Jan-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

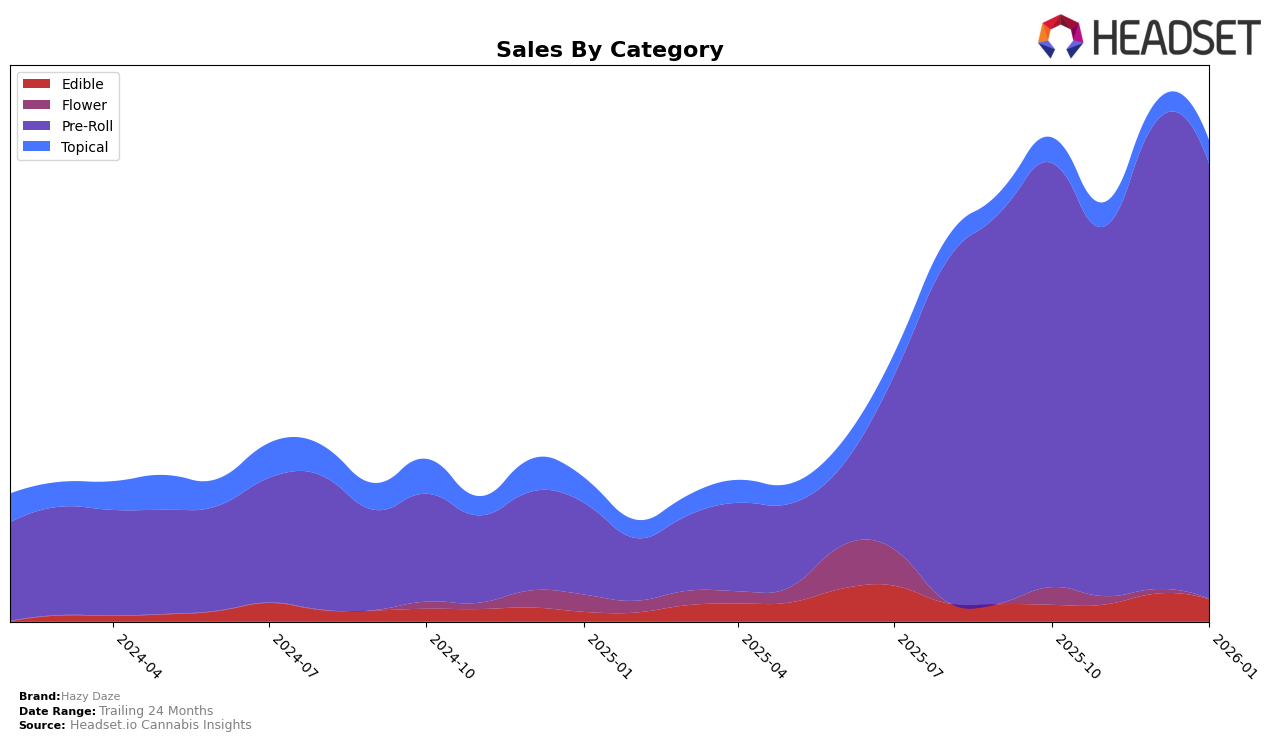

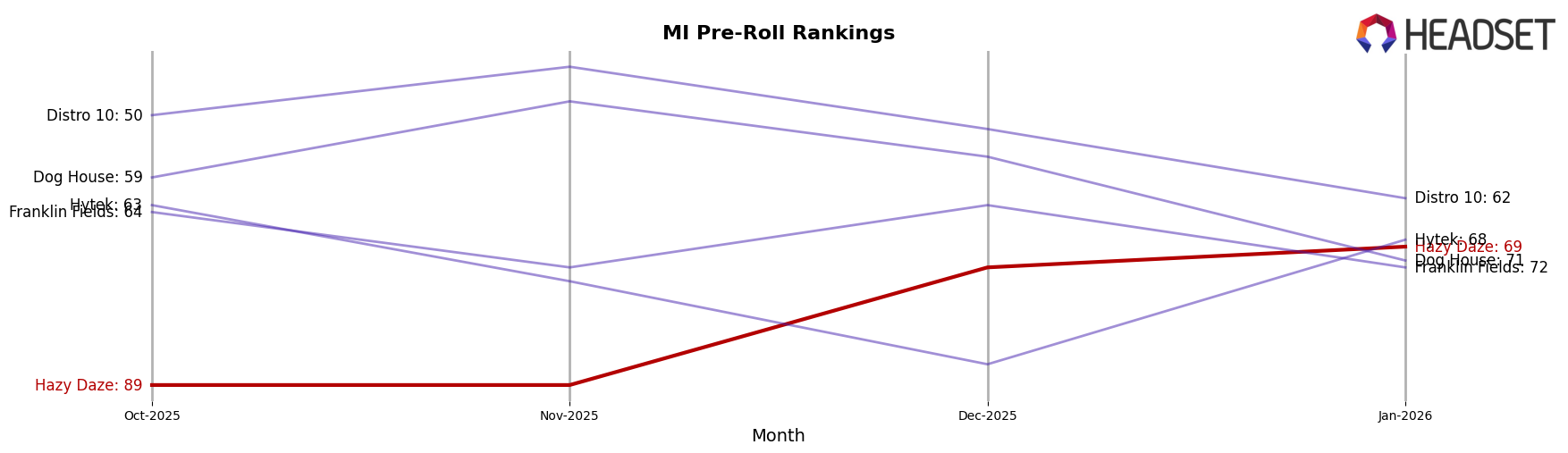

Hazy Daze has shown a consistent upward trajectory in the Pre-Roll category within Michigan, moving from a ranking of 89 in October 2025 to 69 by January 2026. This improvement in rank indicates a strengthening presence in the market, suggesting effective strategies in product placement or consumer engagement. Despite a dip in November, where sales decreased to $96,429, the brand rebounded in December with sales climbing to $125,871, reflecting a successful holiday season push or promotional effort. Their ability to break into the top 70 brands by the start of 2026 is a positive sign of growth and market penetration.

Interestingly, the absence of Hazy Daze from the top 30 brands in any other state or province highlights either a strategic focus on Michigan or challenges in expanding their footprint beyond this region. This could be seen as a limitation or an opportunity, depending on the brand's long-term goals. The lack of ranking in other markets might suggest untapped potential or the need for targeted initiatives to replicate their Michigan success elsewhere. Observing their performance in Michigan could provide insights into strategies that might be employed in other states or provinces to enhance their market presence.

Competitive Landscape

