Jan-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

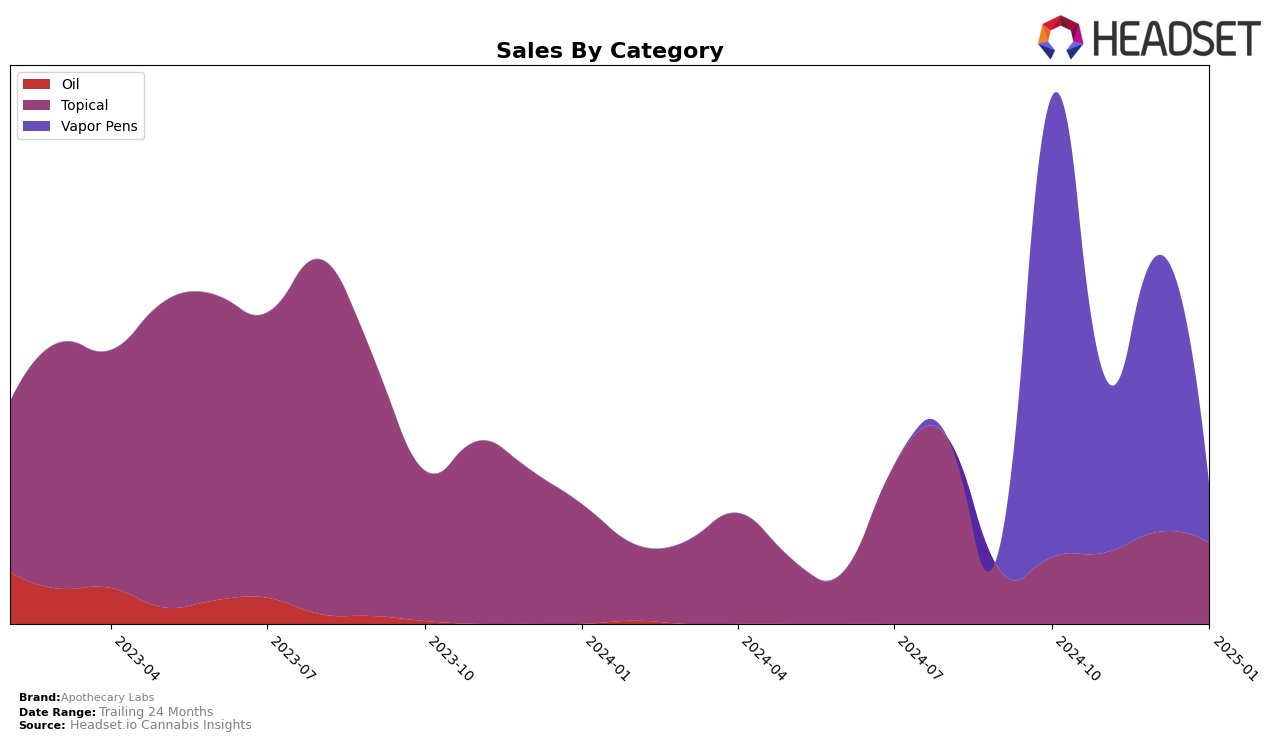

Apothecary Labs has had an interesting performance trajectory across different categories and regions. In British Columbia, the brand's ranking in the Vapor Pens category was notably absent from the top 30 in October 2024, indicating a potential area for growth or increased competition in this market. Despite this, the brand achieved sales of 12,236 units in that month, which suggests that while not top-ranked, there is still a significant consumer base for their products in this category. This gap in the top 30 could be seen as a challenge for Apothecary Labs to enhance their market presence or could indicate a highly competitive environment in British Columbia's vapor pen market.

While the data does not provide a complete picture of Apothecary Labs' performance across all states and categories, the absence of rankings in the subsequent months indicates that the brand did not break into the top 30 in the Vapor Pens category in British Columbia from November 2024 to January 2025. This could suggest a consistent struggle to gain a foothold in this particular segment or a strategic focus on other markets or product lines not detailed here. Without further data, it's unclear whether this is due to external market conditions or internal brand strategies, but it certainly points to an area worth watching for potential developments or shifts in strategy by Apothecary Labs.

Competitive Landscape

In the competitive landscape of vapor pens in British Columbia, Apothecary Labs has faced notable challenges in maintaining its rank and sales. As of October 2024, Apothecary Labs was ranked 55th, but it did not appear in the top 20 rankings in subsequent months, indicating a struggle to compete effectively in this category. In contrast, Lord Jones and BLKMKT have consistently maintained higher ranks, with BLKMKT showing a stable presence in the mid-40s range. Meanwhile, LoFi Cannabis has shown resilience, maintaining a rank around the low 50s, even improving slightly by January 2025. The competitive pressure from these brands, particularly BLKMKT's consistent sales performance, suggests that Apothecary Labs may need to innovate or adjust its strategies to regain its footing in the market.

Notable Products

In January 2025, the top-performing product for Apothecary Labs was the CBD/THC 1:3 Topical Roll-On Gel (20mg CBD, 60mg THC) in the Topical category, which climbed from a rank of 3 in December to secure the top spot. The November Rain Platinum Sunrise Distillate Disposable (0.5g), a Vapor Pen, dropped from first place in the previous two months to second place with sales of 25 units. Similarly, the Strawberry Drizzle Distillate Disposable (0.5g), another Vapor Pen, maintained its second-place ranking from December, sharing the position with the Platinum Sunrise. The CBD:THC 2:1 Extra Strength Roll On (180mg CBD, 60mg THC, 88g) improved its rank from fifth to third, indicating a growing preference for topical products. Notably absent from the January rankings was the November Rain Canadian Thunder Rosin Disposable (0.5g), which had been ranked second in December.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.