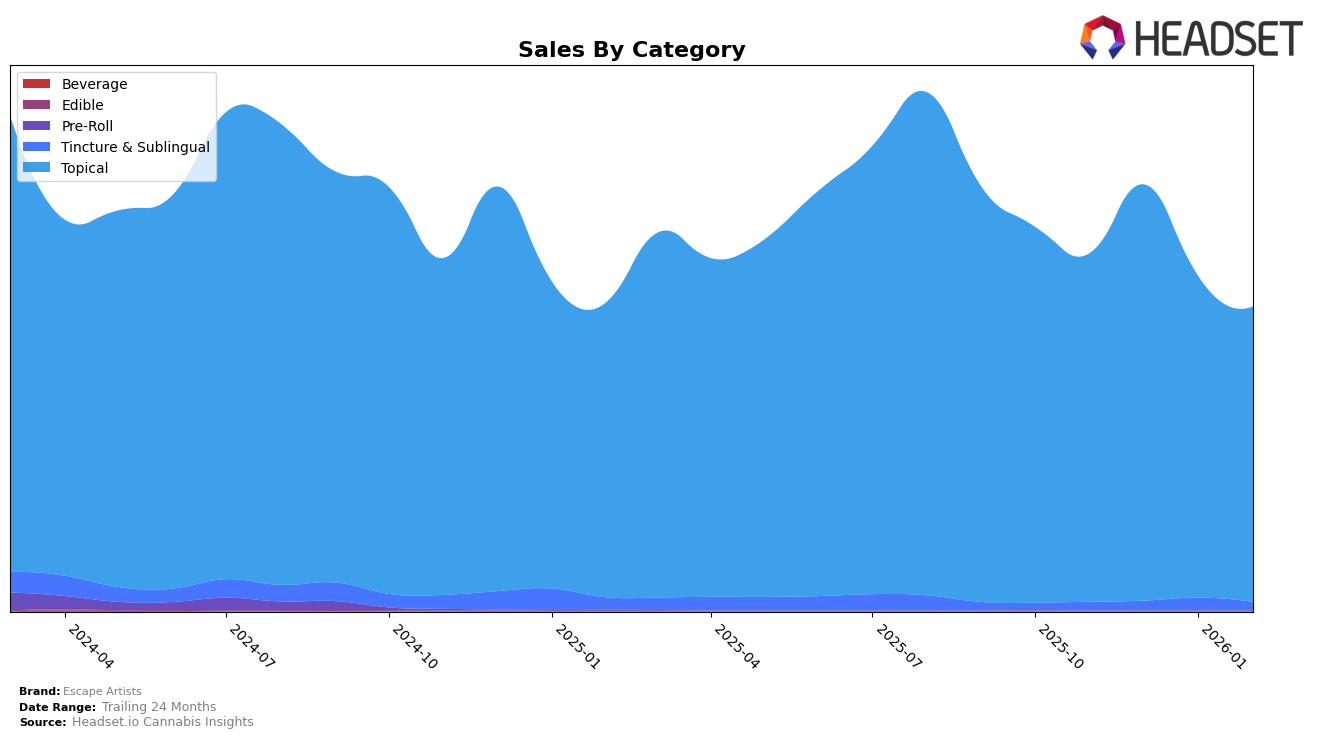

Escape Artists has demonstrated a solid performance in the Colorado market, particularly in the Topical category, where it consistently held the number one rank from November 2025 through February 2026. This suggests a strong foothold and brand loyalty within the state. However, in the Tincture & Sublingual category, while there was an impressive upward movement to the third position in January 2026, the brand experienced a slight dip back to fifth in February. This fluctuation indicates potential volatility or increased competition in this segment within Colorado.

In other states, Escape Artists maintained a steady presence in the Topical category. In both Missouri and New Jersey, the brand consistently ranked second, signaling a strong but not leading position. Meanwhile, in Nevada, the brand saw a slight decline in its rankings from second to third place in January and February 2026, which may indicate emerging competition or changing consumer preferences. Notably, Escape Artists did not make it into the top 30 in any other categories or states, which could be seen as a limitation in their market penetration or product offering diversification.

Competitive Landscape

In the competitive landscape of the Colorado topical cannabis market, Escape Artists has consistently maintained its position as the leading brand from November 2025 through February 2026. This unwavering top rank highlights its dominance in the market, particularly when compared to its closest competitors, Mary Jane's Medicinals and Nordic Goddess, which have both held steady at the second and third positions respectively during the same period. Escape Artists' sales figures significantly surpass those of its competitors, with sales more than double those of Mary Jane's Medicinals and nearly six times higher than Nordic Goddess. This substantial lead in sales volume underscores Escape Artists' strong market presence and consumer preference, positioning it as the go-to choice for topical cannabis products in Colorado.

Notable Products

In February 2026, the top-performing product for Escape Artists was the CBD/CBG/THC 2:1:2 Cedar & Black Pepper Relief Cream, maintaining its first-place rank from previous months with sales of 1796 units. The CBD/CBG/CBN/THC 5:1:1:5 Eucalyptus + Lavender Relief Cream also held steady in second place, showing consistent performance. The CBD/CBG/THC 2:1:2 Lavender Relief Cream remained in the third position, having improved from fourth in November and December 2025. The CBD/CBG/THC 8:1:1 Menthol Relief Cream Tube, which previously fluctuated between third and fifth place, secured the fourth rank. Notably, the CBD/CBG/THC 2:1:2 Rose & Bergamot Relief Cream made its debut in the rankings at fifth place, indicating a positive reception in the market.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.