Jan-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

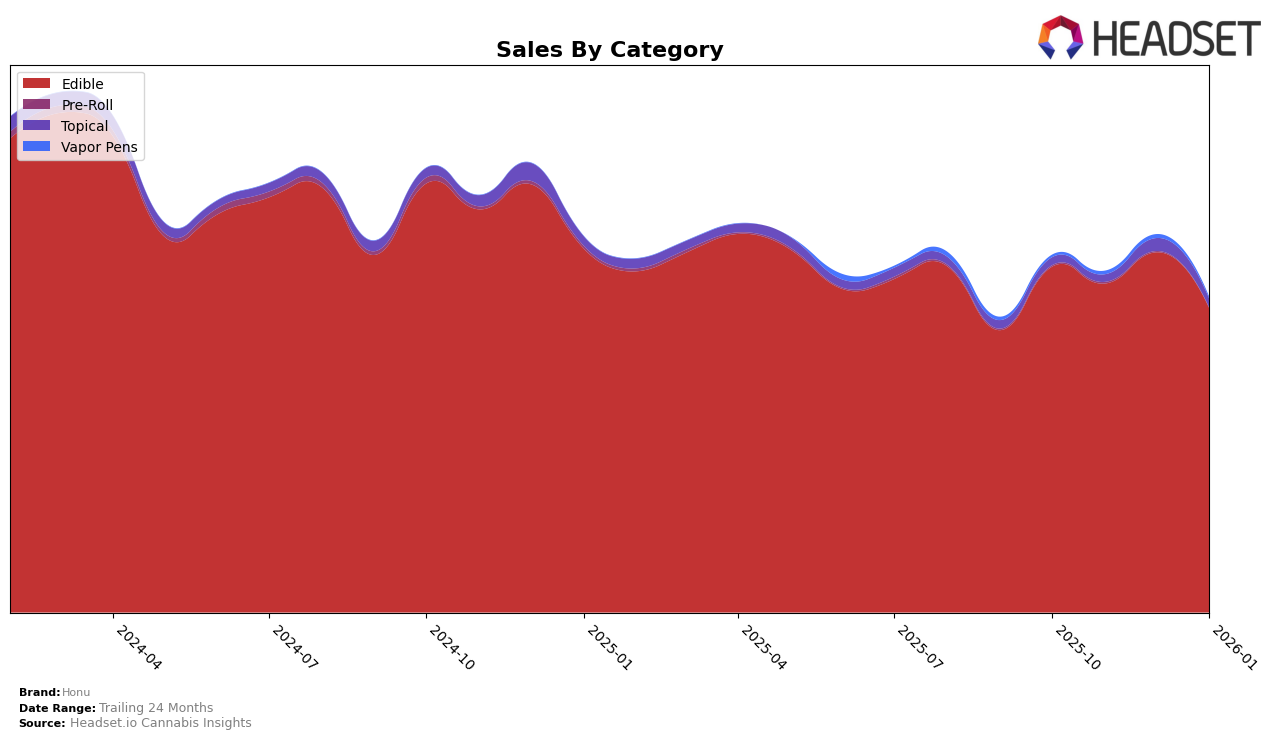

In the state of Washington, Honu has shown a consistent presence in the Edible category. Over the months from October 2025 to January 2026, Honu maintained a steady ranking at 16th place, only dropping slightly to 17th in January. This stability in ranking indicates a solid foothold in the market, although the slight dip in January could suggest increasing competition or seasonal fluctuations in consumer preferences. Despite this, Honu's sales figures reveal a varied performance, with a notable peak in December 2025, before declining in January 2026.

The consistent ranking within the top 20 brands in Washington's Edible category highlights Honu's enduring appeal to consumers in this region. However, not appearing in the top 30 in other states or categories indicates potential areas for growth or challenges in broader market penetration. The absence of rankings in these areas could be viewed as an opportunity for Honu to expand its reach or refine its strategy to capture a larger share of the market. Understanding these dynamics could be crucial for stakeholders looking to capitalize on Honu's existing strengths while addressing areas for improvement.

Competitive Landscape

In the competitive landscape of the Washington Edible market, Honu has experienced some fluctuation in its rankings over the past few months. Starting at the 16th position in October 2025, Honu maintained this rank through December 2025 before dropping to 17th in January 2026. This slight decline in rank coincides with a decrease in sales from December to January, suggesting potential challenges in maintaining market share. In contrast, Verdelux improved its position from 17th to 16th in January 2026, indicating a competitive edge over Honu. Meanwhile, Blaze Soda made a significant leap from 26th in October to 18th by November, maintaining this position through January, which highlights its rapid growth and potential threat to Honu's market standing. Constellation Cannabis consistently held the 15th position, showcasing stability and a strong market presence. These dynamics suggest that while Honu remains a notable player, it faces increasing competition and must strategize to reclaim and enhance its market position.

Notable Products

In January 2026, Honu's top-performing product was the Indica Peanut Butter Cups Chocolate 10-Pack (100mg), maintaining its number one rank for four consecutive months with sales of 1743 units. The Indica Milk Chocolate Turtle 10-Pack (100mg) consistently held the second position, reflecting a stable demand with 1374 units sold. Gimme Sa'More! Treats 10-Pack (100mg) ranked third, showing a consistent performance from December 2025. Sativa Peanut Butter Cups Chocolate 10-Pack (100mg) remained in fourth place, indicating a steady interest despite a slight decline in sales. Indica Chocolate Caramel 10-Pack (100mg) secured the fifth position, maintaining its rank since October 2025, suggesting a loyal customer base.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.