Dec-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

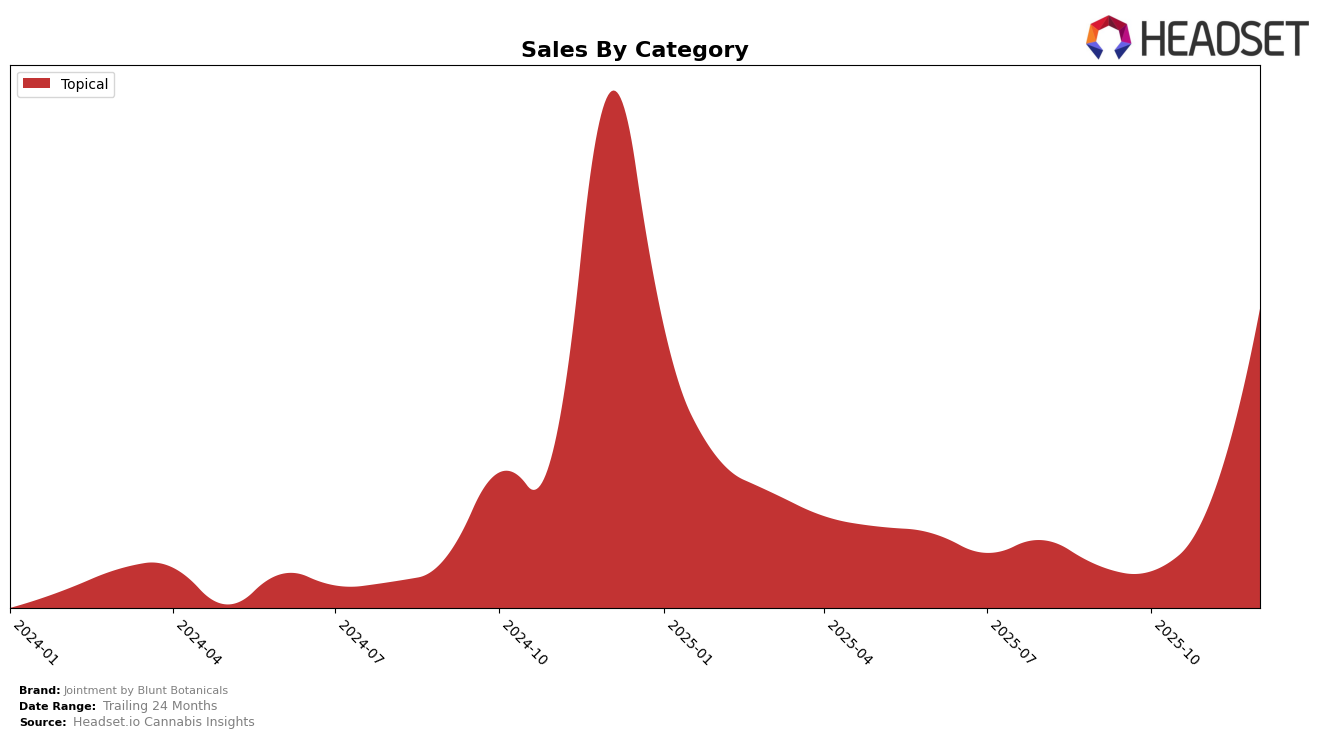

The performance of Jointment by Blunt Botanicals in the Alberta market has shown notable developments, particularly in the Topical category. The brand did not rank in the top 30 for September to November 2025, but made a significant leap to the 6th position by December 2025. This upward movement is indicative of a strategic shift or increased consumer interest in their topical offerings. The absence from the top 30 in the preceding months could suggest either a period of adjustment or increased competition, but the December ranking highlights a successful turnaround or market penetration strategy.

While Alberta saw this impressive rise, it is crucial to note that Jointment by Blunt Botanicals did not appear in the top 30 rankings in other states or provinces for the same period, suggesting a localized success rather than a widespread brand dominance. This could imply a focused marketing effort or product appeal specific to the Alberta market. The December sales figure of $22,472 in Alberta further underscores the brand's capability to capture consumer interest effectively within a short time frame. However, the lack of presence in other regions might point to potential areas for growth or the need for strategic expansion into new markets.

Competitive Landscape

In the competitive landscape of the topical cannabis market in Alberta, Jointment by Blunt Botanicals has made a notable entry by securing the 6th position in December 2025. This is a significant development considering the brand was absent from the top 20 rankings in the preceding months, indicating a strategic push or market acceptance that has bolstered its presence. In contrast, Proofly consistently maintained its 4th rank throughout the last quarter of 2025, with sales figures showing a strong upward trajectory, culminating in a peak in December. Similarly, Solei held steady at 5th place, although its sales experienced fluctuations, with a notable increase in December. The emergence of Jointment by Blunt Botanicals in the rankings suggests a growing competition and potential shifts in consumer preferences within the Alberta topical cannabis market.

Notable Products

In December 2025, the top-performing product from Jointment by Blunt Botanicals was the CBD Pineapple Express Fizzing Bath Soak with a remarkable sales figure of 1008, maintaining its leading position from November. The CBD Alaskan TF Zero Waste Bath Bomb secured the second rank, consistent with its performance in the previous month. The CBD Jointment To Go Roll On improved its ranking to third place, up from fourth in November. CBD/CBN Jointment Bath Salts experienced a slight drop to fourth place compared to its third-place ranking in November. Notably, the CBD/THC Massage Butter, which ranked fifth in October, was not among the top products in December.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.