Jan-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

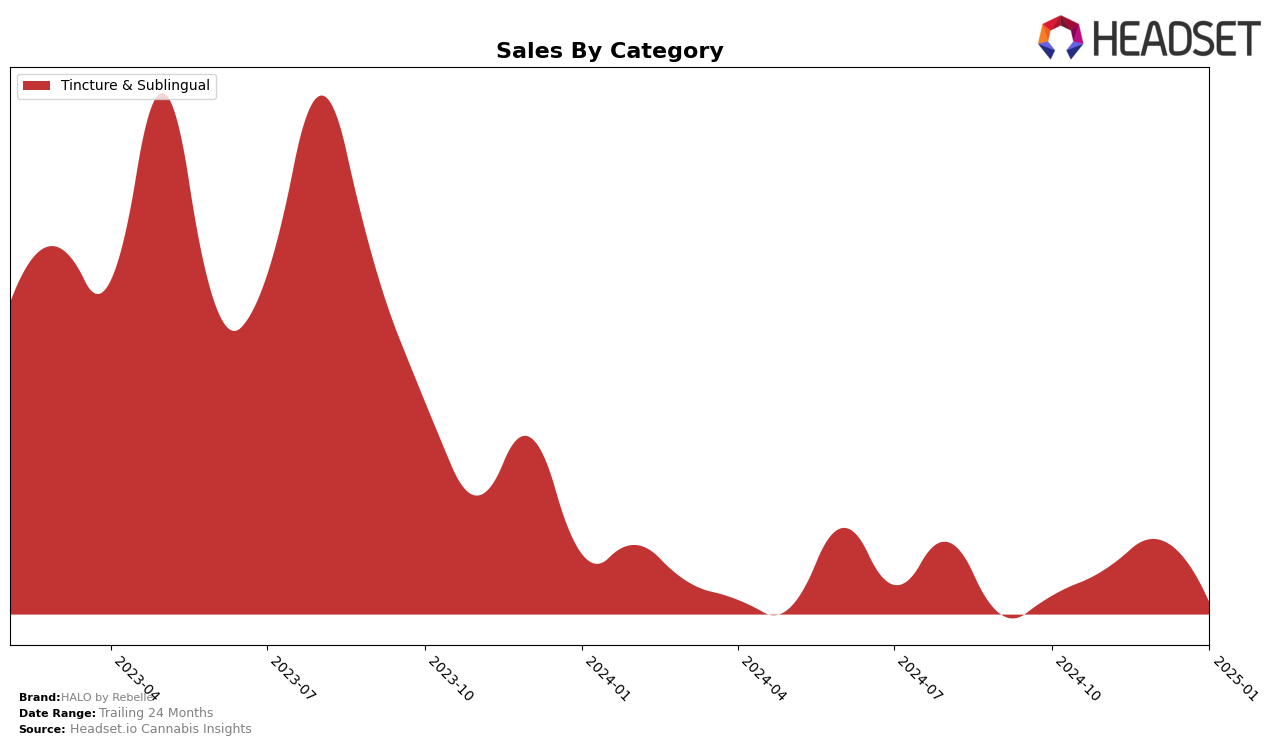

HALO by Rebelle has shown a promising entry into the Massachusetts market within the Tincture & Sublingual category. Notably, the brand made a significant leap in December 2024, securing the 7th position in this category, a commendable feat given its absence from the top 30 in the preceding months. This upward trajectory suggests a growing consumer interest and acceptance of HALO by Rebelle's offerings in Massachusetts, marking December as a pivotal month for its market presence. The absence of a ranking in October and November indicates that the brand was either not competing at a high level or was still in the process of establishing its market footprint.

While the data does not include a ranking for January 2025, the lack of a position in the top 30 could be interpreted as a challenge for HALO by Rebelle to maintain its momentum in the new year. This could highlight either increased competition or a need for strategic adjustments to sustain its market presence. The sales figures from December, however, do reflect a positive reception, suggesting that the brand has potential to regain or even improve its standing if it can address the factors that influenced its January absence. The Massachusetts market remains a key area to watch for HALO by Rebelle as it continues to navigate the competitive landscape of cannabis tinctures and sublinguals.

Competitive Landscape

In the Massachusetts Tincture & Sublingual category, HALO by Rebelle experienced a notable shift in its market presence, debuting in December 2024 at the 7th rank. This entry into the top 20 is significant, especially considering the competitive landscape. For instance, Doctor Solomon's consistently held the 6th position from October 2024 through January 2025, indicating a stable market performance. Meanwhile, Sip maintained the 7th rank in October and November 2024 but did not appear in the top 20 in December 2024 and January 2025, suggesting a decline or market exit during those months. HALO by Rebelle's emergence in December 2024, coinciding with Sip's absence, may suggest a strategic opportunity that HALO capitalized on, potentially capturing market share from Sip. This dynamic shift underscores the importance of tracking competitive movements and market entries in understanding brand performance and opportunities for growth.

Notable Products

In January 2025, the top-performing product from HALO by Rebelle was the Luster Microdose Mist Oral Spray (100mg) in the Tincture & Sublingual category, maintaining its position at rank 1 for four consecutive months with sales of 191 units. The CBD/THC 1:1 Golden Restore Microdose Mist Oral Spray (50mg CBD, 50mg THC) climbed to rank 2 from its previous third position in the last two months. Meanwhile, the THC/CBN 1:1 Twinkle Microdose Mist Oral Spray (50mg THC, 50mg CBN) slipped to rank 3 after holding the second position in November and December 2024. This indicates a consistent preference for the Luster Microdose Mist Oral Spray, while the other two products have shown fluctuations in their ranking. The data highlights the competitive nature within the Tincture & Sublingual category among the top products.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.