Jan-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

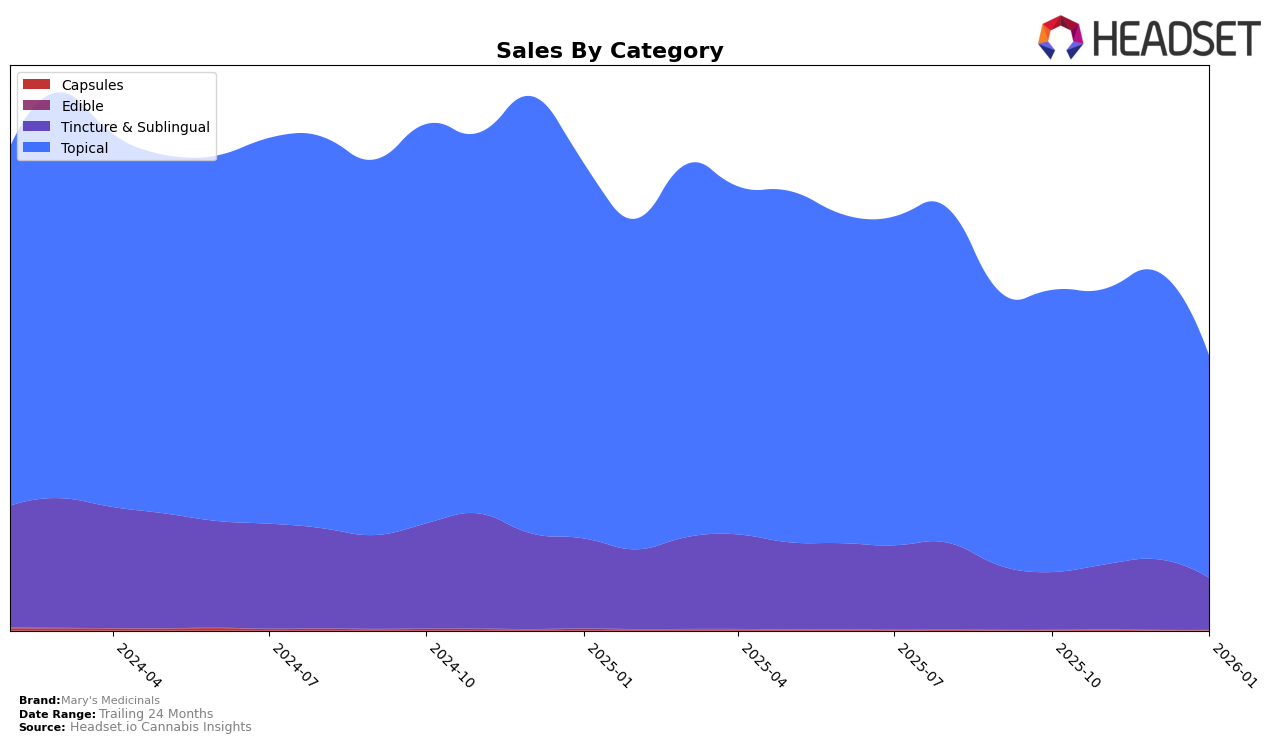

Mary's Medicinals has shown a strong presence in the California market, particularly in the Topical category, where it consistently held the second rank from October 2025 to January 2026. This stability in ranking suggests a solid consumer base and brand loyalty in this segment. However, in the Tincture & Sublingual category, the brand saw some fluctuations, dropping from the 6th rank in December 2025 to the 8th rank by January 2026. This indicates a potential challenge in maintaining its competitive edge, despite a notable sales peak in December.

In Michigan, Mary's Medicinals maintained a steady second rank in the Topical category throughout the observed period, reflecting a strong market position similar to that in California. However, the Tincture & Sublingual category did not perform as consistently, with a slight rank drop in November 2025, though it stabilized at the 4th position by January 2026. Meanwhile, in Missouri, the brand achieved and maintained the top rank in the Topical category, underscoring its dominance there. The absence of rankings in other categories and states indicates areas where the brand might not be as competitive or present, which could be either a strategic choice or a market challenge.

Competitive Landscape

In the competitive landscape of the California topical cannabis market, Mary's Medicinals consistently holds the second rank from October 2025 to January 2026. Despite maintaining its position, it faces stiff competition from Papa & Barkley, which dominates the market as the top brand. While Mary's Medicinals shows a positive sales trend, peaking in December 2025, it still trails behind Papa & Barkley in sales volume. Meanwhile, Buddies consistently ranks third, indicating a stable but less competitive threat. Sweet ReLeaf (CA) fluctuates between fourth and sixth place, suggesting potential volatility in its market position. This competitive environment underscores the importance for Mary's Medicinals to innovate and differentiate to close the gap with the market leader and sustain its stronghold against emerging brands.

Notable Products

In January 2026, the top-performing product for Mary's Medicinals was the CBD/THC 1:1 Relief Transdermal Patch (10mg CBD, 10mg THC), maintaining its first-place rank from previous months, though sales decreased to 2158 units. The CBD Restore Transdermal Patch (20mg CBD) emerged as a new contender, securing the second spot. The CBD/THC/CBN 2:3:1 Formula Transdermal Patch (10mg CBD, 15mg THC, 5mg CBN) improved significantly, climbing to third place from its previous fifth-place ranking in November 2025. The CBD/THC 1:1 No Fragrance Added Transdermal Relief Cream held steady at fourth place, consistent with its December 2025 ranking. Lastly, The Remedy Energy Tincture (1000mg THC, 13.5ml) joined the top five, indicating a growing interest in tinctures and sublingual products.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.