Mar-2024

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

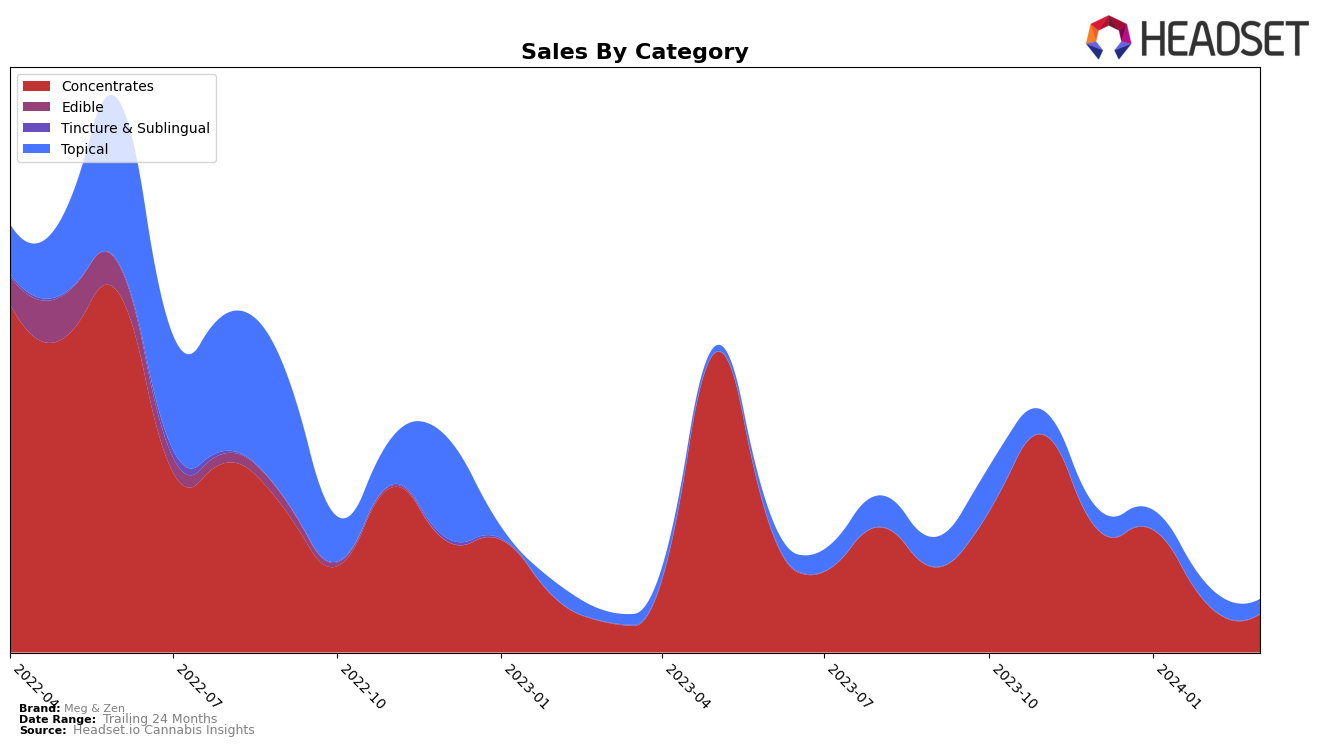

In the topical category within Michigan, Meg & Zen has shown a fluctuating performance over the recent months. Initially ranking at 21st in December 2023, the brand managed to improve its standing to 17th by February 2024, indicating a positive trend in consumer preference and market penetration. However, this upward trajectory did not sustain, as evidenced by a slight dip to the 20th position in March 2024. This drop could suggest a variety of factors including increased competition or a shift in consumer demand within the state's topical cannabis market. Despite these movements, it's notable that Meg & Zen remained within the top 30 brands throughout this period, highlighting its consistent presence in a competitive landscape.

While specific sales figures are reserved, it's worth mentioning that Meg & Zen experienced a gradual decrease in sales from December 2023 to February 2024, before seeing a more significant drop in March 2024. This sales trend somewhat mirrors the brand's ranking fluctuation, possibly indicating a correlation between market position and revenue in this category. The initial sales figure of $3065 in December 2023, while the only one disclosed, offers a glimpse into the brand's performance level during that period. The decline in sales, especially the sharper decrease in March, could point to challenges that Meg & Zen may need to address to maintain or improve its market share and consumer base in Michigan's topical cannabis sector.

Competitive Landscape

In the competitive landscape of the topical cannabis market in Michigan, Meg & Zen has experienced fluctuations in its ranking over the recent months, indicating a dynamic competitive environment. Starting at 21st in December 2023, Meg & Zen improved its position to 17th by February 2024 but then dropped to 20th in March 2024. This shift in rank reflects a challenging market, with competitors like Mary Jane's Medicinals consistently maintaining a higher rank and showing resilience in sales. Notably, Artemis Body Care made a significant leap from 28th to 19th place, surpassing Meg & Zen in March 2024 with a remarkable increase in sales. Other brands such as Zova and Fatty's have had less consistent rankings but indicate the competitive volatility Meg & Zen faces. The data suggests that Meg & Zen needs to strategize not only to reclaim and improve its position but also to fend off rising competitors that are gaining momentum in the Michigan topical cannabis market.

Notable Products

In March 2024, Meg & Zen's top-selling product remained the THC RSO Syringe (1g) within the Concentrates category, marking its fourth consecutive month at the top with sales figures reaching 222 units. Following closely, the CBD/THC 1:1 RSO Syringe (1g) climbed up one rank from the previous month to secure the second position, showcasing a notable improvement in its sales performance. The Zen Ice Balm (100mg THC, 60ml, 2oz) from the Topical category maintained its third position, indicating a consistent demand for topical solutions among consumers. The CBG RSO Syringe (1g) also held steady in its rank, coming in fourth, while the Zen Spice Balm (100mg THC, 2oz, 60ml) made a return to the top five, securing the fifth spot. These rankings reveal a stable preference for concentrates, with a notable interest in topicals, reflecting a diverse consumer base with varied product interests.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.