Mar-2024

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

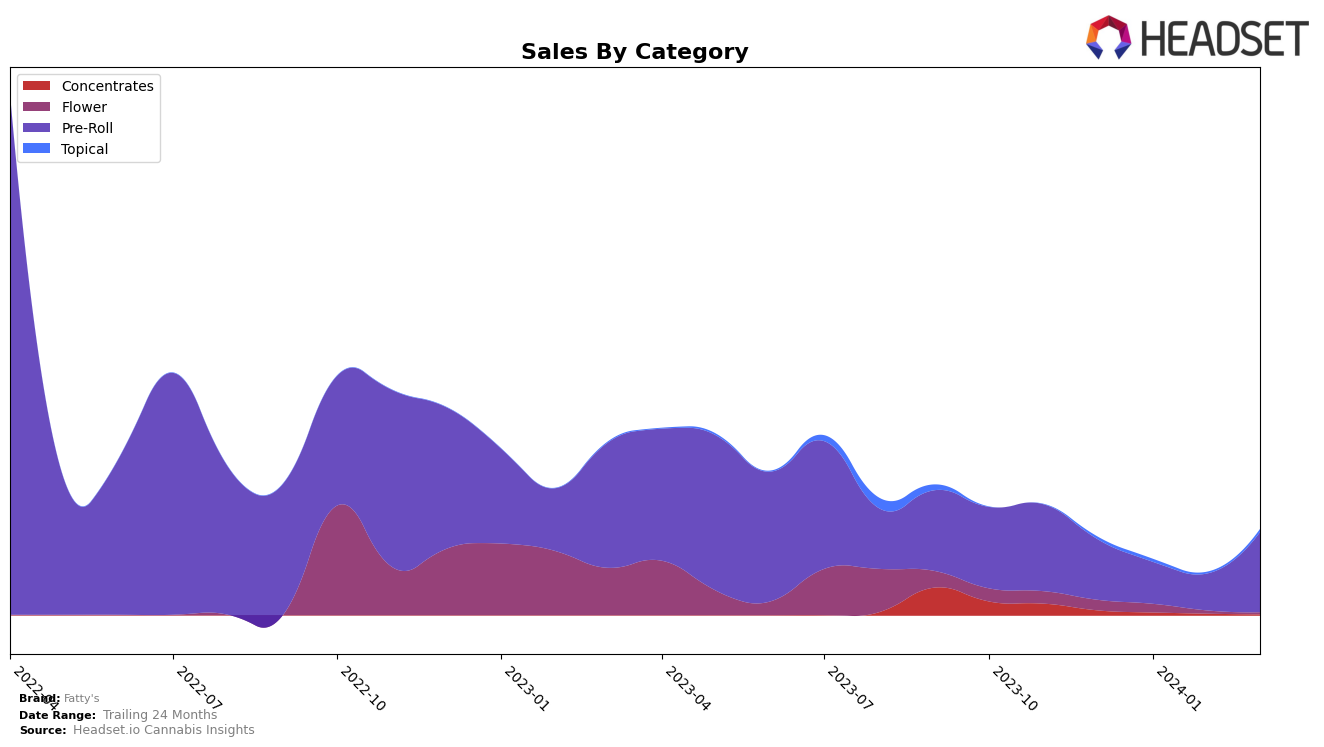

In the Michigan market, Fatty's has shown a consistent upward trajectory in the Topical category over the recent months. Starting at rank 26 in December 2023 and improving its position steadily to rank 22 by March 2024. This improvement in ranking is noteworthy, especially in a competitive category like Topicals, where many brands vie for consumer attention. The sales figures reflect this positive movement, with a notable increase from $1,197 in December 2023 to $1,495 in March 2024. However, there was a slight dip in February to $733, which could indicate fluctuating market demands or inventory challenges but didn't seem to affect their overall upward trend in rankings and sales recovery in March.

Despite the brief setback in February, Fatty's performance in Michigan's Topical category demonstrates resilience and potential for growth. Moving up four spots in a span of four months suggests that Fatty's is gaining traction and possibly capturing a larger share of the market. It's also important to note that being consistently ranked in the top 30 brands for the category across these months signals a stable presence in the market. However, the exact reasons behind the February sales dip and subsequent recovery are not detailed, leaving room for speculation on effective strategies or market dynamics at play. This performance could be a signal for Fatty's to explore further opportunities for growth and consolidation in Michigan and potentially in other states or categories where they operate.

Competitive Landscape

In the competitive landscape of the topical cannabis market in Michigan, Fatty's has shown a consistent improvement in its ranking over the recent months, moving from not being in the top 20 in December 2023 to securing the 22nd position by March 2024. This upward trajectory, however, is set against a backdrop of fluctuating sales, with a notable dip in February before recovering in March. Competitors like Zova and Meg & Zen have demonstrated stronger positions in the rankings for the same period, with Meg & Zen maintaining a spot in the top 20 throughout and Zova re-entering the top 21 in March after missing data for two months. Leilani Bee and CURE also show notable movements, with Leilani Bee making a significant jump to the 20th position in January and CURE moving up to the 23rd by March. The dynamic shifts in rankings and sales among these competitors highlight the competitive nature of the market and the need for Fatty's to continue its upward momentum to capture a larger market share.

Notable Products

In March 2024, Fatty's top-performing product was the Permanent Marker Pre-Roll (1g) within the Pre-Roll category, achieving the highest sales with a significant increase to 1112 units. The Alien Banana Candy Pre-Roll (1g) followed, securing the second rank in its debut month. The Modified Banana Pre-Roll (1g), previously the top product in February, dropped to the third position in March. Tahoe OG Pre-Roll (1g) and Zkittles Pre-Roll (2g) were new entrants to the top 5, ranking fourth and fifth respectively. This month saw a notable shift in consumer preferences, with new products quickly rising to the top ranks.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.