In the competitive landscape of the Michigan pre-roll category, Hazy Daze has shown a promising upward trend in its rankings, moving from a rank of 89 in October and November 2025 to 72 in December 2025, and further improving to 69 by January 2026. This positive trajectory in rankings suggests a strengthening market position, despite facing stiff competition. Notably, Dog House experienced a decline from a rank of 48 in November to 71 in January, indicating potential volatility. Similarly, Franklin Fields maintained a relatively stable presence, though slightly dropping to 72 in January. Meanwhile, Hytek showed a fluctuating pattern, ending January at 68, just ahead of Hazy Daze. Distro 10 remained a strong competitor, although it saw a decline from 43 in November to 62 in January. These dynamics highlight Hazy Daze's potential to capitalize on its upward momentum and the opportunities presented by the shifting ranks of its competitors.

Notable Products

In January 2026, the top-performing product from Hazy Daze was the Frosted Truffle Pie Pre-Roll (1g), which ascended to the number one spot with sales reaching 1659 units. The Electric Peanut Butter Cookie #2 Infused Pre-Roll (1g) maintained a strong presence, securing the second position, despite a drop from its previous top rank in December 2025. The Titty Sprinkles Infused Pre-Roll (1g) experienced a slight decline, moving to third place after leading in December 2025. Notably, the Point Break Pre-Roll (1g) held steady at the third rank since its introduction in December 2025. The CBD/THC 9:1 Bud-ease Biscuits Dog Treat Biscuits 10-Pack (70mg CBD, 7.5mg THC) entered the rankings for the first time, coming in at fourth place, suggesting a growing interest in edibles.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.