Jan-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

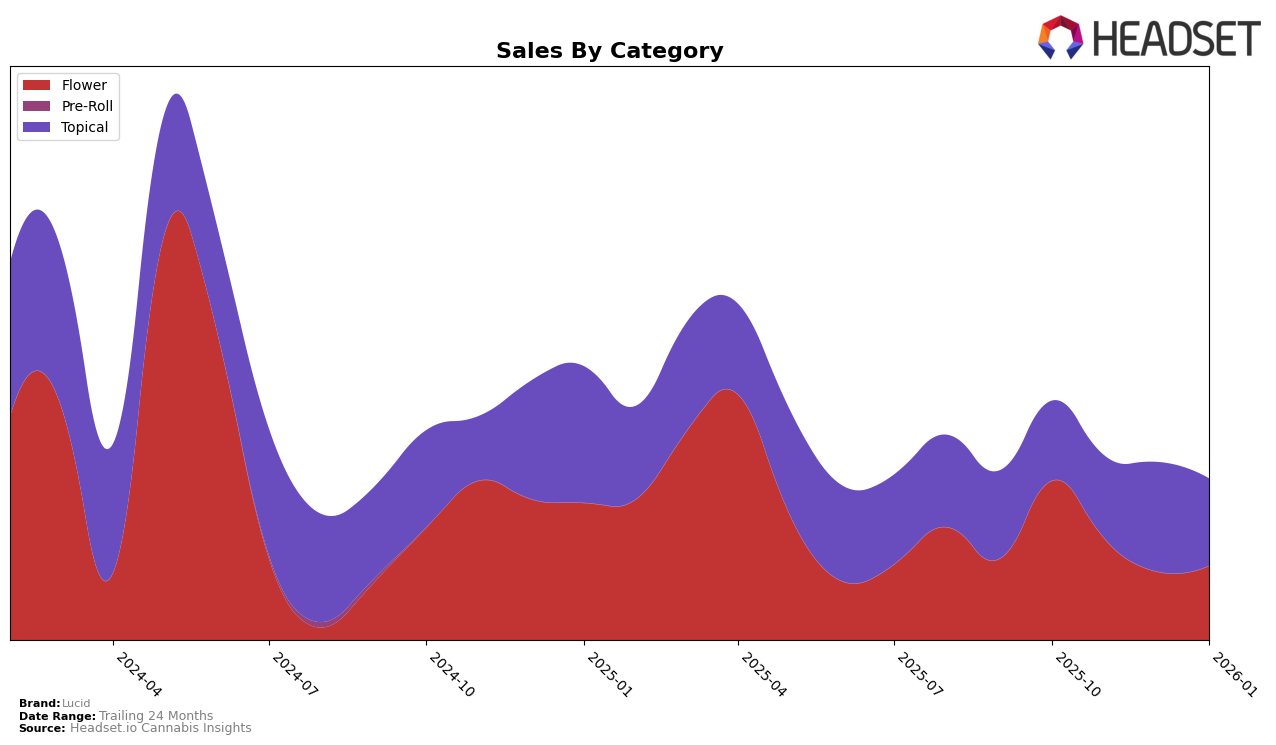

Lucid's performance in the Washington market has shown remarkable consistency in the Topical category over the past few months. The brand maintained a steady 6th place ranking from October 2025 through January 2026, indicating a stable presence in this segment. Such consistent ranking suggests that Lucid has established a strong foothold in Washington's Topical category, appealing to a loyal consumer base. However, the absence of any upward movement might imply a need for strategic initiatives to break into the top five, as competitors could potentially threaten their current position.

Interestingly, while Lucid's sales figures in the Topical category in Washington have shown some fluctuations, the overall trend appears positive, with a notable peak in December 2025. This surge could be attributed to seasonal factors or successful marketing campaigns during that period. On the other hand, the lack of rankings in other categories or states suggests that Lucid either does not compete in those segments or has not yet gained significant traction. This presents an opportunity for the brand to explore potential growth areas outside their current stronghold, leveraging their established reputation in the Topical category.

Competitive Landscape

In the Washington topical cannabis market, Lucid has maintained a consistent rank of 6th place from October 2025 through January 2026. Despite this steady position, Lucid faces stiff competition from brands like SnacMe and Fairwinds, which have consistently ranked higher at 5th and 4th places, respectively. Notably, SnacMe has shown a robust sales performance, with sales figures consistently higher than Lucid's, indicating a stronger market presence. Fairwinds, while maintaining its 4th rank, experienced a decline in sales from October to January, which could present an opportunity for Lucid to close the gap if it can capitalize on this trend. Lucid's sales saw a notable increase in December 2025, suggesting potential for growth if this momentum can be sustained. The competitive landscape indicates that while Lucid holds a stable position, strategic efforts to enhance market share and capitalize on competitors' weaknesses could improve its rank and sales performance in the future.

Notable Products

In January 2026, Sativa Infusion 1000mg reclaimed its position as the top-performing product for Lucid, having been ranked second in December 2025, with sales reaching 307 units. Indica Infusions 1000mg, which led in December 2025, fell to the second position. Sativa Infusion 500mg climbed up to third place, showing a consistent upward trend since November 2025. Indica Infusions 500mg, however, dropped to fourth place, despite a slight increase in sales. Green Crack 14g maintained its fifth position from December 2025, marking its stable performance in the flower category.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.