Jan-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

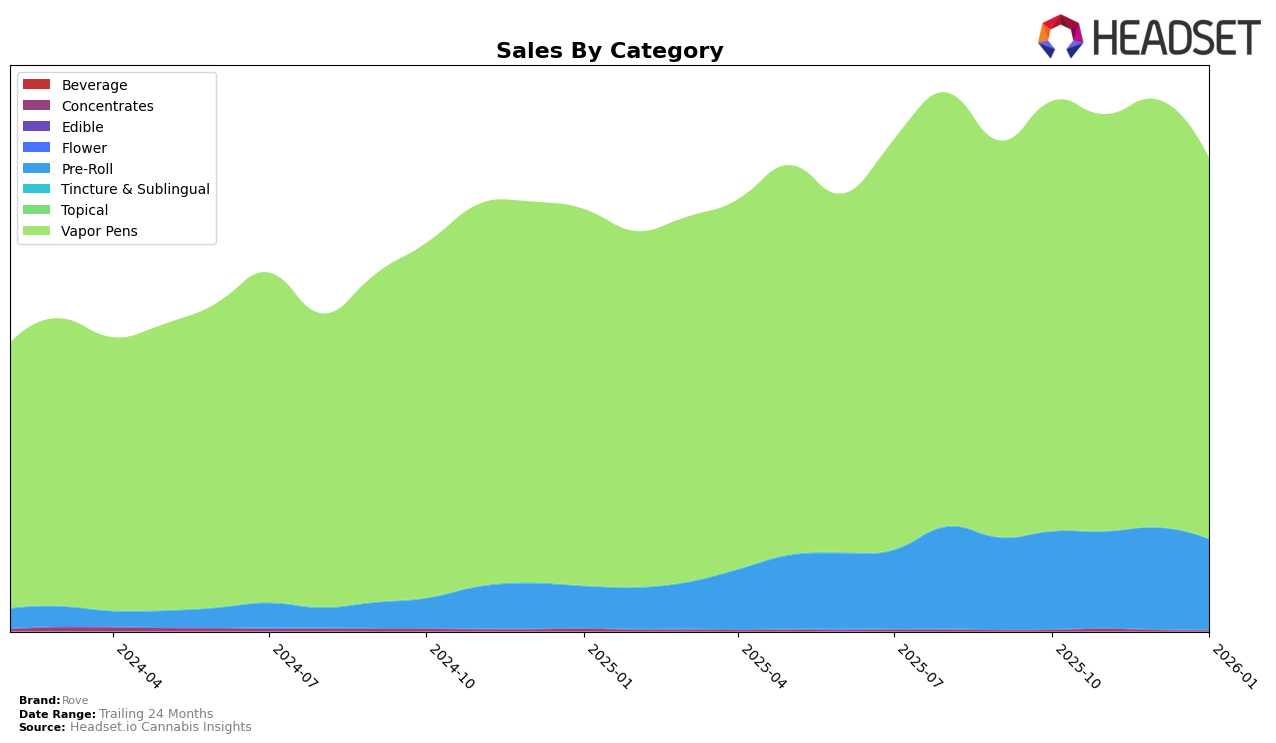

Rove's performance across various states and categories demonstrates both consistency and areas for growth. In California, Rove's presence in the Vapor Pens category has been quite stable, maintaining a position within the top 10 from October 2025 to January 2026. However, their entry into the Pre-Roll category in California could be seen as a challenge, as they did not break into the top 30 until January 2026, where they ranked 32nd. In Nevada, Rove has shown a dominant presence in both Pre-Roll and Vapor Pens categories, consistently holding the top spot in Vapor Pens and maintaining a strong fourth place in Pre-Rolls. This indicates a strong brand recognition and consumer preference in Nevada.

In the eastern states, Rove's performance varies. In Massachusetts, Rove has maintained a stable position in the Vapor Pens category, consistently ranking fourth, while showing some fluctuation in Pre-Rolls, moving from ninth to twelfth over the same period. Meanwhile, in New Jersey, Rove has shown improvement in Pre-Rolls, climbing from eighth to sixth place, but experienced a slight decline in Vapor Pens, dropping from fifth to seventh. This mixed performance across different states suggests that while Rove has a strong foothold in certain markets, there are opportunities for growth and increased market penetration in others.

Competitive Landscape

In the competitive landscape of vapor pens in California, Rove has shown a steady upward trajectory in rankings, moving from 11th place in October 2025 to 9th place by December 2025, maintaining this position into January 2026. This improvement in rank is indicative of a positive trend in sales performance, as evidenced by a notable increase in sales from November to December 2025. However, Rove still faces stiff competition from brands like Jeeter, which consistently ranks higher, holding the 8th position from December 2025 to January 2026, and Cold Fire, which maintains a strong presence at 7th place. Meanwhile, Dime Industries trails slightly behind Rove, ranking 10th in December 2025 and January 2026. The competitive dynamics in this category suggest that while Rove is making gains, there is still a significant gap to close with the top-tier brands in terms of market share and consumer preference.

```

Notable Products

In January 2026, the top-performing product for Rove was the Blue Dream Live Resin Diamond Disposable (1g) in the Vapor Pens category, which climbed to the number one rank despite a slight decrease in sales to 10,684 units. Following closely was the Pineapple Express Live Resin Diamonds Reload Pod (1g), which slipped from the top spot in December to second place. The Apple Jack Live Resin Diamond Cartridge (1g) maintained a steady performance, ranking third for the month. Maui Waui Liquid Diamond Live Resin Disposable (1g) held its position at fourth, consistent with its December ranking. The Pineapple Express Live Resin Melted Reload Diamond Disposable (1g) remained in fifth place, showing stability in its ranking since its debut in December.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.