Feb-2024

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

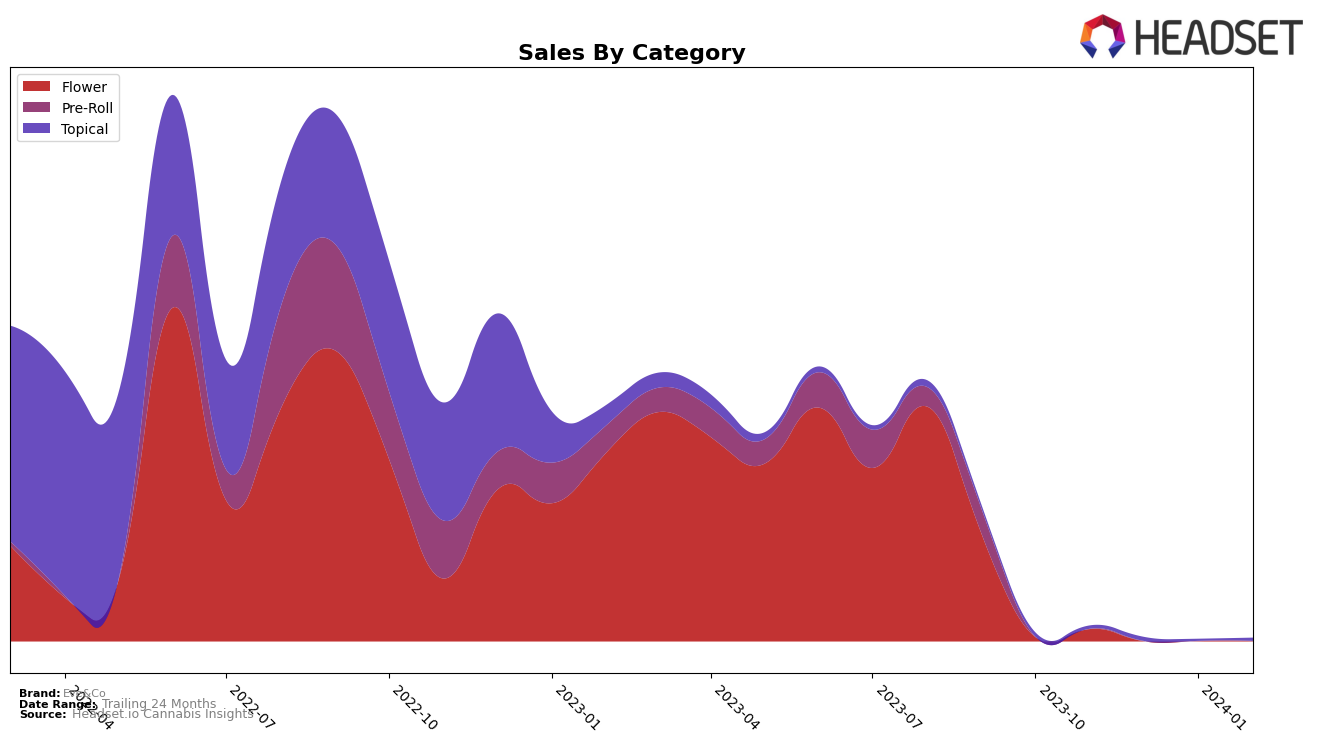

In the topical category within Ontario, Eve&Co has shown an interesting trajectory over the last few months. Initially ranked 17th in November 2023 and maintaining that position into December, the brand experienced a slight dip in January 2024, falling out of the top 20 to rank 21st. This decline could be seen as a setback, considering the competitive nature of the market. However, Eve&Co managed a commendable recovery by February 2024, climbing to the 15th rank. This rebound is noteworthy, indicating a potential resurgence in consumer interest or strategic adjustments by the brand. The sales figures, peaking in December 2023 at 1448 units before dropping in January and then partially recovering in February, mirror this fluctuation in rankings, suggesting a correlation between sales performance and market positioning.

While specific sales numbers and the factors driving these ranking changes are not disclosed in detail, the overall trend for Eve&Co in the Ontario market suggests a brand that is actively navigating the challenges of the competitive cannabis landscape. The initial stability, followed by a temporary setback and subsequent recovery, highlights the dynamic nature of consumer preferences and market competition. The absence from the top 20 in January 2024 serves as a critical reminder of the volatility in the cannabis market and the importance of maintaining consistent engagement and innovation to stay relevant. Eve&Co's ability to improve its standing in February, however, indicates resilience and perhaps an effective strategy adjustment or marketing push that helped regain lost ground. Such movements provide valuable insights into the brand's performance and potential strategies employed to enhance its market presence.

Competitive Landscape

In the competitive landscape of the topical cannabis category in Ontario, Eve&Co has experienced fluctuations in its market position, indicating a dynamic market environment. Initially ranked 17th in November and December 2023, Eve&Co saw a dip in January 2024, falling out of the top 20, before rebounding to 15th place in February 2024. This volatility highlights the competitive pressures from brands such as Nuveev, consistently ranking higher and showing stronger sales performance. Meanwhile, Pura Earth (Canada) maintained a steady presence in the top 15, indicating a solid consumer base. Interestingly, Assuage and Apothecary Labs also experienced shifts in their rankings, with Assuage notably climbing closer to Eve&Co's position by February 2024. This competitive analysis underscores the importance of strategic marketing and product differentiation for Eve&Co to enhance its market position and sales trajectory amidst a competitive field.

Notable Products

In February 2024, Eve&Co's top-performing product was the CBD/THC 1:2 The Lover Bath Bomb (60mg CBD, 140mg THC) within the Topical category, maintaining its number one rank from the previous two months with notable sales figures of 46 units. Following closely in second place was the CBD/THC 1:1 The Dreamer Bath Bomb (100mg CBD, 100mg THC), also in the Topical category, which held its position steadily from January. The third spot saw a new entry, CBD/THC 1:1 The Boss Bath Bomb (100mg CBD, 100mg THC), indicating a shift in consumer preference towards topical products. Notably, the DayLite Sativa (28g) from the Flower category, which was the top seller in November 2023, dropped out of the rankings entirely by February 2024. This shift underscores a significant change in consumer preferences within Eve&Co's product range, highlighting an increased interest in topical cannabis products.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.