Jan-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

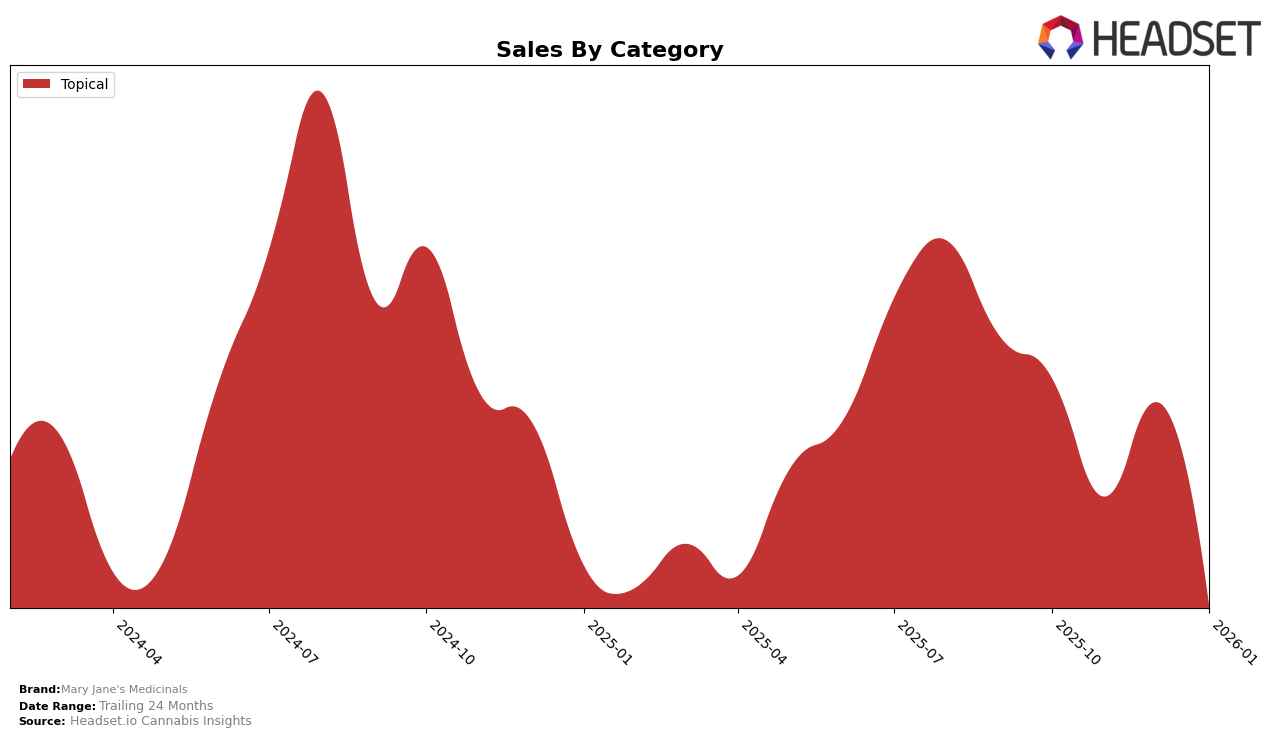

Mary Jane's Medicinals maintains a strong presence in the Colorado market within the Topical category, consistently holding the second spot from October 2025 through January 2026. This consistent ranking indicates a stable demand for their products in this category. Despite a noticeable decrease in sales from October to January, the brand's ability to retain its position suggests a loyal customer base that values their offerings. Such stability in rankings, despite fluctuating sales, highlights the brand's strong market positioning in Colorado.

Interestingly, outside of Colorado, Mary Jane's Medicinals does not appear in the top 30 rankings for any other states or categories, which could be seen as a limitation in their market reach. This absence from other state rankings suggests potential areas for growth and expansion. By focusing on diversifying their product offerings or enhancing their market strategies in other regions, Mary Jane's Medicinals could potentially replicate their success in Colorado across a broader geographic footprint.

Competitive Landscape

In the competitive landscape of the Colorado topical cannabis market, Mary Jane's Medicinals consistently holds the second rank from October 2025 to January 2026. This stability in rank indicates a strong market presence, despite a noticeable decline in sales from October 2025 to January 2026. The leading competitor, Escape Artists, maintains the top position with significantly higher sales figures, suggesting a robust consumer preference or superior distribution strategy. Meanwhile, Nordic Goddess and My Brother's Flower consistently rank below Mary Jane's Medicinals, with sales figures that are considerably lower, indicating a less competitive threat in terms of market share. This competitive positioning suggests that while Mary Jane's Medicinals is a strong contender, there is room for strategic initiatives to close the sales gap with the market leader.

Notable Products

In January 2026, the top-performing product for Mary Jane's Medicinals was the CBD/THC 1:1 Super Strength Salve, maintaining its top rank from November 2025, despite a slight decrease in sales to 393 units. The CBD/THC 1:1 Cloud 9 Bath Bomb slipped to the second position after leading the sales in December 2025. The CBD/THC 2:1 Lip Bong showed a positive trend, moving up to third place from fifth in December. A new entry, the CBD/THC 1:3 Original Salve, debuted at fourth place, indicating a promising market reception. Another topical product that was previously ranked first in October 2025, has dropped to fifth place, reflecting a significant decline in sales performance.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.